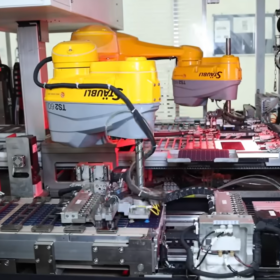

Tractor-mounted, hydraulic panel cleaning arm for solar farms

Tamil Nadu based Next Automation has come up with a tractor-mounted hydraulically operated arm as a fast, accurate, cost-effective, and water-efficient cleaning solution for panels in solar farms.

Gautam Solar releases gel battery solution for solar storage

India’s Gautam Solar says its gel batteries provide a safer, cost-effective, and long-lasting alternative for the energy storage space.

India’s utility-scale PV capacity hit 41.7GW in December

India installed 41.7GW of cumulative utility-scale solar capacity as of Dec. 31, 2021. It has another 44.6GW in the pipeline.

Rajasthan emerging as a solar hub

Rajasthan, which has already surpassed the 10GW milestone of installed PV capacity, has mopped up commitments for over INR 8 lakh crore of investment in the State’s energy sector alone.

ATUM Charge deploys 250 solar-powered EV charging stations across India

These self-sustaining universal electric vehicle charging stations are powered by Visaka’s ATUM solar roof.

Tata Power commissions 160MW AC solar project for NTPC

Tata Power today announced its solar manufacturing and EPC arm had commissioned a 160MW AC solar project in Rajasthan within 15 months. The project was awarded to it by NTPC.

Tata Power commissions 300MW solar plant with single-axis PV tracker system

Tata Power Renewables Energy Ltd (TPREL), an arm of Tata Power arm, has commissioned a 300MW solar plant in Gujarat–the largest PV project utilizing single-axis trackers in India.

IndianOil, L&T and ReNew to form green hydrogen development JV

IndianOil, Larsen & Toubro, and ReNew will hold an equal stake in their proposed joint venture to develop, execute and own green hydrogen assets in India. Additionally, IndianOil and Larsen & Toubro will form a JV for the production and sale of electrolyzers.

NTPC’s 160MW Jetsar solar project now fully online

The 160MW Jetsar solar project in Rajasthan is now fully operational with its second-part capacity of 80MW commissioned in March.

NTPC commissions 22MW floating solar capacity in Kerala

The capacity is part of NTPC’s 92MW floating solar project at Rajiv Gandhi Gas based Power Station in Kayamkulam.