Balancing the renewable energy intermittency

Annual renewable energy balancing between resource-surplus and resource-deficit states can help solve DISCOM woes while ensuring their compliance to renewable purchase obligations.

Clarify basic customs duty on solar modules as Change in Law, NSEFI writes to SECI

Solar cells and modules will continue to attract zero basic customs duty unless exemption notification 24/2005, dated March 1, 2005 is amended to reflect the 20% increase by Ministry of Finance, said the lobby group.

SECI invites global bids for 14 MW solar with 42 MWh battery storage in Ladakh

The project will be awarded to the bidder who quotes the lowest viability gap funding requirement. The upper limit for VGF to be quoted by a bidder is kept at Rs 130 million for 1 MW solar PV project with battery storage of 3 MWh.

SECI concludes world’s largest renewables-plus-storage tender at Rs4.04/kWh

Pumped hydro and battery projects, coupled with renewables, offer the world’s lowest peak clean electricity tariff. The tender, which received bids for for 1.62 GW of capacity against the 1.2 GW sought, saw Greenko secure 900 MW of pumped storage capacity and Renew Power 300 MW of battery storage.

Maheswari Mining & Energy secures the largest slice of 97.5 MW rooftop solar

The developer won 9 MW under RESCO mode. Other major winners include SunSource with 8 MW, Ampsolar and Varp (5 MW each), and Hero Future and HFM Solar Power (4.075 MW each).

SECI tenders 1.2 GW wind-solar hybrid, 4 MW floating solar plus storage

Developers have until February 25 to bid for ISTS connected wind-solar hybrid projects to be set up anywhere in India at the location of their choice. Bidding for 4 MW of grid-connected floating solar project with 2 MW/1 MWh battery energy storage system—to be set up in Andaman & Nicobar Islands—closes on February 13.

SECI tenders another 1.2 GW of grid-connected solar projects across India

Bidders can pitch for up to 300 MW of generation capacity per project with the deadline for proposals on February 4. The eighth tranche of inter-state transmission system program capacity offered by the Solar Energy Corporation of India comes with a solar energy price ceiling of Rs2.78/kWh.

Azure Power secures up to 4 GW of solar project capacity under manufacturing-linked tender

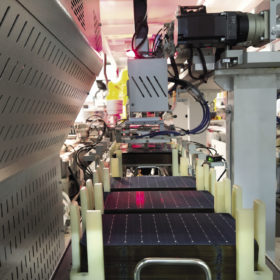

The NYSE-listed developer will set up a 500 MW cell and module production line as its manufacturing commitment under the SECI tender. The tender aimed to secure 2 GW of new annual manufacturing capacity by offering 7 GW of power project permits. Azure has an agreement with an Indian solar panel manufacturer to jointly establish the new production facilities with the developer holding a majority stake in the enterprise.

ReNew Power forms JV with Korean major GS E&C for 300 MW solar project in Rajasthan

The Indian developer will hold majority 51% equity in the joint venture, while the balance will be held by GS E&C. The project is part of the capacity auctioned by Solar Energy Corporation of India (SECI) under its tranche-IV earlier this year.

SECI seeks global bids for 1.2 GW wind-solar and 1.2 GW solar projects

The Solar Energy Corporation of India shall enter into a 25-year power purchase agreement (PPA) with the developers that can set up the projects anywhere in India on “build own operate” basis.