China’s TOPCon module prices rose for a third consecutive week, as market participants continued to digest the impacts of export rebates removal and higher cell prices. Beyond spot prices, prices along the forward curve have also edged higher, reflecting expectations that recent policy shifts could feed through to forward pricing.

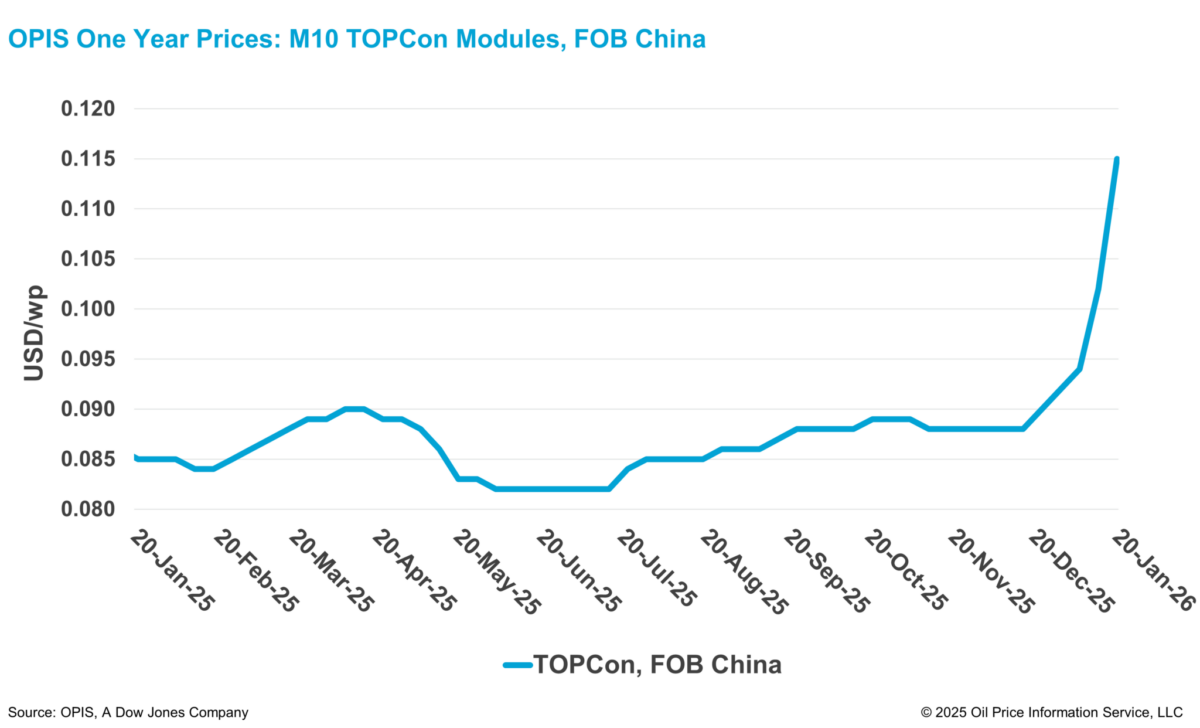

According to the OPIS Global Solar Markets Report released on January 20, the Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China, rose 12.75% on the week to $0.115/W Free-On-Board (FOB) China.

OPIS FOB China TOPCon module forward curve indications for Q2 2026 loading cargoes were assessed at $0.120/W, up 14.29% on the week. Forward prices for Q3 2026 loading cargoes moved higher to $0.121/W, rising 15.24% on the week.

Q4 2026 loading cargoes rose 10.42% week-on-week to $0.106/W while Q1 2027 loading cargoes saw the steepest increase of 13.5% to $0.109/W.

According to one tier-1 producer, silver prices will remain a key variable. Even if upstream polysilicon prices were to soften from April onward, module prices would struggle to fall back to end-2024 levels of around CNY0.70 ($0.10)/W as long as silver prices stay at current levels. The producer added that buyers have largely accepted the higher price levels and expect the uptrend to persist.

However, some trade sources pointed to a lingering “wait and see” sentiment in the market, largely driven by uncertainty around upcoming policies, particularly China’s anti-monopoly measures, which may be limiting the full transmission of recent price increases.

While these measures are primarily focused on the polysilicon segment and the proposed consolidation platform, downstream market participants told OPIS they could also have implications for cell and module markets, where major producers have been operating under strict production and sales coordination arrangements for over a year.

Several producer sources said this could unintentionally intensify production and price competition in an industry already grappling with significant overcapacity. However, they noted that clearer regulatory guidance would still be needed before manufacturers adjust their production and sales strategies.

In early January, the Beijing Municipal Administration for Market Regulation initiated a meeting with major polysilicon producers and the China Photovoltaic Industry Association to address monopoly risks and outline rectification requirements related to anti-monopoly compliance. The rectification measures are due to be submitted to the State Administration for Market Regulations (SAMR) by Jan. 20.

Under the proposed framework, companies are prohibited from reaching agreements on production capacity, utilization rates, sales volumes and pricing. Capital contribution ratios should not determine market allocation, output or profit distribution, and any form of coordination or communication on prices, costs, production and sale volumes is not allowed.

Meanwhile, high inventory levels and downstream oversupply remain a headwind, making it difficult to justify current price levels, sources said. One tier-1 producer noted that the cell and module segments are likely to remain challenging in 2026, noting that it is difficult to pinpoint a clear price ceiling amid ongoing policy uncertainty, while further price increases could also weigh on power plant investment decisions.

A developer source said uncertainty remains elevated, with any further price gains dependent on the market acceptance of current module prices. The source added that while suppliers continue to push for increases, it may be difficult for module prices to keep rising given current electricity tariffs, as most new PV projects are priced through market-based mechanisms rather than guaranteed feed-in tariffs (FiTs).

Major Chinese PV manufacturers are expected to release their financial results for 2025 in the coming weeks, with several already signalling another difficult year in 2025 amid oversupply across the value chain and persistently weak prices. Depressed module selling prices and tighter trade conditions have continued to squeeze margins, with some companies reporting wider losses in Q4 2025 versus Q3.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.