Brookfield acquires controlling stake in Leap Green Energy

Brookfield will initially make an equity investment of over $200 million in Leap Green Energy, through subscription of new shares and acquisition of shares from current shareholders. It may infuse further $350 million of incremental equity capital to support Leap Green’s future growth in renewable energy solutions for the commercial and industrial sector.

The Hydrogen Stream: India’s second electrolyzer tender attracts proposals for more than 2.8 GW

India’s second 1.5 GW electrolyzer manufacturing tender under production-linked incentives scheme has attracted bids from 23 companies for a cumulative annual capacity of 2,847 MW.

REC secures JPY 31.96 billion green loan from Deutsche Bank AG

REC Ltd has secured a green loan of JPY 31.96 billion (equivalent to $200 million) from Deutsche Bank AG to finance eligible green projects in India.

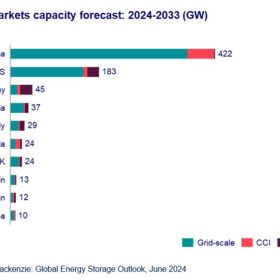

Global energy storage fleet to surpass 1 TW/3 TWh by 2033, WoodMac says

According to the latest forecast from Wood Mackenzie, the global energy storage market (excluding pumped hydro) is on track to reach 159 GW/358 GWh by the of 2024 and grow by more than 600% by 2033, with nearly 1 TW of new capacity expected to come online.

India’s installed battery storage capacity reached 219.1 MWh as of March end: Mercom

The recently released Mercom report expects India to add 1.6 GWh of standalone battery energy storage systems and 9.7 GW of renewable projects plus energy storage by 2027.

India leading the solar wave to become world’s second-largest module manufacturer

Continued government support, coupled with strategic investments in technology and infrastructure, will be crucial in realizing India’s renewable energy goals and cementing its position as a global leader in solar module manufacturing.

The Hydrogen Stream: India issues guidelines for second round of green hydrogen incentives

The Ministry of New and Renewable Energy (MNRE) has released guidelines for the second round of incentives for green hydrogen production under the Strategic Interventions for Green Hydrogen Transition (SIGHT) Programme.

Solar industry grapples with oversupply and uncertainty

The solar industry stands at a critical juncture. Oversupply, regulatory hurdles, and technological advancements are all reshaping the landscape. Manufacturers must adapt swiftly, balancing production with demand while navigating the complexities of global trade.

South Africa imposes 10% import tariff on solar panels

The International Trade Administration Commission of South Africa (ITAC) has imposed a 10% import tariff on solar panels to protect local manufacturers, attract investment, and deepen the value chain. The South African Photovoltaic Industry Association has questioned the lack of formal industry engagement, calling the timing “not ideal.”

ICRA upgrades Tata Power to AA+ with Stable outlook

The ratings upgrade takes into account Tata Power’s healthy operating and financial performance driven by the diversified business profile, superior operating efficiencies, and long-term offtake agreements for the generating portfolio.