Waaree Energies, IIT Bombay collaborate to drive perovskite solar R&D

Waaree Energies will support creation of an advanced fabrication and characterization setup for high-efficiency perovskite solar cells at IIT Bombay.

Jakson Green partners Dutch solar desalination company Desolenator

Jakson Green and Netherlands-based Desolenator have partnered to scale Desolenator’s solar desalination technology for deployment in India and other countries, addressing the growing global water challenges.

Marico now meets 67% of its energy requirement through renewable sources

The FMCG major aims to achieve net-zero operational emissions in India (across owned manufacturing units) by 2030 and in global operations by 2040.

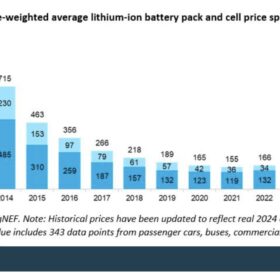

BNEF: Lithium-ion battery pack prices drop to record low of $115/kWh

Battery prices continue to tumble on the back of lower metal costs and increased scale, squeezing margins for manufacturers. Further price declines are expected over the next decade.

Mahindra Susten closes INR 1,448 crore financing for 560 MWp of solar projects

Mahindra Susten has secured a Rupee term loan of INR 1,448 crore from HDFC Bank and Axis Bank for 560 MWp of solar power projects being developed in Gujarat and Rajasthan.

Sinovoltaics updates battery energy storage system financial stability ranking

The latest financial stability ranking keeps Tesla, Mustang Battery, Kung Long Batteries, Hyundai Electric and Eaton, in the top five spots in a report that includes 55 manufacturers.

Reliance Power sets up renewables arm

Reliance Power has set up a new subsidiary, Reliance Nu Energies, for renewable energy business. Mayank Bansal and Rakesh Swaroop, who previously worked with ReNew Power, join Reliance Nu Energies as chief executive officer and chief operating officer, respectively.

Coal-based steelmaking plans jeopardize India’s net-zero target

The “build now, decarbonize later” approach misses the opportunity to develop steel capacity using low-emissions technologies, which could make India a leader in green steel capacity, save on decarbonization efforts later, and reduce current and future stranded asset risk in the industry.

Hitachi Energy advances energy forecasting with new AI solution

Hitachi Energy’s Nostradamus AI solution enables users to make better decisions by quickly generating accurate forecasts for solar and wind generation, market pricing, load, and more.

Avaada Group commits INR 1 lakh crore renewable energy investments in Rajasthan

Avaada Group will invest across pumped storage, green hydrogen, green ammonia, wind and solar power projects in Rajasthan.