IIT Bombay, BHEL in race to develop high-efficiency solar cells

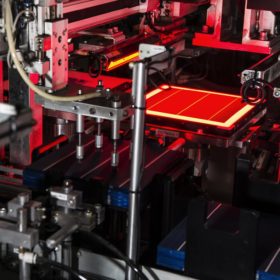

India’s Ministry of New and Renewable Energy is funding the research to develop high-efficiency crystalline silicon solar cells, including those with passivated emitter and rear contact structure, and perovskites.

Virescent assigned provisional ‘AAA’ rating for its renewable energy InvIT

The renewable energy infrastructure investment trust (InvIT) proposed to be launched by KKR-backed Virescent Infrastructure aims to achieve approximately 1.5 GW of assets in the next three years. Its initial portfolio will comprise nine solar energy projects with an aggregate capacity of about 400 MWp.

India eyes 10 GW of ingot-to-module solar factory capacity within two years

Under a production-linked incentive scheme, the government will reward manufacturers for building vertically integrated PV production lines. The scheme aims to attract 10 GW of production capacity by April 2023.

India has the opportunity to build a new energy future

India is set to see the largest increase in energy demand of any country over next 20 years, a new International Energy Agency (IEA) report says, highlighting potential for policies and investment to accelerate clean energy transition.

Tamil Nadu could save INR 35,000 crore with shift from coal to renewables

A new report suggests that the State shut down 3.1 GW of old coal plants and replace the lost generation with renewables. It also advocates switching from expensive power (tariffs > INR 4/kWh) to renewable energy (which now costs INR 3/kWh or less) and halting the construction of new coal plants.

Kalpataru Power Transmission acquires controlling stake in Brazilian EPC firm Fasttel

The Indian multinational has acquired a 51% stake in Brazilian company Fasttel Engenharia Ltd that specializes in engineering, procurement and construction (EPC) of power transmission, substation and distribution services.

Union budget: Customs duty rise for solar inverters but modules spared

Imported solar inverters and lanterns will get costlier, as the union budget for the next fiscal year has proposed customs duty increases from 5%, for both items, to 20% and 15%, respectively. The budget, which also incentivizes Indian manufacturing of solar project components whilst giving a helping hand to raw materials, makes no mention of solar cells or panels.

Financing large scale renewables in emerging economies

pv magazine has taken part in a webinar examining the thorny issue of financing clean energy generation in developing markets.

Electric vehicle transition presents US$266-billion investment opportunity this decade

A new report by government thinktank NITI Aayog and Rocky Mountain Institute (RMI) identifies financing as one of the hurdles for India’s electric mobility transition. It proposes solutions to lower the cost and increase finance for electric vehicles in the nation.

State power companies invited to develop 5 GW of solar

The PV projects—tendered under the Central Public Sector Undertaking scheme—will be entitled to government support through viability gap funding, with the level of VGF awarded determined by reverse-bidding auctions for the project capacity.