Rajasthan now has the most installed solar capacity in India

The state has reached an installed solar capacity of 7,738 MW. With this, it has replaced Karnataka to become the PV energy leader in India.

Hero Future Energies secures India’s first deal for large scale solar in Bangladesh

The Haryana-based renewables company, which is part of a bike and motorbike manufacturing conglomerate, will be paid $0.1025/kWh by the Bangladeshi government for the electricity that will be generated by a 50 MW plant in Khulna district, with the power purchase deal running for 20 years.

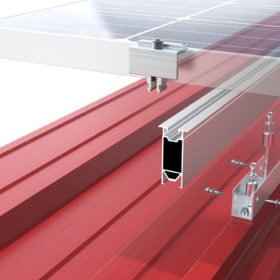

Aerocompact starts making flat-roof solar racking products in India

The Austrian solar racking solutions provider, which is currently making sheet-metal roof mounting products in India, has started local production for flat roofs too. The India-made flat-roof PV mounting products shall be available from January next year.

Recycling solar panels: Making the numbers work

NREL researchers said a profitable and sustainable solar panel recycling industry could establish itself by 2032. Here’s how the numbers work.

India added 521 MW of rooftop solar in Q2 2021

The second quarterly (April-May-June) addition of 521 MW is India’s highest-ever rooftop solar capacity installed in a quarter.

Movable solar power station for off-grid applications

The modular power station comes with two lithium iron phosphate (LFP) batteries and has a capacity of 6 kW/24.6 kWh. It relies on a 3 kW pure sine wave inverter which the manufacturer said is able to adjust the AC charging rate.

Sterling and Wilson Solar commissions 66 MWp PV project in Jordan

The Al Husainiyah solar plant, 200km south of Jordanian capital Amman, is the Indian multinational EPC provider’s third project in Jordan.

Solar on new-build homes has significantly shorter payback period

A report by BloombergNEF and Schneider Electric has pressed the case for governments to unlock the world’s potentially huge rooftop solar potential, and cited California’s solar mandate as a shining example.

Tata Power awarded 250 MW solar project in Maharashtra

With this large-scale solar project, the company’s total renewable capacity will swell to 4,611 MW comprising an installed capacity of 2,947 MW and 1,664 MW under implementation.

Residential rooftop solar in India

Established in 2015, Gurugram-based solar EPC player Corrit Energy and Infra caters to a diverse customer profile ranging from large-scale industries to residences. Director and CEO Mayur Misra speaks about the current state of residential rooftop solar in India and emerging trends.