With India requiring investments totalling $10 trillion (INR 883 lakh crore) to achieve net-zero emissions by 2070, credible corporate climate transition planning is fast becoming a critical requirement for mobilising capital. Yet, transition planning in India’s corporate landscape remains fragmented, and largely driven by compliance, finds a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

The absence of dedicated transition plan disclosures within the Business Responsibility and Sustainability Reporting (BRSR) framework, combined with limited guidance on financial materiality and forward-looking metrics, has resulted in disclosures that are difficult to compare, verify, or use meaningfully for investment and lending decisions.

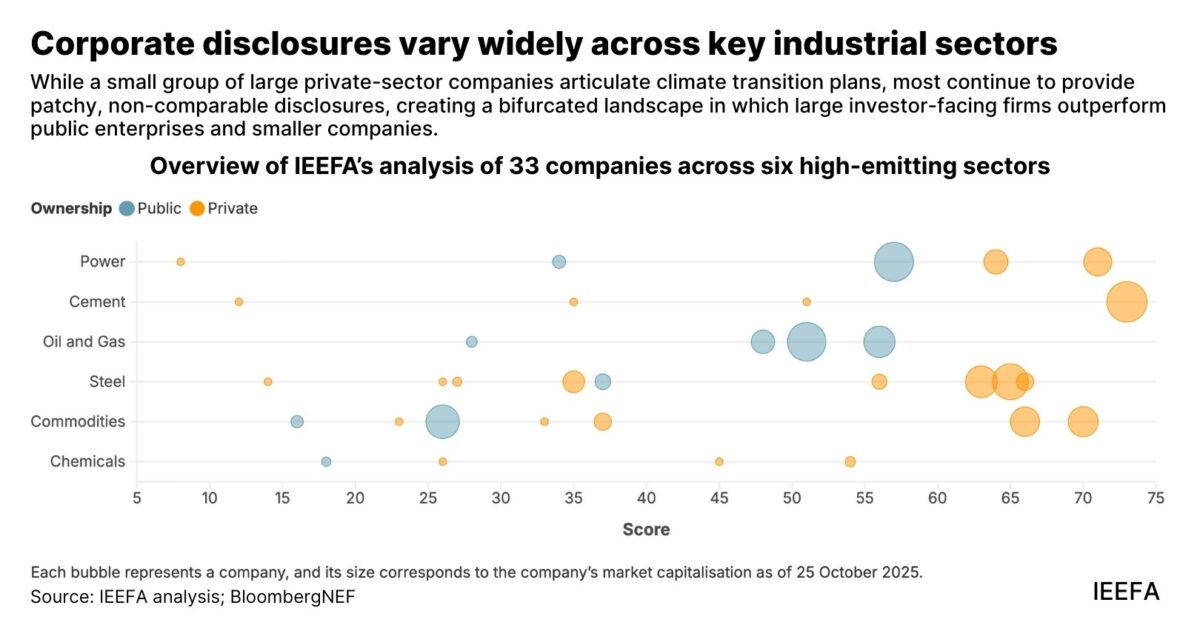

IEEFA’s report examines transition planning practices across India’s corporate sector through a comprehensive assessment of 33 companies operating in six high-emitting sectors — power, steel, cement, chemicals, commodities, and oil and gas. It identifies three systemic weaknesses in India’s current transition planning landscape. First, transition ambition rarely translates into quantified, time-bound, and financially integrated pathways, with limited linkage between targets, CapEx, revenues, and risk management. Second, governance structures are present in form but weak in substance; and finally, disclosures are fragmented and backward-looking, reducing their usefulness for capital providers.

The assessment finds that while most companies have announced net-zero or emission reduction targets, few explain how these targets will be achieved. “Only a limited number link their goals to capital expenditure plans, revenue assumptions or changes in business strategy, making it difficult for investors and lenders to assess the feasibility of transition pathways,” says Shantanu Srivastava, research lead, sustainable finance and climate risk, South Asia.

Financial disclosures also remain a major gap. Companies rarely quantify the potential financial impacts of climate-related risks and opportunities. Scenario analysis, where disclosed, is qualitative and lacks transparency around assumptions, time horizons or financial implications.

Governance disclosures further weaken the effectiveness of transition planning. “While most companies report board- or management-level oversight of sustainability issues, few provide evidence of clear accountability, decision-making authority or incentive structures linked to transition outcomes,” says Tanya Rana, energy analyst, IEEFA – South Asia, and the report’s co-author.

Overall, the sectoral review reveals significant heterogeneity in transition plan disclosure maturity across India’s key emitting industries. A consistent pattern emerges where a handful of large, listed, or globally exposed companies demonstrate relatively advanced practices, while the majority remain at an early stage of transition planning.

“Disclosures are strongest on high-level ambition statements, and weakest on lever-level quantification, financial integration, and Scope 3 coverage,” says Srivastava. Governance structures are often in place, but operational embedding, capacity building, and climate-linked remuneration remain limited. Engagement on workforce and community transition continues to be framed as Corporate Social Responsibility rather than Just Transition, and external assurance practices vary widely by firm size.

The report outlines a set of targeted recommendations to strengthen corporate transition planning and improve the decision-usefulness of disclosures in India.

At the corporate level, the report recommends that companies move beyond high-ambition statements and develop transition plans that clearly link emissions targets to capital expenditure, operational changes, financing needs and risk management processes. This includes improving the use of scenario analysis, strengthening internal data systems, and embedding transition planning within the core business strategy.

For regulators, the report recommends that SEBI explicitly integrate transition planning expectations within the BRSR framework, including clearer guidance on forward-looking metrics, financial materiality and the linkage between climate targets and business strategy.

“Strengthening corporate transition planning and disclosure practices will require coordinated action by regulators and corporates,” says Rana. Indian corporates should invest in internal capacity building, scenario analysis, data systems, and governance structures.

Regulatory coherence will also be key. Alignment with the Reserve Bank of India’s proposed climate risk disclosure framework, sectoral decarbonisation roadmaps, and the Bureau of Energy Efficiency’s Carbon Credit Trading Scheme can help ensure that corporate transition planning becomes part of a unified ecosystem driving India’s low-carbon transformation.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.