Avaada Energy closes INR 597 crore refinancing for C&I solar projects

Avaada Energy has secured around INR 597 crore ($71.1 million) in refinancing for its commercial & industrial (C&I) solar projects in Karnataka and Maharashtra.

Avaada Group commits $12 billion to renewables, storage in Rajasthan

Avaada Group plans INR 1 lakh crore ($12 billion) investment to set up a 1.2 GW pumped hydro storage project, a 1 mtpa green ammonia project, a 1 GW wind power project, and a 10 GW solar power project in Rajasthan.

The hidden potential of green energy stocks

The green energy sector in India has been showing strong performance, and so are the green energy stocks. And everyone wants a piece of the pie.

The Hydrogen Stream: Advait Infratech arm increases investment in Norway’s fuel cell company TECO 2030

Advait Energy Holdings has made a further investment in the Norwegian company TECO 2030 that develops PEM hydrogen fuel cell stacks and PEM hydrogen fuel cell modules.

Zelestra closes €132 million financing for its 435 MW solar plant in Rajasthan

Spanish developer Zelestra has raised €132 million financing for its 435 MW solar plant in Gorbea, Rajasthan. The financing has been signed with HSBC, Credit Agricole, MUFG and Bank of America.

Datta Infra secures INR 1,500 crore REC loan to develop 500 MW of renewable energy projects

Adyant Enersol, a wholly-owned subsidiary of Datta Infra, has signed an agreement with REC for financing of 500 MW of renewable energy projects.

NTPC Green Energy files draft papers for $1.19 billion IPO

The initial public offer (IPO) will comprise only a fresh issue of equity shares, with no offer-for-sale component included.

Sunsure Energy, REC sign MoU for INR 10,000 crore to develop green energy projects

REC has agreed to provide INR 10,000 crore in debt funding to support Sunsure Energy in the development of 3 GW of solar, wind, hybrid, and battery energy storage projects.

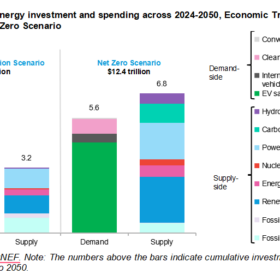

India’s decarbonization presents $12 trillion opportunity in clean technologies

A BloombergNEF study estimates India’s energy sector investment and spending under its net-zero scenario at $12.4 trillion over 2024-50, 34% (or about $3 trillion) higher than in the economic transition scenario.

India to host 2nd edition of International Conference on Green Hydrogen from Sept 11-13

The three-day event in New Delhi will bring together thought leaders, policymakers, industry experts, and innovators from around the world to explore the latest advancements in green hydrogen technology.