There are moments in an industry’s lifetime when the direction of progress changes quietly but irreversibly. India’s solar sector is at that moment. For years, the focus was on installations, targets, and gigawatts. Today, the conversation has shifted. India is no longer only deploying solar, it is learning to own the technology, the capability, and the value chain behind it. The rise of end-to-end manufacturing is not just another milestone; it is the turning point that will decide the country’s long-term energy security and its place in the global market.

Around the world, energy supply chains are being rearranged as countries rethink where and how they source technologies that influence their economies and climate commitments. For India, these shifts create room to step forward as a stable, transparent, and cost-efficient manufacturing partner. But stepping forward requires more than production volumes; it requires integration, from raw materials to modules and everything in between.

Integration: The Missing Link India Is Finally Addressing

The past few years have transformed India’s solar landscape. Module manufacturing capacity has jumped from 8.2 GW in 2021 to nearly 120 GW by late 2025. Policies have supported this rise, and demand has kept pace. Cell manufacturing is expanding as well, strengthened by the Production Linked Incentive scheme, which is set to unlock more than 48 GW of new capacity.

Yet, even with this expansion, a critical gap remains. Much of India’s upstream requirement, particularly ingots and wafers, still comes from outside the country. As a result, domestic value addition remains limited at the module stage, leaving manufacturers exposed to disruptions in global supply chains. Integration is what changes this equation. It allows a company to control quality, costs, and technology without depending on external supply cycles. For a country with ambitious renewable goals, this shift is not optional anymore; it is essential.

Policy Support Is Pushing the Sector Forward

Government policy has moved decisively in the direction of integration. The ₹24,000 crore PLI scheme is helping create giga-scale integrated units. The ALMM framework is steering demand toward domestic modules and, starting mid-2026, toward domestic cells as well. These interventions aim to correct a long-standing imbalance: while India is on track for over 125 GW of module capacity in the near term, cell capacity still lags below 30 GW.

Correcting this imbalance will require investment, skilled talent, and a rethink of quality systems. But the direction is clear, India is transitioning from expanding capacity to building capability.

Technology Will Decide India’s Global Position

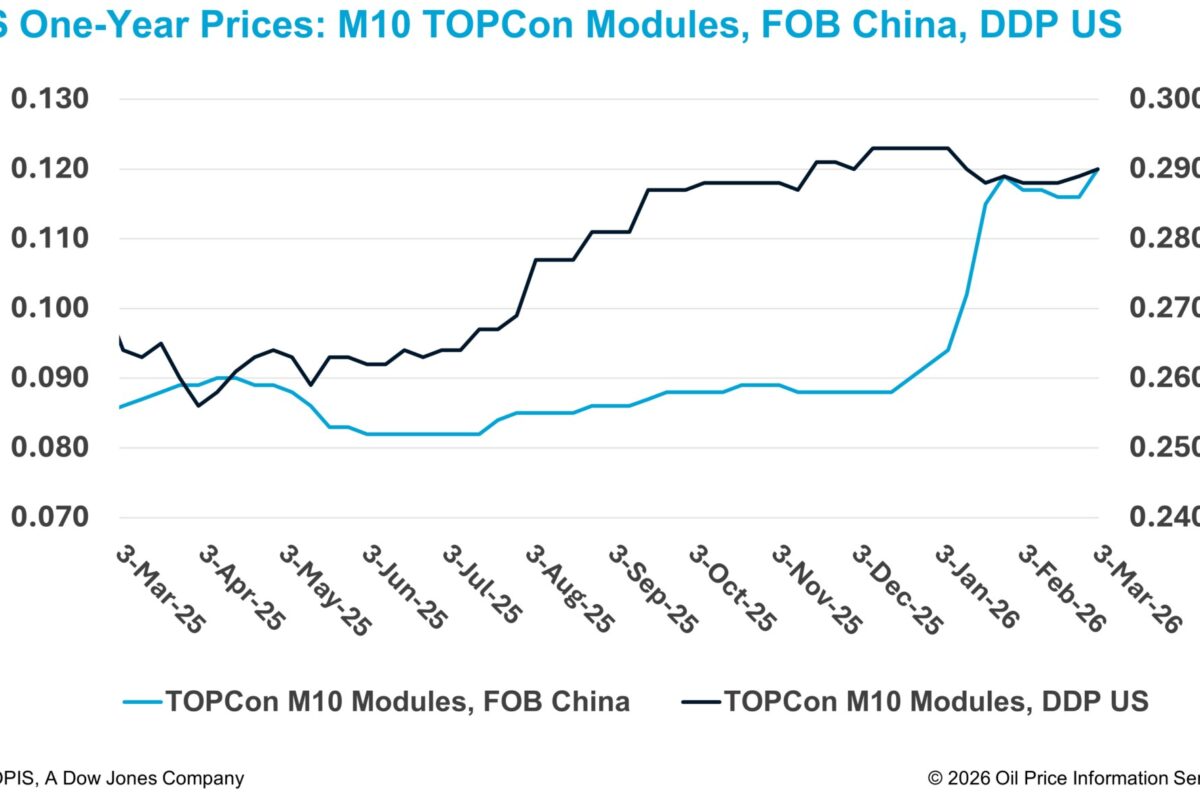

As global demand evolves, so do the technologies that power it. While PERC continues to be the backbone of India’s current production, the world is moving toward TOPCon, and tandem perovskite-silicon technologies. These technologies promise higher efficiency and stronger performance under real-world conditions, qualities international buyers increasingly insist upon.

The encouraging sign is that the gap is narrowing. TOPCon modules produced in India are already becoming price-competitive, and companies are modernizing their lines with automation and advanced quality systems. Freight emissions also play in India’s favor, especially for markets that assess products based on carbon footprint.

To maintain this momentum, India must build deeper strengths in materials science, cell architecture, and reliability engineering. Competing globally means being prepared not only on cost but also on longevity, traceability, and sustainability.

Challenges That Cannot Be Ignored

Despite strong tailwinds, the sector must overcome structural barriers. India still imports more than 80% of upstream materials. Capital requirements for ingot and wafer manufacturing remain high. There is a pressing need for skilled talent in cell processing, automation, and engineering. Technology gaps must be closed with focused investment in R&D. And domestic tariffs, while protective, often increase project costs.

Strengthening upstream manufacturing from polysilicon to wafers and building capabilities in advanced cell technologies will define the next phase of progress. Equally important is aligning with global ESG norms and traceability standards so that Indian products meet not just pricing expectations but also environmental and ethical benchmarks.

Looking Ahead

The decade ahead will determine the future of global energy systems, and India has entered it with scale, policy momentum, and growing international trust. What the country does next will decide whether it becomes a global manufacturing leader or remains dependent on imported technologies.

The path forward is clear: integration over assembly, technology over imitation, and long-term capability over short-term scale. End-to-end manufacturing is the bridge that will reduce import reliance, stabilize costs, strengthen supply chains, support exports, and help India move confidently toward its 500 GW renewable energy goal. With the right investments and a continued focus on innovation, India is positioned not just to participate in the solar revolution, but to help shape it.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.