SmartHelio appoints key executives

The Swiss PV diagnostics and predictive solutions provider has appointed Neeraj Dasila as chief technology officer (CTO), and Shankaransh Srivastava as vice president-marketing.

Reliance New Energy Solar buys 1.84 crore Sterling & Wilson Renewable shares from Shapoorji Pallonji

Consequent to this acquisition, Reliance New Energy Solar holds 25.16% of the total paid-up equity share capital of Sterling & Wilson Renewable Energy (formerly known as Sterling and Wilson Solar Limited).

Cabinet approves intrastate transmission scheme backing 20 GW of renewable energy capacity

The second phase of Green Energy Corridor (GEC) scheme for Intra-State Transmission System will facilitate grid integration and power evacuation of approximately 20 GW of renewable energy (RE) power projects in Gujarat, Himachal Pradesh, Karnataka, Kerala, Rajasthan, Tamil Nadu, and Uttar Pradesh.

Hero Future Energies, Ohmium to install 1 GW of green hydrogen capacity

Indian renewable energy developer Hero Future Energies has partnered with US-based Ohmium International on the development of green hydrogen plants in India, the UK, and Europe with a cumulative electrolyzer capacity of 1 GW.

Airtouch Solar appoints Nimish Jain as India CEO

Nimish Jain brings to Air Touch India, the India arm of the Israeli robotic cleaning specialist for the solar industry, around 13 years of work experience in renewable energy in new market development, operations, strategy and business development functions. He has worked with companies like Solarig Global, Vikram Solar, and Jinko Solar.

NHPC to acquire majority stake in 500 MW floating solar JV with GEDCOL

State-run hydropower producer NHPC will form the joint venture with a capital investment of INR 500 crore, raising a majority stake of 74% with the rest 26% held by Green Energy Development Corporation of Odisha Limited (GEDCOL).

India added 935MW of private-contract backed solar in first nine months of 2021

That meant the nation reached a cumulative 4.8GW of “open-access” solar generation capacity by the end of September. At that point, there were also more than 1.1GW of open access projects in the development pipeline, according to analyst Mercom India Solar.

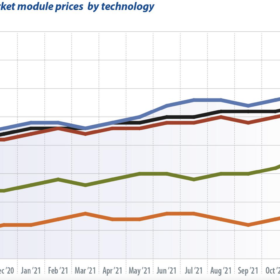

PV module price index: The price spiral winds up

The title of Martin Schachinger’s October market commentary was “Module prices set to rocket back to 2019 levels.” This month, he writes that prices have already reached December 2018 levels and notes that there is no reversal in sight. Prices for all module technologies have once again risen by an average of 3 percentage points since last month.

India’s energy transition: Opportunities in power transmission, monitoring and storage

As India ramps up renewable capacity, there will be a higher requirement for substations, transmission corridors as well as battery energy storage. There is tremendous potential in technology localization in areas such as remote power monitoring, predictive maintenance, EV charging, green hydrogen, and energy storage.

Waaree supplies 1.53 MW of solar modules to RBA Power

The Mumbai-headquartered solar manufacturer supplied its 335 Wp polysilicon modules for the 1.53 MW PV project located at Kovilpatti in the Indian State of Tamil Nadu.