ACME Solar signs 450 MW FDRE PPA with SJVN, commissions second phase of 285 MW/600 MWh BESS project in Jaisalmer

ACME Solar has secured two power purchase agreements (PPAs) with SJVN Ltd for 300 MW and 150 MW, totaling 450 MW, under a firm and dispatchable renewable energy (FDRE) project. The company also announced the commissioning of an additional 38 MW/82 MWh at its 285 MW/600 MWh battery energy storage system (BESS) project in Jaisalmer district, Rajasthan.

Enrich Energy awarded 300 MW solar EPC project by NTPC REL

Enrich Energy has secured EPC contract, including land package, for a 300 MW grid-connected solar project to be developed at NTPC Anta, Rajasthan.

Beyond the panels: How India’s solar growth and PM-KUSUM are redefining the grid

While policy discussions focus on solar tariffs and farmer incentives, we see a different challenge emerging on the factory floor: Infrastructure Redefinition. The humble transformer is being asked to do things it was never originally designed to do.

Premier Energies buys 51% stake in EPC JV with BA Prerna Renewables

Indian solar manufacturer Premier Energies has completed the acquisition of 104,550 equity shares of HeliosAnthos Energies, securing 51% of the company’s paid-up equity share capital. HeliosAnthos Energies is a joint venture between Premier Energies and BA Prerna Renewables, formed to expand Premier’s presence in the engineering, procurement and construction (EPC) segment of renewable energy projects.

Bondada Engineering Ltd commissions 61.7 MWp of solar in March

Bondada Engineering Ltd has commissioned 61.7 MWp of solar projects for clients including Paradigm IT and Maharashtra State Power Generation Company Ltd (MAHAGENCO) in March.

MNRE’s GIB‑related SCOD relief to benefit 8.6 GW RE projects: India Ratings

India Ratings and Research (Ind-Ra) said the Ministry of New and Renewable Energy’s decision to treat commissioning delays arising from the Supreme Court’s ongoing proceedings in the Great Indian Bustard (GIB) matter as a force majeure‑like event provides material relief to developers of approximately 8.6 GW of renewable capacity.

India expected to install about 42.5 GW of new solar capacity in 2026: JMK Research

India installed around 37.8 GW of solar capacity in CY2025. This comprised about 28.6 GW of new utility-scale solar, a 54.6% increase from 2024, and 7.9 GW of rooftop solar, up 72% year on year. Off-grid additions stood at 1.35 GW, compared to 1.48 GW in 2024.

SolarPower Europe issues due diligence guide for PV-BESS

SolarPower Europe has released new technical due diligence guidelines for utility-scale solar-plus-storage projects, covering risk, engineering and lifecycle standards for co-located PV and battery systems.

Suzlon strengthens leadership to support full-stack renewable expansion

Suzlon has formed a Group Executive Council (GEC), elevated JP Chalasani to the GEC, and appointed a new group CEO to drive its business transformation from a wind energy solutions provider to a full-stack renewable energy solutions conglomerate.

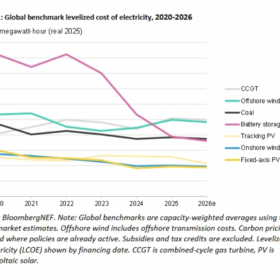

Solar LCOE to fall 30% by 2035, says BloombergNEF

Analysis from BloombergNEF finds the levelized cost of electricity (LCOE) of a typical fixed-axis solar farm increased by 6% year-on-year in 2025 to stand at $39/MWh, but innovation and competition are expected to see costs fall by 30% through to 2035.