JinkoSolar hits 8 GW of solar module shipments to India

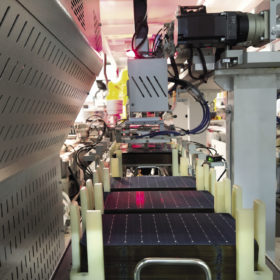

JinkoSolar claims that it has shipped 8 GW of solar modules to India, following record-breaking performance in recent quarters.

India’s first grid-scale storage tenders to spur investment, domestic manufacturing

If Solar Energy Corp. and NTPC can successfully execute tenders for standalone energy storage systems, it could drive investment, support domestic manufacturing, and facilitate the development of new business models, according to a newly released report.

Solar tariffs to rise 21% over the next 12 months

Solar tariffs will likely increase to INR 2.95 ($0.039)/kWh in the next 12 months, mainly due to the 40% basic customs duty on imported solar modules.

Punjab-based textile manufacturer goes solar with a 5 MWp rooftop PV plant

Punjab-based ST Cottex India is getting a 5 MWp rooftop solar plant installed at its yarn manufacturing unit in Ludhiana. Mumbai-based EPC solutions provider Roofsol Energy is doing the ‘OPEX’ mode installation.

India may miss 2022 solar target of 100GW by 27%

A new report by JMK Research and the Institute for Energy Economics and Financial Analysis (IEEFA) says India is likely to miss its ‘100GW by 2022’ solar target by about 27GW, mainly due to the underwhelming growth of rooftop solar. While utility-scale solar is on track to achieve nearly 97% of the 60GW installed capacity targeted by 2022, rooftop solar will be 25GW short of the 40GW mark.

Building a sustainable, vertically integrated solar manufacturing ecosystem in India

A new report by JMK Research and IEEFA says Indian solar manufacturers need to create a strong foundation for sustainable development overall by integrating raw materials and impetus to R&D in their plans, rather than focusing solely on output.

Round-the-clock tenders can help India meet demand for firm renewable power

A report has stated the renewable-plus-fossil fuel model is the best short term option to meet the assured supply conditions in the Solar Energy Corporation of India’s round-the-clock power tenders. Further out, as the cost of batteries decline, that technology is likely to become the most viable option for providing critical, non-intermittent power.

Up to code for decarbonization

The International Energy Agency predicts that India will record the world’s fastest growth in energy consumption from buildings through 2040. The energy demand could create a big market for solar installers and equipment providers, particularly in the commercial and industrial sector. While building codes now include provisions for renewable energy integration, effective implementation will be key to ensuring compliance.

Scaling finance could drive MSME rooftop solar

Rooftop solar growth in India has so far largely been driven by a few large creditworthy organizations in the commercial and industrial sector. However, if accessible financing options are made available, growth can also be replicated in micro, small and medium-sized enterprises (MSMEs) as well, says a new report.

Commercial and industrial rooftops in India could deploy 1,875 MW of solar in 2021

According to a new report, India’s commercial and industrial sector will increase its rooftop solar deployments by 47% year-on-year, with bifacials and large-size high-wattage modules offering cost-effective support for reducing electricity costs.