China’s TOPCon cell prices rose for a fourth consecutive week, led by higher production costs from surging silver prices and ongoing discussions around the removal of export tax rebates. In contrast, PERC cell prices declined amid weakening demand, due to the industry’s continued technological shift towards TOPCon cells, according to trade sources.

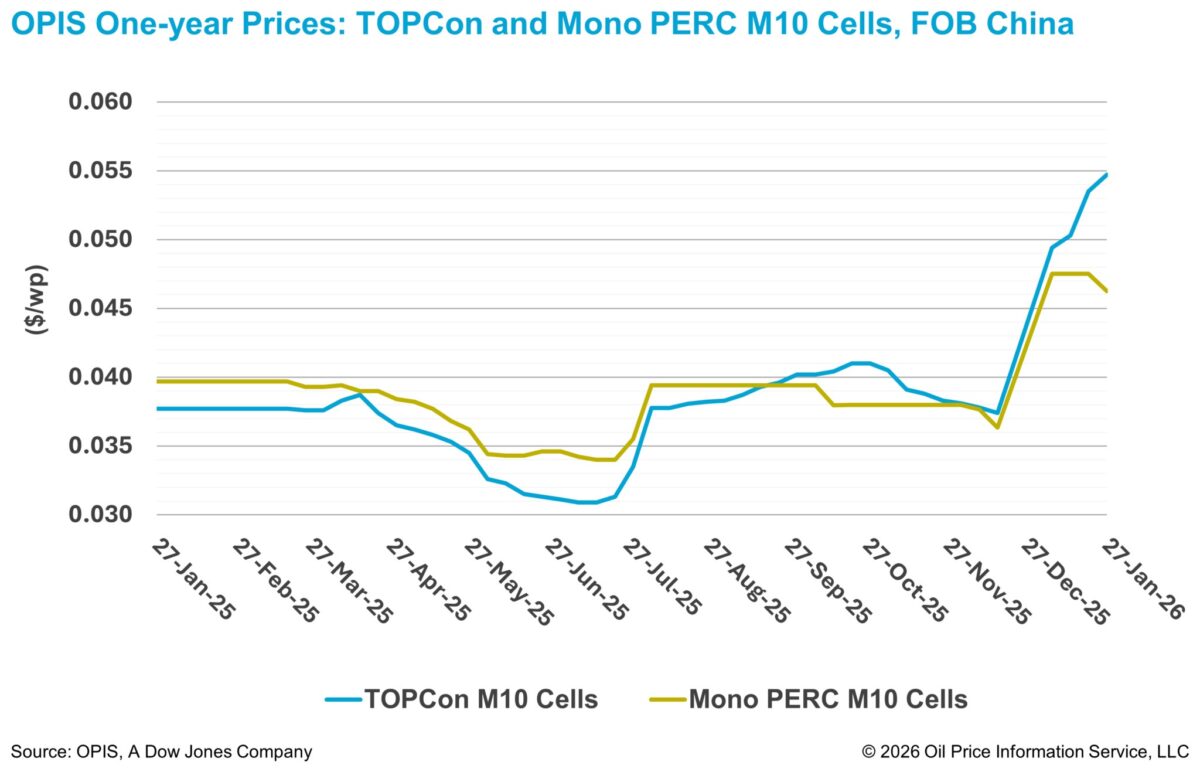

According to the OPIS Global Solar Markets Report released on January 20, Chinese TOPCon M10 cell prices were assessed 2.24% higher on the week at $0.0547/W Free-On-Board (FOB) China. Meanwhile, FOB China Mono PERC M10 cells fell 2.53% to $0.0463/W over the same period.

Silver prices have surged to record highs, gaining more than 40% year-to-date, driven by rising industrial demand and increased investment flows. Chinese policy developments have also further tightened the market, with authorities introducing export restrictions on silver through 2027.

Under the new framework, only 44 approved companies are permitted to export silver under a quota-based licensing system, requiring exporters to secure approval for overseas shipments.

Market sources said silver prices have become a key variable for cell pricing, as silver now represents one of the largest cost components in TOPCon cell manufacturing. Several sources noted that even if upstream prices soften from Q2 2026, cell and module prices are unlikely to retreat to 2025 price levels should silver prices remain elevated.

Since the start of this year, downstream OPIS TOPCon cell prices have surged 46%, while TOPCon module prices climbed nearly 35%. Upstream cost increases have been more modest, with OPIS China Mono Premium—OPIS’ assessment for mono-grade polysilicon used in N-type ingot production—up 0.15% and N-type wafer prices up around 13% over the same period.

This week, upstream polysilicon and wafers segments showed early signs of weakness, with OPIS China Mono Premium and N-type M10 wafers down 2.34% and 2.20%, respectively. In contrast, FOB China TOPCon modules continued to edge higher by 3.48% over the same period.

According to the China Nonferrous Metals Industry Association (CNMIA), sentiment in the wafer segment remained cautious this week, with upstream and downstream players locked in a stalemate. Despite continued price gains in cells and modules, driven by export tax rebate policy changes and rising silver prices, price increases have yet to effectively transmit upstream.

CNMIA noted that domestic end demand remains sluggish, and under cost pressure, cell manufacturers have become increasingly reluctant to accept high-priced wafers, resulting in few wafer procurement orders.

With downstream demand unlikely to recover meaningfully before the Lunar New Year, and polysilicon prices showing signs of softening, the wafer market is expected to stay weak in the near term, the association added.

Downstream sources added that higher production costs, combined with weak end-user module demand, could limit cell output levels in the longer term.

Market analysts have previously projected China’s installation demand to fall by over 20% in 2026, following the transition from feed-in-tariffs to a market-based electricity pricing mechanism. Furthermore, the planned removal of export tax rebates may weigh on overseas demand, reinforcing a bearish demand outlook for cells later this year, sources said.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.