“Multi-dimensional renewable energy growth key to India’s long-term development and energy security”

India’s renewable energy expansion will extend beyond utility-scale projects to distributed renewable energy, green open access and emerging prosumer models enabled by digital platforms and the India Energy Stack as the nation advances toward its vision of becoming a developed nation by 2047.

ABB invests further $75 million to expand manufacturing and R&D footprint in India

ABB will invest a further $75 million in India during 2026 to significantly expand its manufacturing and research and development (R&D) capabilities for critical electrification and automation solutions.

The strategic turn in industrial energy procurement

Industrial energy procurement has broadened in scope. Tariffs remain an important part of the decision, alongside a wider set of considerations. Buyers now weigh reliability, predictability, sustainability, and long-term exposure alongside price.

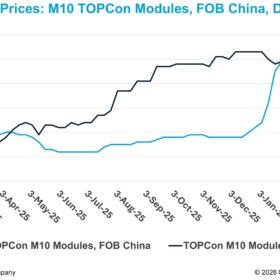

China TOPCon module prices edge higher as March cargoes clear

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

Why tech-enabled, solar-compatible BESS will power the next energy boom

The next clean-energy boom will be driven not only by renewable generation but by intelligent storage. Tech-enabled, solar-compatible battery energy storage systems (BESS) will make clean energy predictable, resilient, and commercially viable at scale.

Silent bottleneck in India’s EV transition: Roadmap for localization, talent and better user experience

Several EV and charging components such as rectifiers, power modules, semiconductors, battery cells and PCBs are still largely imported. These create ecosystem-wide challenges including supply volatility, cost exposure, limited local integration, and scaling constraints. However, these gaps also represent one of India’s biggest opportunities.

European Commission proposes Made in EU requirements for solar inverters, cells

The Industrial Accelerator Act says solar projects awarded through public procurements or other public support schemes would need to feature Europe-made solar inverters and cells within three years after the act becomes law. For battery energy storage systems, similar requirements would be introduced using a phased approach from one year after the act enters force.

Advait Energy Transitions upgraded to ‘A-/Stable’ by Crisil Ratings

CRISIL has upgraded Advait Energy Transitions Ltd’s long-term rating to A-/Stable from BBB+/Stable, and short-term rating to A2+. In addition, the total bank loan facilities rated have been enhanced from INR 110 crore to INR 405 crore.

Siemens Energy India Q1 profit rises 34.9% to INR 313 crore

Siemens Energy India Ltd has reported a 26% year-on-year increase in revenue to INR 1,911 crore and a 34.9% rise in profit after tax to INR 313 crore for the quarter ended December 2025 (Q1 FY2026). The company’s order backlog expanded 37.6% to INR 17,599 crore.

Premier Energies buys 51% stake in EPC JV with BA Prerna Renewables

Indian solar manufacturer Premier Energies has completed the acquisition of 104,550 equity shares of HeliosAnthos Energies, securing 51% of the company’s paid-up equity share capital. HeliosAnthos Energies is a joint venture between Premier Energies and BA Prerna Renewables, formed to expand Premier’s presence in the engineering, procurement and construction (EPC) segment of renewable energy projects.