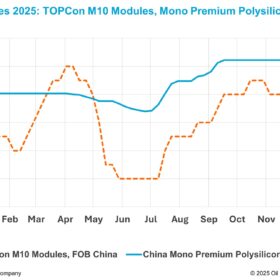

Solar module prices will stay high until 2023, IHS Markit says

IHS Markit predicts that global installed solar PV capacity will grow by 20% to over 200 GW in 2022, despite a difficult cost environment. PV system costs are expected to resume their downward trend from 2023, when more polysilicon capacities will come into operation.

Around 20 companies show interest in 50 GWh battery cell tender under PLI Scheme

The pre-bid conference for the 50 GWh battery storage tender under the production-linked incentive (PLI) scheme saw the participation of around 20 prospective bidders. The conference was organized by India’s ministry of heavy industries to discuss and address the bidders’ queries.

REIL tenders for 2.6 MW of mono PERC modules

Domestic manufacturers have until November 19 to bid for supplying the mono-crystalline/mono PERC silicon solar modules rated for a peak power output of 380-390W each.

Govt to increase PLI funding for solar manufacturing to INR 24,000 crore

The increase in the financial layout will help accommodate more manufacturers under the government’s production-linked incentives scheme to support gigawatt-scale manufacturing of high-efficiency solar modules.

Reuse or replace? IEA PVPS analysis considers all options for underperfoming PV modules

In a new report, experts from the International Energy Agency Photovoltaic Power System Programme (IEA-PVPS) have assessed the economical and environmental benefits of repairing and reusing or replacing solar modules that are not complying with a 30-year expected lifetime. They found that reusing offers the best environmental impact in all cases, while the profitability of this option is currently guaranteed only by rooftop PV under certain conditions. As for large-scale solar, module replacement remains the most competitive option.

Shirdi Sai Electricals gets LoA to set up 4 GW solar fab under PLI Scheme

The Telangana based power distribution transformer manufacturer and installer had placed an INR 1,875 crore incentive bid to set up a fully integrated 4 GW polysilicon-to-module fab under government’s production-linked incentives scheme.

“450 GW by 2030 renewable energy target ambitious but achievable”

At the Renewable Leadership Summit 2021 held recently in New Delhi, Dinesh Jagdale, joint secretary, Ministry of New and Renewable Energy, also asserted the ministry is working on addressing stakeholders’ concerns to ensure the investments keep flowing into RE capacity expansion and equipment manufacturing. The Summit, organized by Solar Association, also saw Solis launch its new-generation PV plant monitoring platform and off-grid hybrid inverters.

Sustaining the battery storage supply chain

Noida-headquartered Lohum plans to expand its integrated lithium-ion battery manufacturing and recycling facility in India to 3 GWh and expand into the US with its first facility. Co-founder Justin Lemmon speaks to pv magazine about how their operations in India will solve the battery supply chain and cost challenge for the nation’s electric mobility and renewable energy ambitions.

Adani Green targets 45 GW renewable energy generation capacity by 2030

The renewable energy developer had an operational capacity of 5,410 MW (4,763 MW solar and 647 MW wind) as of September 30.

US Commerce Department throws out anti-dumping petitions

The dismissal is a win for the Solar Energy Industries Association, which vigorously opposed the request by American Solar Manufacturers Against Chinese Circumvention (A-SMACC) for anti-dumping and anti-circumvention (AD-CVD) tariffs