EV Financing 2.0: Building the Financial Backbone of India’s Green Mobility Ecosystem

As the country accelerates towards a greener future, the focus is rapidly shifting to financing the entire electric vehicle (EV) ecosystem, spanning charging infrastructure, batteries, fleet operations, and clean energy integration. This transition marks the emergence of EV Financing 2.0: a more holistic approach that goes beyond point-of-sale lending to enable sustainable, scalable, and economically viable green mobility.

Electrolyser selection and balance-of-plant engineering for renewable integrated hydrogen projects

Green hydrogen will scale not through isolated technology breakthroughs, but through disciplined engineering execution. Projects that embed electrolysers within robust, flexible, and future-ready Balance-of-Plant architectures will define the next phase of industrial decarbonisation and renewable energy integration worldwide.

Renewable energy industry’s key expectations from Union Budget 2026

The upcoming budget must prioritize in-house technology and equipment development, provide clarity on delayed power purchase agreements (PPAs) and power sale agreements (PSAs), increase budgetary allocation and policy support for Green Energy Corridors, introduce production-linked incentives for battery energy storage system (BESS) manufacturing, establish an Approved List of BESS Integrators (ALBI), lower the cost of capital through priority sector lending, extend ALMM for solar cells, and continue the ISTS waiver, among other measures.

India–EU FTA anchors climate and trade in a fracturing global order

The India–EU free trade agreement is emerging as a platform for climate-trade convergence. The climate dimension is not incidental—it’s already embedded in ongoing India–EU frameworks.

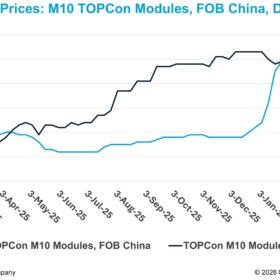

China TOPCon solar module prices climb over 30% since mid-December

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

Why end-to-end solar manufacturing is India’s competitive edge

End-to-end solar manufacturing is the bridge that will reduce import reliance, stabilize costs, strengthen supply chains, support exports, and help India move confidently toward its 500 GW renewable energy goal. With the right investments and a continued focus on innovation, India is positioned not just to participate in the solar revolution, but to help shape it.

Building responsibly: India’s steel sector and the carbon budget challenge

India’s steel sector stands at a decisive moment. As the country pursues industrial growth, it must also demonstrate that development and decarbonisation can move together. The carbon budget framework offers not a constraint, but a compass, guiding industry toward innovation, resilience and global competitiveness.

European PV market faces potential 2026 price shock from China export tax

China’s PV manufacturing sector is operating at full capacity ahead of an April 1 export tax change, contributing to module price increases of 20% to 30% in parts of the supply chain and raising risks for price-sensitive European commercial and utility-scale projects in early 2026.

Why India’s digital future will be built at the edge

The centralized cloud model is now under strain. India alone is estimated to have reached roughly 2,070 MW of data center capacity by the end of 2025, up from about 1,255 MW in 2024, driven by AI adoption, 5G rollout, and video led consumption, even as power, land, and network constraints become more visible. At the same time, global data center markets are grappling with power constraints, rising energy costs, and land limitations, making the continued expansion of a few large hubs increasingly inefficient.

Energy storage for homes: Why hybrid inverter systems will lead the next phase of solar growth

Energy storage for homes—anchored by hybrid inverter systems—will lead the next phase of solar growth in India. Not as an upgrade, but as a necessity for a nation building toward energy independence by 2047.