The MENA region is forecast to add 860 GW of solar PV between now and 2040, according to a report from DNV.

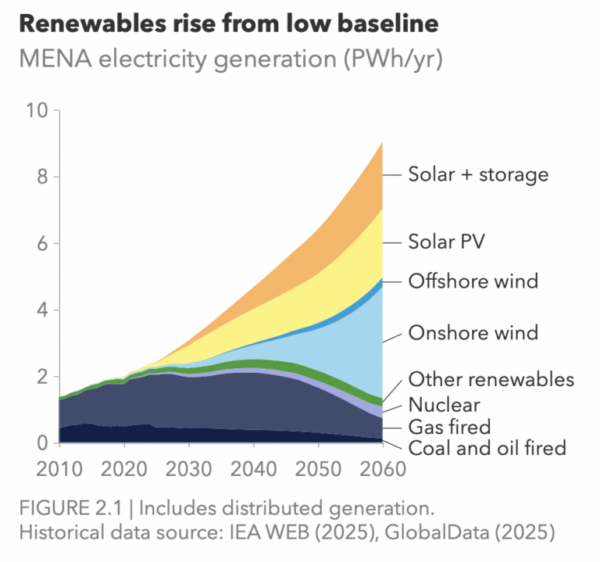

The Rise of Renewables in the Gulf Region report said variable renewable electricity generation will grow 14-fold by 2040, led by solar as it is the cheapest and quickest power source to install.

“The region’s solar build-out benefits from a unique geographical advantage: peak solar supply matches peak electricity demand, both daily and seasonally,” the report said. “This is due to the scale of space cooling demand and reduces the need for the shifting of solar electricity generation with batteries and the risk of significant generation curtailment.”

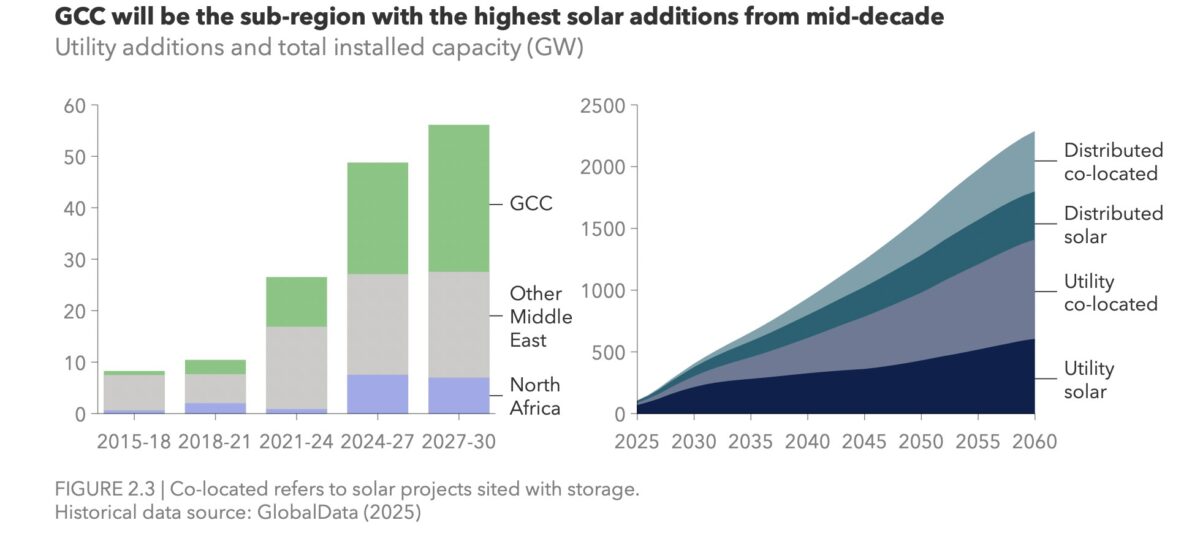

The MENA region had 76 GW of solar capacity in 2024, according to figures in the report, consisting of 61 GW utility-scale and 15 GW distributed solar supplying 4% of the region’s electricity. DNV expects solar capacity to double to 154 GW by the end of 2026 and double again to 343 GW by 2029, at which point solar will supply 19% of the region’s electricity.

Utility-scale projects in the region are getting larger, the report adds, with 80% of completed projects expected to be larger than 1 GW by the end of the decade, up from 20% at the beginning of the decade. An increasing number are also tied to storage. Half of utility-scale solar in the region will be tied to storage by 2044, DNV said, compared to 16% in 2024.

The MENA region currently has 36 GWh of storage capacity, equivalent to 1.4% of global capacity. DNV said storage capacity will grow alongside projected growth in renewable generation to maintain grid stability and flexibility. Forecasts anticipate a tenfold growth to 2030, 100-fold to 2045 and to reach 9.5 TWh by 2060, at which point it will equal 12% of global capacity. Co-located storage projects overtook pumped hydro as the leading storage technology in the region last year and are expected to expand to 70% of total storage capacity this year.

Distributed solar is a relatively smaller market segment in the MENA region compared to elsewhere in the world. A total 19% of solar power in the region was distributed in 2024, compared to a global average of 30%, and DNV said the region is likely to reach that global proportion only by 2035.

The report adds that new demand for solar projects up to 2040 will initially come from buildings, in particular space cooling and desalination. Between 2040 and 2060, DNV is forecasting an additional 2.2 TW of solar and wind will be installed in the region, with demand growth driven by the switch to electric vehicles, an increase in AI data centers and green hydrogen production. By 2060, 92% of electricity generation will be non-fossil, the report predicted, up from 14% in 2024.

“MENA has yet to reach the point of additionality: when growth in non-fossil electricity generation outpaces growth in electricity demand,” the report said. “We forecast this milestone will be passed after 2040, and it is only then that the transition will truly begin.”

DNV added that the region’s relatively new and robust grid means renewable growth is unlikely to be hampered by grid constraints impacting most other regions of the world in the short term. Transmission and distribution lines in the region have grown 24% over the past decade and are expected to double over the next decade, growing a further 52% to 2034.

From 2035 onwards, the grid could become a bottleneck if expansions and upgrades do not match renewable capacity growth, DNV warned. “The near-absence of bottlenecks in MENA is mainly because renewables expansion is still at a relatively early stage, but as the region lacks domestic production for key components it still faces some supply chain delays,” said the report.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.