IndiGrid, BII, and Norfund form $300 million platform to develop greenfield transmission and BESS projects in India

IndiGrid has partnered with British International Investment (BII) and Norfund to form a $300 million platform, EnerGrid, to develop greenfield transmission and standalone battery energy storage system (BESS) projects in India.

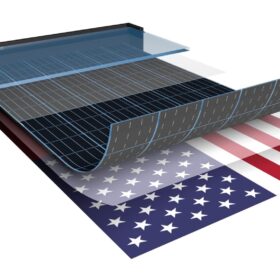

The future of clean energy policies in a new Trump administration

With passage of a trifecta of clean energy legislation, the U.S. now has strong industrial policy that is building out domestic manufacturing, bringing jobs to the U.S., increasing clean energy capacity, driving the economy and more. What could change?

DGTR recommends anti-dumping duty on solar glass imports from China, Vietnam

India’s Directorate General of Trade Remedies (DGTR) has recommended an anti-dumping duty on solar glass imports from China and Vietnam after its investigation concluded that imports from these countries are undercutting the prices of the domestic industry. The landed value of the imports is below the selling price as well as the cost of the domestic industry.

Driving India’s green energy transition: Effective government policies and incentives

If India is to lead the global green energy revolution, the nation needs to take several key measures such as redirecting financial support from traditional energy sources to clean energy technologies, introduction of a well-structured carbon pricing mechanism, and incentivizing emerging technologies.

Reliance Power claims ‘fraud’ by third party, to challenge SECI ban

In a stock exchange filing later today, Reliance Power said it will take all legal steps to challenge SECI’s action that bars the company from participation in future government tenders for three years.

India’s climate policies to reduce 4 billion tonnes of CO2 emissions between 2020 and 2030: CEEW Study

India’s climate policies on power, transport and residential sectors, such as scaling renewables to advancing energy efficiency and electric mobility, have already mitigated 440 million tonnes of carbon dioxide (MtCO2) between 2015 and 2020, and are on track to save 3,950 MtCO2 emissions between 2020 and 2030. However, achieving net-zero by 2070 needs bolder action.

Anil Ambani’s Reliance Power debarred from participating in SECI’s tenders for three years

The debarment follows the submission of a fake document by Reliance Power’s arm Maharashtra Energy Generation Ltd (the ‘bidder’), now known as Reliance NU BESS Ltd, in response to SECI’s tender for setting up 1 GW/2 GWh of standalone battery energy storage (BESS) projects.

U.S. Government releases bottom-up solar pricing tool

The U.S. Department of Energy’s latest solar cost model shows that residential solar prices are up, commercial solar is getting cheaper and utility-scale pricing remains flat. The addition of batteries increases costs by $1.75/W for residential projects and $0.75/W for larger installations.

Rajesh Power Services plans to raise around INR 150-160 crore through IPO

The Gujarat-based EPC service provider for the power sector intends to utilise part of the net proceeds for in-house development of technical expertise in the production of green hydrogen and associated equipment such as electrolysers.

Rajasthan, Gujarat need policy interventions to sustain leadership in renewable energy deployment: IEEFA

A new briefing note by the Institute for Energy Economics and Financial Analysis (IEEFA) recommends lower incremental green tariffs, dedicated infrastructure funds, green budgeting, scaling up distributed renewable energy and advancing grid modernisation and energy storage to cement Gujarat and Rajasthan’s leadership in renewable energy deployment.