SECI’s latest auction yields green ammonia price of INR 51.8 per kg

Solar Energy Corp of India (SECI) has discovered a new record-low green ammonia price of INR 51.8 per kg (around $591.25 per metric tonne) in its latest auction. The winning bid was placed by NTPC Renewable Energy Ltd.

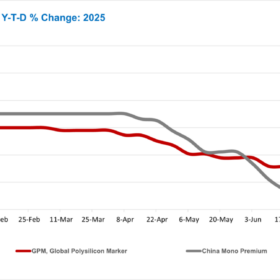

China’s polysilicon rally enters fourth week, defying market fundamentals

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

ACME Group receives Letter of Award for green ammonia production project under SIGHT Scheme

ACME Group will supply 75,000 metric tonnes of green ammonia for a period of ten years to Paradeep Phosphates Ltd, one of India’s largest chemicals and fertilizer companies, at their facility in Paradeep, Odisha.

Is India’s energy storage market headed for oversupply?

A recent report by SBICAPS projects that India will add 30 GW of energy storage capacity (battery storage, pumped storage, etc) through standalone and firm and dispatchable renewable energy (FDRE) projects by June 2027. This would bring the country’s total storage capacity to 36 GW—far exceeding the projected demand of around 24 GW, and possibly leading to oversupply.

Jakson Green secures its first wind PPA with GUVNL

Jakson Green has entered wind power generation by securing power purchase agreement (PPA) for a 100 MW project with Gujarat Urja Vikas Nigam Ltd.

India could cut electricity costs to $50/MWh by 2050 with a fully wind and solar-based power system, says ETC report

India could achieve clean power system at a cost (including generation, balancing, and grid infrastructure) of around $50/MWh by 2050—significantly below current fossil fuel-driven wholesale prices—by shifting to a fully wind and solar-based electricity system requiring primarily day-night balancing.

US lifts duties on certain small solar devices imported from China

The US Department of Commerce will lift trade duties on certain low-power solar devices from China, citing limited domestic interest in maintaining the tariffs. The decision affects small modules typically used in lighting and other control applications.

Waaree Energies records INR 4,597.18 crore revenue in Q1 FY 2026

Waaree Energies Ltd has reached an order book of 25 GW—comprising 58.7% overseas and 41.3% domestic orders—valued at approximately INR 49,000 crore.

Surplus solar panels offer timely solution for industry under pressure

Supply chain challenges, subsidies and tariff uncertainties are forcing the solar energy industry to find significant cost efficiencies. As older models of installed solar panels become harder to source, the growing second-life solar market helps industry find replacement panels and other equipment.

Acme Solar posts INR 131 crore profit for Q1 FY2026

Acme Solar has reported a net profit of INR 131 crore for the first quarter of FY2025-26, a stellar increase of 9,319% YoY.