From pv magazine Global, September edition

Seeing the merits in optimal land use, India has joined the floating solar race, where China already has a strong foothold. India has to date installed less than 1 MW of floating PV, but the 10 GW target indicated by Solar Energy Corporation of India (SECI) has set the foundation for rapid growth.

A 5 MW project is currently under construction in West Bengal. Recently, SECI has also issued a tender for 150 MW of floating solar to be developed over Rihand Dam in Sonbhadra district of Uttar Pradesh. The potential of power generation from floating solar is mind-boggling for India, as the country is endowed with many large reservoirs. The states of Uttar Pradesh, Odisha, Madhya Pradesh, Karnataka, and Andhra Pradesh alone hold 79% of the major reservoirs.

“The overall surface area of India’s major water reservoirs is more than 40 million square kilometers. Even if only one third of this (around 14 million square kilometers) was covered with floating solar installations, India could generate 700 GW of solar capacity,” according to Shekhar Dutt, Director General, Solar Power Developers Association.

The intent is there, so are the challenges

Indian public-sector units like NTPC and National Hydroelectric Power Corporation intend to develop two floating solar plants of 22 MW and 10 MW capacity as part of their renewable expansion plan. Yet, it is still early days for floating solar in India. “There is a lack of technical knowledge in megawatt-scale floating solar projects such as the 3 × 50 MW Sonbhadra project. Indian engineering, procurement, and construction (EPC) players lack expertise in floating and anchoring solutions. At this early stage, they are dependent on the floating solution providers like France-based Ciel & Terre for floating and anchoring design,” shares Ivan Saha, BU Head of Solar Manufacturing and CTO, Vikram Solar.

High capital cost of transportation and installation, as well as technology accessibility issues are limiting floating power plant market growth. There is a need to lower the costs, set up appropriate technical standards, and promote domestic manufacturing. According to renewable energy consulting firm Bridge to India, the capital cost of floating solar is 15-20% higher than ground-mounted solar, notwithstanding some benefits in land and transmission cost, net cost of power may be higher by 30-50%. It remains to be seen whether the utilities will agree to pay a little more for this power.

Ivan Saha feels that policymakers must turn their attention to driving down balance of system (BOS) costs. Policy frameworks favoring minimal capital costs of implementation will help in reducing the capital cost and allow faster adaptation of floating solar. New policies encouraging innovation through the subsidizing of practical applications will also improve the structural design and integrity of the installations.

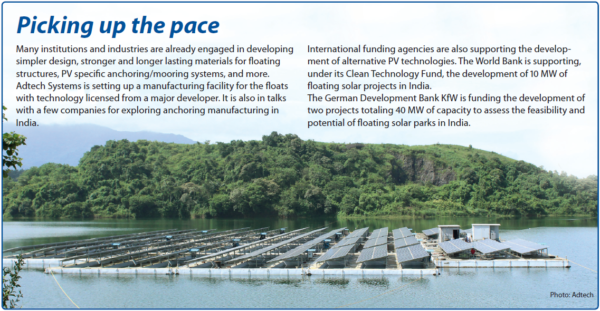

“Pricing is a major factor in the floating solar space, and economies of scale can play a major part in reducing the current costs to make floating solar project costs per megawatt closer or lower than ground-mount projects. Also, India can take a cue from countries such as China, Japan, and South Korea which have successfully implemented large-scale floating projects while providing sufficient support to the industry,” adds Adtech Systems Chair M. R. Narayanan. Unlike projects on land, floating solar projects are extremely site specific, and require a lot of knowledge.

“Therefore, detailed study has to be conducted on the site conditions such as topography of the reservoir, wind speed, water depth, and variations in depth,” explains Narayanan. “Only after careful consideration of these parameters and detailed design and planning can projects be executed. Once this ground work has been done properly, such project viability can be increased due to optimized designs.”

Operationally, the biggest issue is inadequate long-term experience of floating solar anywhere in the world. “Operating conditions demand a careful approach to managing equipment corrosion and degradation risks due to high moisture content in the atmosphere. It may become necessary to devise a new set of technical standards and specifications for floating solar projects. Hopefully, unlike in ground-mounted solar, policymakers and regulators in India will be ahead of the curve on these fronts,” shares Surbhi Singhvi, manager-consulting at Bridge to India. The major components for floating solar are the floats themselves. India needs sufficient manufacturing capacity of floating racking units, as imports are not really viable. Also, floats need to be designed and manufactured with appropriate quality and standards to ensure the lifetime performance of the plant.

Another major component is the anchoring system, which is currently imported in the majority of cases as there are no manufacturers in India producing to the required standard. “The government needs to identify the capable EPC entities for pontoon structure development and overseeing technical nitty- gritty, and publicize the data for faster project adaptation,” suggests Vikram Solar’s Ivan Saha. Issues like the long-term impact of wet environments on modules and cables, safe transmission of power through floats to the nearest feeder point, and the environmental impact on the water body and the marine life need to be addressed. Rapid environmental policy development (such as the environmental policy of São Paulo state, Brazil, for floating solar) and enforcement will also spur growth.

Floating solar presents multiple benefits that further extend solar energy generation paybacks, coupled with environmental and water saving features. The government can look at incentivizing these benefits.

Looking forward

Given floating solar is a new sub-market, it is natural that there is some uncertainty regarding operational concerns, site approval, and more. “Some delays can be expected as tender requirements are adapted to local condi- tions and market interest. In Sonbhadra, for instance, the project was increased from 100 MW to 150 MW,” says Josefin Berg, Research Manager at analyst firm IHS Markit. “The lack of experience of floating PV in the Indian market means that the coming year will require under- standing how these projects could get built.”

“For developers, this is an opportunity to build up expertise in a domain with higher entry barriers than the regular PV market,” Berg continues. “Expertise in floating PV would also open up opportunities in other parts of the world, mainly in Asia, where floating PV is already gaining traction. The biggest challenge, however, will be the price versus quality of the projects, as low bid prices may impact the quality of the solutions.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.