Avaada Electro’s ALMM listed solar module capacity surpasses 5.4 GW

Avaada Electro has announced the inclusion of its Butibori (Maharashtra) and Dadri (Uttar Pradesh) solar module manufacturing lines in the Approved List of Models and Manufacturers (ALMM) by the Ministry of New & Renewable Energy (MNRE), Government of India. This takes its combined ALMM enlisted capacity to over 5,400 MW a year.

L&T signs MoU with ACWA Power for EPC of renewables and grid infrastructure at Yanbu Green Hydrogen Hub

Larsen & Toubro has signed a Memorandum of Understanding with ACWA Power for engineering, procurement and construction of the renewables and grid infrastructure at the Yanbu Green Ammonia Project in Saudi Arabia.

Sunsure commissions 82.5 MWp open-access solar plant in Uttar Pradesh, its 10th in the State

Sunsure Energy has commissioned an 82.5 MWp open access solar power plant in Erach village of Jhansi district in Uttar Pradesh. This latest addition cements its position as a key renewable energy player in the state, with around 300 MW of cumulative operational capacity.

Prime Minister Narendra Modi inaugurates Avaada Group’s 280 MW solar power plant in Gujarat, lays foundation stone for 100 MW project

Prime Minister Narendra Modi recently inaugurated Avaada Group’s 280 MW solar power plant in Surendranagar district, Gujarat. The project features Avaada Electro’s ALMM-certified, Make-in-India TOPCon n-type bifacial solar PV modules. On the same occasion, the Prime Minister also laid the foundation stone for Avaada’s upcoming 100 MW solar project in Vadodara district.

The Hydrogen Stream: “Hydrogen to play transformative role in India’s space missions, transportation, and clean energy future,” says ISRO Chairman

Hydrogen is set to play a transformative role in India’s space missions, transportation, and clean energy future, said Dr. V. Narayanan, Chairman, Indian Space Research Organisation (ISRO), at a National Workshop on “Hydrogen Fuel Technologies and Future Trends” held at Alliance University, Bengaluru, in association with Indian Institute of Science.

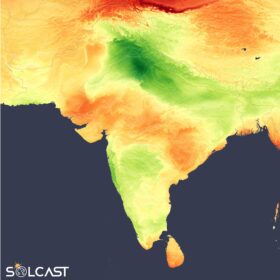

Early monsoon triggers irradiance swings across India in August

In a new weekly update for pv magazine, Solcast, a DNV company, reports that solar irradiance fell by up to 30% in India’s northern regions during the southwest monsoon season, while central areas of the country made solar gains.

Waaree Renewable Technologies invests in Cooling-as-a-Service company Smart Joules

Waaree Renewable Technologies Ltd, the solar EPC arm of Waaree Energies, today announced a strategic investment in Smart Joules, India’s largest Cooling-as-a-Service (CaaS) and energy efficiency company.

Adani Group gets clean chit from SEBI in Hindenburg Case

Market regulator, the Securities and Exchange Board of India (SEBI), has dismissed US-based short seller Hindenburg Research’s allegations of stock manipulation against the Adani Group companies and the Group’s Chairman, Gautam Adani.

Why phasing out ISTS waiver is a step towards equitable energy development

The gradual phase-out of ISTS charges waiver for solar and wind projects–75% for projects commissioned by June 30, 2026, 50% by June 30, 2027, and 25% by June 30, 2028, and zero thereafter–is bound to push up final price for end consumers. The shift could increase tariffs by INR 0.40–0.50 per unit

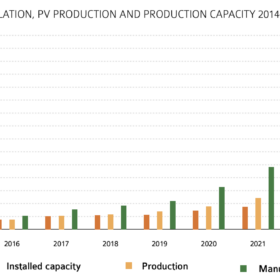

Draft ALMM List-III signals India’s push for self-reliance in solar manufacturing

The draft order for the implementation of the Approved List of Models and Manufacturers (ALMM) for wafers and ingots clearly indicates the government’s commitment to advancing domestic solar PV upstream integration and bridging the capacity gap between modules, cells, and wafers. Issuing this order nearly three years before its effective date and one year before the implementation of ALMM List-II will allow solar manufacturers to plan for wafer capacity alongside their upcoming cell capacities.