US Customs solar exclusions might be ‘de facto ban on Chinese polysilicon’

Longi solar modules made of Tongwei polysilicon have been excluded from entry to the U.S.

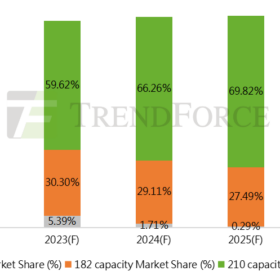

Big module makers in China call for wafer standards

Trina Solar, JinkoSolar, JA Solar, Longi, Risen, Canadian Solar, Tongwei, Chint, and Das Solar have issued a joint statement demanding the standardization of wafer sizes.

Longi claims 33.5% efficiency for perovskite/silicon tandem solar cell

The European Solar Test Installation (ESTI) has confirmed the results of Longi’s new perovskite/silicon tandem solar cell. It is currently the second-highest efficiency record in the world for a perovskite/silicon tandem cell.

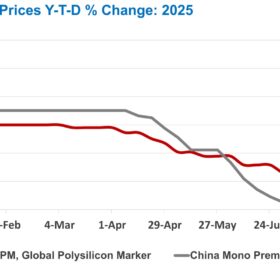

Trina to build 25 GW ingot factory, Longi reduces wafer prices by 30%

Longi said today it cut the prices of its wafer products by 30% and Trina announced it will build a 25 GW monocrystalline ingot factory in the Sichuan province. Furthermore, the National Bureau of Statistics (NBS) revealed that the Chinese PV industry produced 39.92 GW of solar cells in April, and Datang Group unveiled the results of a tender to procure 8 GW of solar panels.

Top PV module manufacturers by shipment volume in 2022

TrendForce has ranked the top six module manufacturers by shipment volume in 2022, with Longi topping the list, followed by Trina Solar and JinkoSolar. JA Solar, Canadian Solar, and Risen Energy rounded out the top six, in a year dominated by large-format modules.

Australia’s top 10 solar panel, inverter manufacturers

Sunwiz has revealed the leading rooftop solar and inverter manufacturers in Australia for 2022.

Longi raises wafer prices as polysilicon hits $34.98/kg

The China Nonferrous Metals Industry Association (CNMIA) said that prices for monocrystalline silicon ranged from CNY 222 ($32.30)/kg to CNY 248/kg last week, up 31.37% from the middle of January. Longi, meanwhile, has raised its wafer prices by more than 15%.

Longi releases new alkaline electrolyzer

China’s Longi claims that its new ALK Hi1 electrolyzer can produce hydrogen with an energy content of 4.3 kWh per normal cubic meter. It says the levelized cost of hydrogen could be up to 2.2% lower than other electrolyzers on the market.

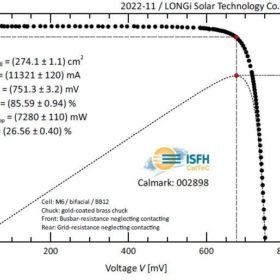

Longi claims world’s highest efficiency for p-type, indium-free HJT solar cells

Longi said it has achieved a 26.56% efficiency rating for a gallium-doped, p-type heterojunction (HJT) solar cell and a 26.09% efficiency rating for an indium-free HJT cell, both based on M6 wafers. Germany’s Institute for Solar Energy Research in Hamelin (ISFH) has confirmed the results.

Is hydrogen about to have its solar moment?

As Longi and other solar manufacturers kick off massive growth in hydrogen generation capacity, expect large price decreases resulting from steep learning curves, echoing the rapid advances experienced by the solar power industry since the 1970s.