Beyond the panels: How India’s solar growth and PM-KUSUM are redefining the grid

While policy discussions focus on solar tariffs and farmer incentives, we see a different challenge emerging on the factory floor: Infrastructure Redefinition. The humble transformer is being asked to do things it was never originally designed to do.

FOB China TOPCon solar cell prices hold steady as market awaits post-holiday reassessment

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

What India needs to accelerate sustainable lending post-budget

The next phase of green growth will depend on how quickly capital reaches businesses that are ready to modernize, become energy-efficient, and invest in cleaner production systems. The question is no longer whether sustainable lending will grow, it is how fast we can remove the barriers preventing it from scaling.

Solar module prices rise faster than expected in February

Solar module prices increased by €0.01 ($ 0.012)/W to €0.015/W in February, lifting levels 15% to 18% above the December 2024 low despite falling wafer costs, as manufacturers seek to restore margins after prolonged losses.

From panels to complete energy systems: The evolution of India’s rooftop solar market

Rooftop solar is moving from being a supplementary solution to becoming a central component of India’s energy architecture. The next phase of growth will not be defined by panel installations alone but by how effectively generation is integrated with storage, digital intelligence, and grid infrastructure.

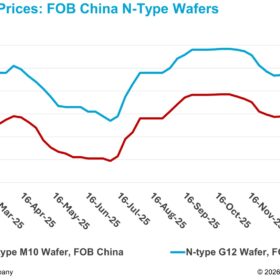

China wafer prices fall for fourth week as discounting deepens under inventory pressure

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

India’s 2030 battery gigafactory ambition: Strengths, bottlenecks and solutions

The number of operational battery gigafactories will increase significantly, with more than 30 manufacturing sites expected to be in operation by 2030, targeting a total production capacity exceeding 290 GWh. However, challenges such as raw material and skilled labor shortages, insufficient R&D investment, and a lack of long-term strategic planning remain.

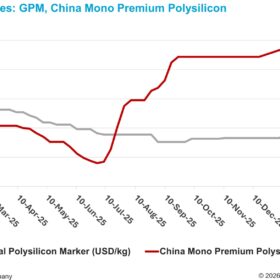

Polysilicon transactions remain subdued amid buyer hesitancy

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

India’s blueprint for sustainable solar success

By embedding quality benchmarks into procurement and manufacturing incentives, policymakers are ensuring that India’s energy transition is durable, not disposable. The focus has moved from rapid installation to long-term reliability — a sign of sectoral maturity.

UV testing, solar cell factory inspection now mandatory for Munich Re’s PV warranty insurance

The world’s largest reinsurer has recently introduced stricter requirements for PV warranty insurance to further de-risk insured PV parks and set a higher benchmark for industry wide reliability and production quality.