One of the biggest highlights from Mercom’s Q4 and annual India Solar Market Update is that solar was the fastest growing energy generation source in India in 2017, accounting for over 45% of all new power generation capacity installed, with 9.6 GW.

“Despite the challenges, solar overtook coal in 2017 to become the top source of new power generation additions in India for the first time ever,” says Mercom. “The shift came after the price of developing new solar projects fell below the cost of adding coal-fired capacity. Solar accounted for the largest portion of new capacity additions, at 45 percent, compared to coal’s 19 percent.”

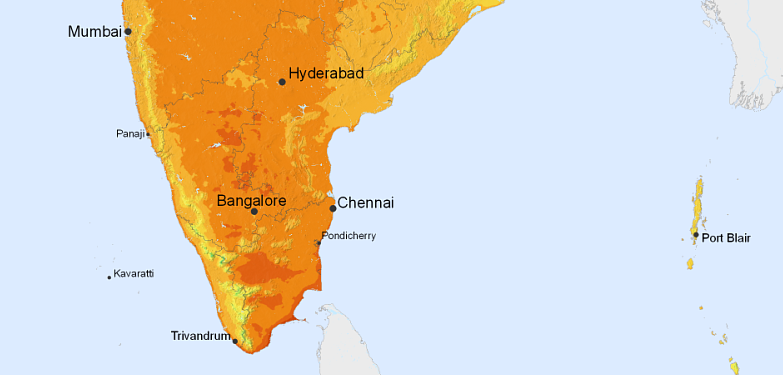

As India’s cumulative installations almost reached 20 GW in 2017, the southern states had major part to play. Indeed, Telangana and Karnataka installed over 2 GW each and accounted for around 50% of all installations across the country. Moreover, Telangana became the first Indian state to surpass 3 GW of cumulative solar installations.

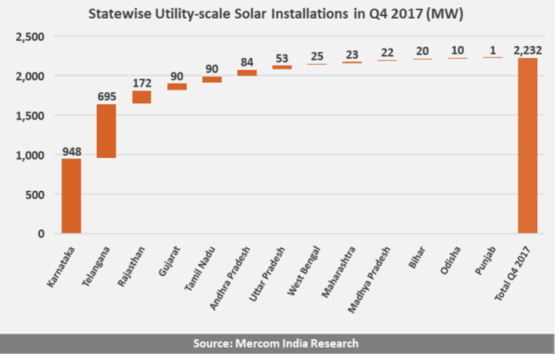

Over the entire year, Andhra Pradesh was the state with the third highest levels of solar installations, at 1.23 GW. In Q4, however, Karnataka saw the most solar installations, at 948 MW. It was followed by Telangana, which installed 695 MW. Tamil Nadu, meanwhile, has the largest project pipeline, totaling over 2 GW.

Source: Mercom

The above graph clearly indicates that solar installations have been highest in the southern states for Q4.

Overall India’s growth in 2017 has been impressive, with solar installations increasing by 123% to reach just under 10 GW, compared to the 4.3 GW installed in 2016. Of this, large-scale solar projects accounted for the lion’s share of installations, at around 90% or 8.63 GW, with the remaining 10% (995 MW) coming from rooftop solar.

Meanwhile, Mercom finds that approximately 10.6 GW of large-scale solar projects were under construction, and another 4.3 GW of tenders pending auction, as of December 31, 2017.

Despite last year’s record growth, Mercom predicts a decline to 7.5 GW in 2018. It cites a number of reasons for this, including: higher module prices – Chinese module average selling prices increased by 19% between Q2 and Q4 2017, says Mercom – and a smaller project pipeline.

“After a very strong year the sector now finds itself beset with uncertainty. There are three different types of duties – safeguard, anti-dumping, and port – that the industry now has to wade through,” adds Raj Prabhu, CEO and co-founder of Mercom Capital Group.

“More than the duties themselves, it is the uncertainty of not knowing what is coming and when that has left the industry in a very tough spot. Government agencies need to come out quickly and resolve these issues to maintain positive investor sentiment going forward,” he continues.

It is not all doom and gloom, however, as Mercom does believe India will continue to be among the top three solar markets for “many years to come.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.