GCF approves $24.5 million investment in Avaana Capital’s climate and sustainability fund

Green Climate Fund (GCF) has approved a $24.5 million investment in Avaana Capital’s Climate and Sustainability Fund for technology-driven climate solutions.

More than one lakh people register for PM Suryaghar Yojana in Rajasthan so far

The state government stated that more than 100,000 people have been registered on the portal under the PM Suryaghar Yojana for residential rooftop solar systems in the state so far.

GP Eco Solutions India files DRHP with NSE Emerge

GP Eco Solutions intends to utilize INR 12.45 crore of the IPO proceeds to meet its working capital requirements and invest INR 7.6 crore in its subsidiary Invergy India to procure plant and machinery and set up a new facility.

India’s $2.1 billion green hydrogen programme off to a good start but there’s room for improvement

While the Strategic Interventions for Green Hydrogen Transition (SIGHT) programme is a vital first step, it can be finetuned to generate interest among start-ups and global players.

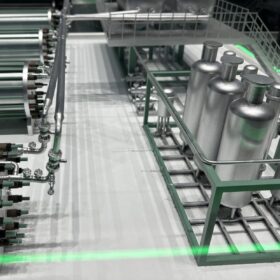

Matrix Gas & Renewables raises INR 350 crore in pre-IPO round

Matrix Gas & Renewables stated the capital raise will accelerate its green hydrogen production projects and hydrogen electrolyzer manufacturing plant, in addition to advancing the company’s growth in the gas aggregation business.

Onix Renewable to launch IPO by the end of 2024

Onix Renewable said it intends to use the proceeds from the issue to finance its renewable power projects and scale up solar module production capacity to 1.2 GW.

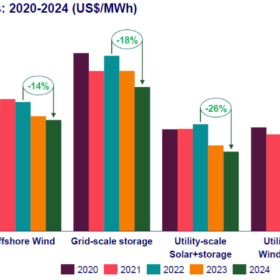

Utility-scale PV cheapest power source in Asia Pacific, says WoodMac

Wood Mackenzie says the levelized cost of electricity (LCOE) in the Asia-Pacific region hit an all-time low in 2023, as utility-scale PV beat coal to become the cheapest power source. It predicts a further drop in costs for new-build solar projects, driven by falling module prices and oversupply from China.

Fitch assigns Adani Green’s proposed USD notes ‘BBB- (EXP)’ rating with Stable outlook

Fitch Ratings has assigned Adani Green Energy Ltd Restricted Group 1’s proposed $409 million senior secured notes due 2042 an expected rating of ‘BBB-(EXP)’ with a stable outlook.

The rise of green finance: Financing the future of renewable energy in India

India has witnessed a surge in solar and wind energy projects, backed by investments from both domestic and international sources. Green finance plays a pivotal role in funding these projects.

ReNew posts $43 million profit in the first nine months of FY 2024

ReNew reported a total income of $870 million and net profit of $43 million in the first nine months of FY 2024.