Building battery storage systems in India

Nexcharge, a joint venture of India’s largest lead-acid storage battery manufacturer, Exide Industries Limited, and Swiss Lithium-ion battery manufacturer Leclanché, has fully automated assembly lines of li-ion battery packs, modules, and cell testing labs in Gujarat. Ketan Chitnis, vice president-stationary BU, tells pv magazine the government’s PLI Scheme is a major incentive for attracting investment into Li-ion cell manufacturing.

Solar remains energy of choice for lenders

In 2020, 74% of the value of the energy project loans (US$4,435 million) went to renewables (solar and wind) and 26% to coal. Solar PV accounted for 81% of renewable energy deals and 57% of all deals.

Over 90% of India’s solar and wind projects received investment-grade ratings in 2020

An analysis by the CEEW Centre for Energy Finance reveals that India’s renewable energy sector has made significant progress on the back of policies that have helped mitigate several risks for solar and wind project investors.

American bank to lend $500 million for First Solar’s 3 GW fab in India

The debt finance from U.S. International Development Finance Corporation will support the thin-film solar manufacturer’s 3 GW/ annum module manufacturing facility coming up in Tamil Nadu.

IREDA, BVFCL sign MoU on renewable energy and green hydrogen

The Indian Renewable Energy Development Agency Ltd (IREDA) shall provide its techno-financial expertise to help Brahmaputra Valley Fertilizer Corporation Limited develop renewable energy, green hydrogen, green ammonia, and energy efficiency and conservation projects.

The outlook for residential rooftop solar in India

After stagnant annual growth for a couple of years, the rooftop PV market is showing signs of improvement with the usual obstacles no longer so daunting.

Magenta to invest US$33.6 million in Tamil Nadu

The company will invest INR 250 crore for the R&D and manufacturing of cutting-edge technologies in the e-mobility segment.

TVS Motor commits US$161.2 million of electric vehicle investment in Tamil Nadu

The company has signed a memorandum of understanding with the state government to invest INR 1,200 crore for the design, development and manufacturing of new products and capacity expansion in the electric vehicles space.

Renew Power wants to set up 50 kiloton green hydrogen plant in Madhya Pradesh

The renewable energy developer is ready to invest INR 18,000 crore (US$ 2414.29 million) in setting up a 50 kilotonne per annum green hydrogen production plant in the State.

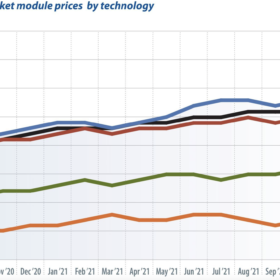

PV module price index: Prices set to rocket back to 2019 levels

First, the bad news: PV modules will be caught up in the global wave of inflation. After a very brief respite, prices are picking up again for almost all module technologies. But the changes recorded for early October are paltry compared to the price increases still to come, writes Martin Schachinger of pvXchange. As of the cutoff date for this market survey, some manufacturers had already announced even more significant upward corrections for future deliveries. The price adjustments shown in the October index are thus only a tentative start to rises of no less than 15-20% over the price levels that prevailed just a few weeks ago. However, this will probably be the last price correction we can expect at the manufacturer level until the end of the year.