Distributed solar developers want ongoing open-access and net metering projects excluded from ALMM mandate

Over 4GW of open access and rooftop solar projects under various stages of development can get stuck due to the ALMM requirement, according to Distributed Solar Power Association (DiSPA).

Torrent Power completes the acquisition of 50MW solar plant from Lightsource bp and UKCI

The PV plant, situated in Maharashtra, is owned and operated by Lightsource BP’s renewable energy arm Lightsource Renewable Energy (India) in finance partnership with UK government-funded green investment platform UKCI.

Solar sector’s response to Covid

The COVID-19 outbreak impacted the solar industry in terms of cash flow, payment collection from distribution businesses, working capital needs, workforce availability, and, most critically, supply chain availability. The government’s response to this situation was mainly positive.

NSEFI, HAI launch Green Hydrogen Consortium of Indian Industry

Through this initiative, the National Solar Energy Federation of India (NSEFI) and Hydrogen Association of India (HAI) will drive the industry response to promote indigenous manufacturing, advocate policy measures, and support pilot projects while facilitating industry-academia collaboration.

Ola, Hyundai, Reliance and Rajesh Exports emerge winners in 50GWh battery cell tender under PLI Scheme

Those put under the waiting list include Mahindra & Mahindra Limited, Exide Industries Limited, Larsen & Toubro Limited, Amara Raja Batteries Limited, and India Power Corporation Limited.

Vikram Solar files for IPO to raise funds for 2GW integrated fab

The Kolkata-headquartered solar manufacturer has filed draft papers with SEBI for its initial public offering (IPO), which comprises a fresh issue of up to INR 1,500 crore and an offer for sale (OFS) of up to five million equity shares by the existing shareholders.

Battery supply could remain tight into next year

Analyst Wood Mackenzie has predicted soaring demand for electric vehicle devices will ensure supply will not keep pace with demand until some point in 2023.

ArcelorMittal, Greenko partner on a renewables-plus-storage project

UK-headquartered ArcelorMittal will own and fund a hybrid wind-solar project with energy storage for round-the-clock RE supply to the Hazira plant of its joint venture ArcelorMittal Nippon Steel India. Greenko will design, construct and operate the project.

China and Hong Kong are India’s biggest lithium battery suppliers

The two nations together supply 96% of India’s lithium-ion cell and battery imports and almost 70% of non-rechargeable lithium products.

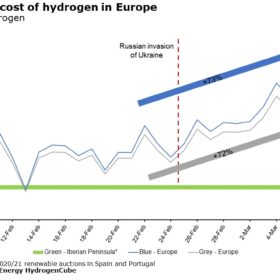

Invasion of Ukraine an inadvertent boost for green hydrogen

Rystad Energy has joined BloombergNEF with a significant forecast for gray and blue hydrogen off the back of Russia’s invasion of Ukraine. According to the analysts, the impact of the war has sent prices of fossil fuel-tied forms of hydrogen production surging, leaving the gradual but consistent downward price trend of green hydrogen now looking remarkably competitive.