Torrent Power acquires 50 MW solar plant from Canadian developer SkyPower

The solar plant, located in Telangana, benefits from a 25-year power purchase agreement (PPA) with the State discom at a fixed tariff of approx. INR 5.35/kWh. It has a remaining useful life of approx. 20 years.

India calls for credit guarantee fund to drive solar adoption in electricity-deprived regions globally

RK Singh, India’s power minister, and president of the International Solar Alliance (ISA) Assembly, called on nations to support solar investments in developing and under-developed regions, including Africa, through low-cost finance and credit guarantee fund.

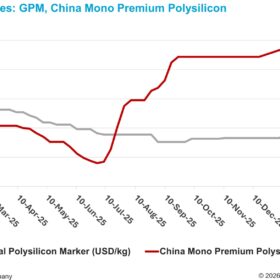

Solar module prices increased 38% in the last 20 months

Supply demand mismatch is the most crucial factor which is directly or indirectly leading to an increase in module prices. At present, demand (especially for poly-Si) far outstrips the supply. A balance between the supply and demand is essential for stabilization of solar module prices.

Green ammonia, low-hanging fruit for India’s green hydrogen economy

A new report from IEEFA says green ammonia could help India significantly reduce its trillion-rupee fertilizer subsidy bill and cut dependence on liquefied natural gas (LNG) imports for fertilizer production. The report looks at leading green hydrogen to green ammonia projects worldwide and reviews the cost competitiveness of producing green ammonia using various electricity inputs – grid electricity, round-the-clock renewable power, and solar power plus batteries. It also looks at the policy interventions required for green hydrogen and ammonia projects.

Lithium battery recycling in India

Nitin Gupta, chief executive officer and co-founder, Attero Recycling, speaks to pv magazine about the supply chain concerns for lithium battery storage manufacturing in India, current battery recycling scenario and Attero’s capacity.

THDC, Rajasthan government sign agreement for 10GW of solar parks

The State-run hydropower producer will develop 10 GW of solar park capacity in Rajasthan through a joint venture with Rajasthan Renewable Energy Limited (RRECL).

Adani Solar expands PV panel retail distribution to Tamil Nadu

The solar manufacturer, with a 3.5GW cell and module production capacity, has expanded its retail sales footprint to Tamil Nadu with Festa Solar as the official distribution partner for the region.

Bangladeshi fabrics maker invests in 100 MW solar plant

The solar park will sell power to the Bangladesh Power Development Board at a price of $0.1195/kWh under a 20-year power purchase agreement.

BlackRock, Mubadala to invest in Tata Power Renewables

Tata Power has raised INR 4,000 crore (US$ 525 million) from a consortium led by the world’s largest fund manager BlackRock Real Assets and Abu Dhabi sovereign wealth fund Mubadala Investment Company to fund the growth of its renewable energy business.

ALMM policy deferment, a much awaited but temporary relief to the solar market

While ALMM does support domestic manufacturers, this is not a sustained solution considering the wide demand-supply gap. Disincentivising imports could be a workable strategy when there is enough capacity back home.