EV Financing 2.0: Building the Financial Backbone of India’s Green Mobility Ecosystem

As the country accelerates towards a greener future, the focus is rapidly shifting to financing the entire electric vehicle (EV) ecosystem, spanning charging infrastructure, batteries, fleet operations, and clean energy integration. This transition marks the emergence of EV Financing 2.0: a more holistic approach that goes beyond point-of-sale lending to enable sustainable, scalable, and economically viable green mobility.

India requires $145 billion in annual energy investment to bridge growth and climate targets

India must mobilise around $145 billion in annual energy investment to sustain economic growth while pushing its net-zero ambitions. The bulk of this capital will be directed toward scaling up renewable power generation, grid infrastructure modernization, and energy storage, according to Wood Mackenzie.

IndiGrid raises INR 1,500 crore through institutional placement

India’s first and largest publicly listed power sector Infrastructure Investment Trust (InvIT), IndiGrid, has successfully raised INR 1,500 crore through an institutional placement (IP). The placement was oversubscribed by around two times and saw strong participation from both domestic and global institutional investors.

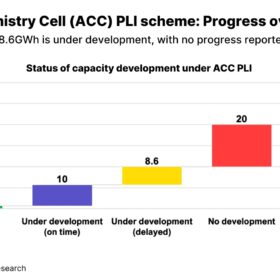

India’s PLI scheme achieves just 2.8% of targeted 50 GWh battery manufacturing capacity so far

Despite strong industry interest, India’s Advanced Chemistry Cell Production Linked Incentive (ACC PLI) scheme, launched in October 2021, is yet to translate policy ambition into realised capacity. As of October 2025, only 2.8% (1.4 GWh) of the targeted 50 GWh capacity has been commissioned within the stipulated timeline, entirely by Ola Electric—according to a new report by JMK Research and the Institute for Energy Economics and Financial Analysis (IEEFA).

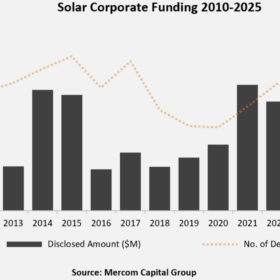

Global solar corporate funding reached $22.2 billion in 2025

While global solar corporate funding in 2025 fell to the lowest level recorded since 2020, deal count rose to its highest level since 2017. Mercom Capital Group says investors favored smaller, lower-risk, execution-ready projects last year amid policy uncertainty, trade pressures and higher financing costs.

Distributed solar platform Aerem raises $15 million in SMBC-led funding round

Aerem Solutions, an end-to-end platform for distributed solar, has raised $15 million in a Pre-Series B funding round led by SMBC Asia Rising Fund, the venture capital arm of Sumitomo Mitsui Banking Corp. (SMBC).

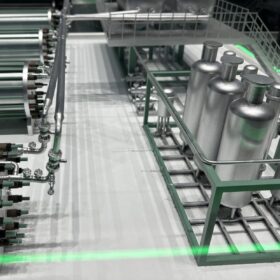

Omani polysilicon factory reaches financial close

United Solar Holding has secured more than $900 million to complete the financing required for its 100,000 MT polysilicon manufacturing facility in Oman. Production is expected to begin during the first quarter of this year.

Kosol Energie signs MoU for INR 90,000 crore investment in Gujarat

Kosol Energie has signed a memorandum of understanding (MoU) with the Government of Gujarat to invest INR 90,000 crore in the State. The company said the proposed investment will support the development of advanced solar module manufacturing facilities, next-generation R&D centers, large-scale renewable energy parks, and integrated green energy ecosystems.

Green bonds totaling $870 million issued for 2 GW solar project in UAE

Joint owners of the 2 GW Al Dhafra solar power plant Abu Dhabi National Energy Company, Abu Dhabi Future Energy Company, EDF Power Solutions and Jinko Power, alongside offtaker Emirates Water and Electricity Company, have issued the green bonds to refinance the plant’s existing debt obligations and support its continued operation.

Inox Clean Energy raises INR 3,100 crore to expand renewable energy and solar manufacturing capacity

Inox Clean Energy Ltd has raised around INR 3,100 crore through an equity round involving the company and its subsidiary, Inox Solar Ltd. The company said the equity infusion will support its plans to achieve 10 GW of installed IPP capacity and 11 GW of integrated solar module manufacturing capacity by FY28.