I’d like to start the new solar year with a brief overview. 2026 is already shaping up to be a year of radical change, and this trend shows no sign of slowing.

Last year ended relatively quietly, particularly in terms of module prices, which remained largely stable for months. With the December holidays, the sector also shut down early, giving everyone a chance to rest, reflect on the past year, and make plans for the future.

That tranquility, however, ended in the opening days of 2026. According to early forecasts, the year will bring a mix of changes, opportunities, and challenges. In China and across Asia, astrologically, it is the Year of the Fire Horse—a symbol of independence, dynamism, and a strong drive for change, occurring only once every 60 years. In many ways, that spirit seems to have arrived forcefully in global markets, fueled not only by harsh winter weather but also by significant geopolitical upheavals. It feels as though nothing has been left untouched, and the world is seeking a new order.

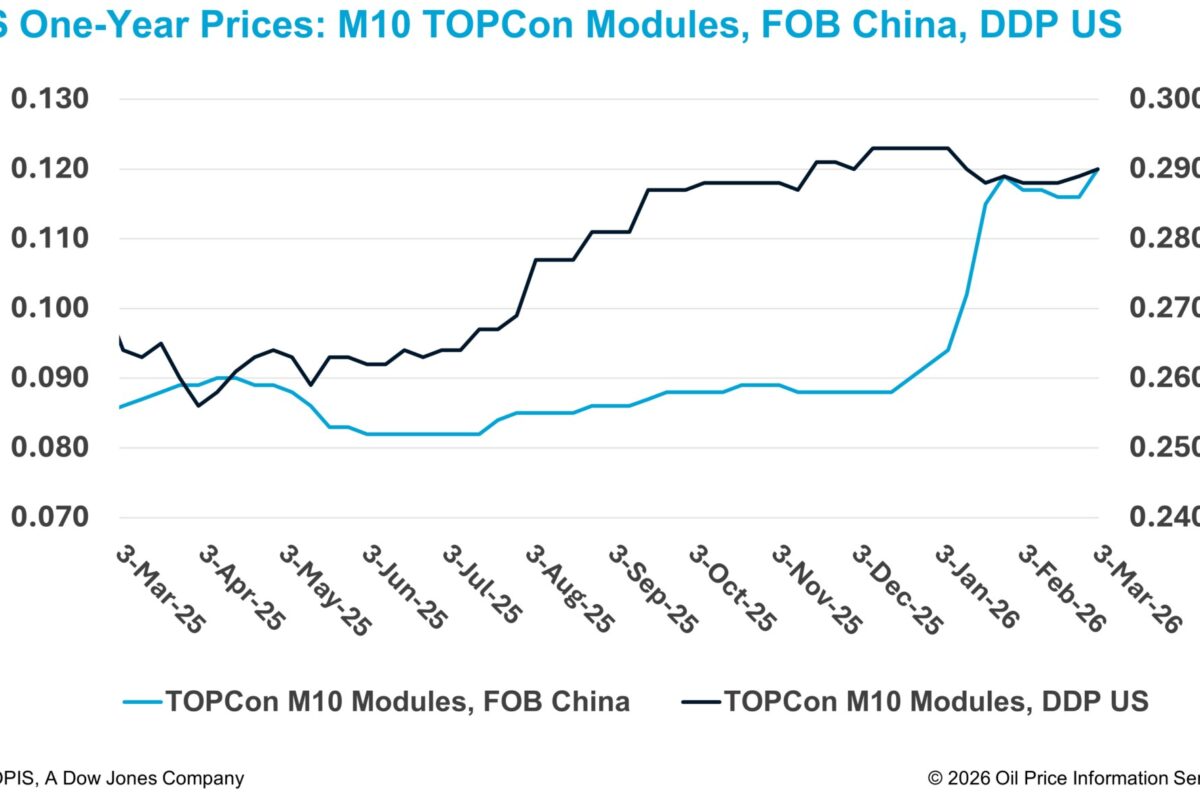

Across different regions, calls for change are resounding, often turbulent and sometimes violent: energy, fire, transformation. The solar market is not immune—changes are expected to be substantial, even if the impact is far less dramatic than in crisis-affected regions. Many anticipated a rise in module prices, but the timing and magnitude of the recent increases have taken most by surprise.

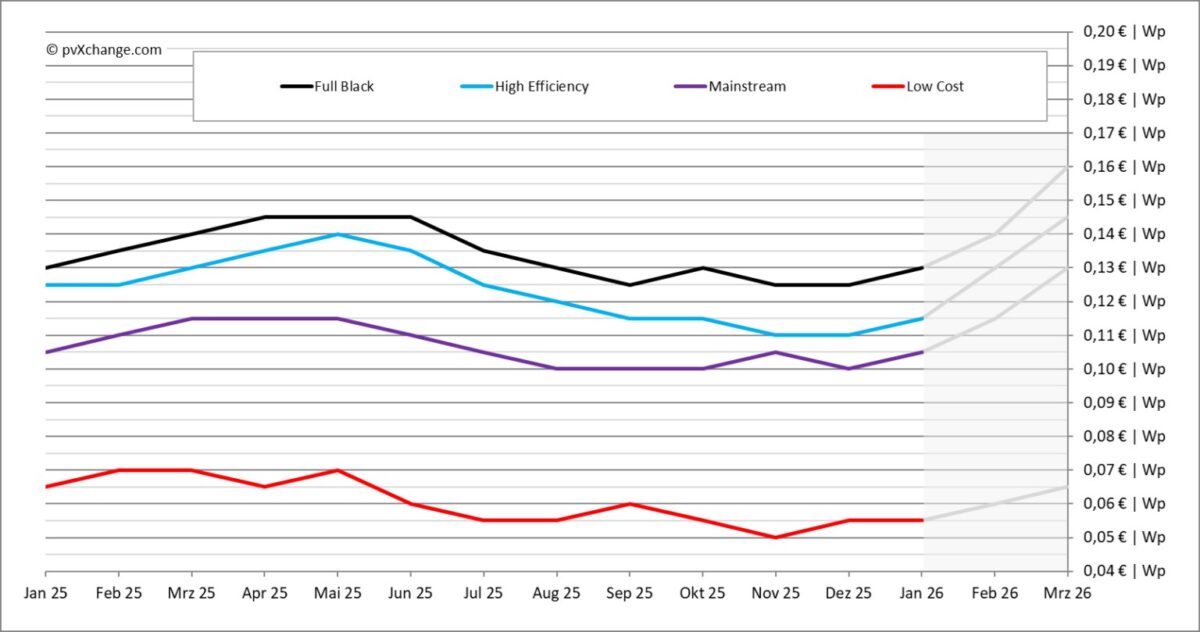

In China, the secret is out: the announced elimination of export discounts will take effect on April 1. What initially seemed like a gentle breeze now appears to be turning into a veritable tsunami—faster than expected. To reflect this, the chart below has been expanded with a two-month forecast.

If we consider the average price evolution across all technology categories in January, with increases of 0–5% at most, everything appears to be proceeding as normal. However, looking ahead and taking into account recent manufacturer announcements, a very different picture emerges.

Many distributors are already informing customers, via email, social media, or in person, that prices will rise starting in early April, advising them to stock up according to their project portfolios. Yet when customers try to secure supplies for the second quarter, they often encounter prices far higher than the 9% increase that would be justified by changes in China alone. In the project sector, price increases of up to 20% are now expected, while in distribution and online stores, module prices in some cases have already risen by as much as 30% in recent days.

Where is this sudden jump coming from, when production cost increases are far lower? Asian manufacturers point to the elimination of export tax relief, as well as rising prices for upstream materials—from silicon ingots to silver pastes, cells, glass, and aluminum for module frames. But does this fully justify a 20–30% price increase? Hardly. Is it sustainable? Hardly.

Production in China is currently running at full capacity, with the goal of manufacturing as much as the lines can handle until March. Until the end of the month, the motto is simple: sell everything. By then, as much merchandise as possible must be shipped by sea or already delivered to destination countries to capitalize on prices that already factor in the upcoming tax increase. Production lines are expected to scale back in April to reduce costs.

Many producers appear eager to take advantage of the government-announced price increase, fulfilling expectations as an opportunity to return to profitability and offset the significant losses suffered during the low-price period of recent years. This tendency to overcompensate for price-affecting events has been observed repeatedly in recent years. However, prices often cannot be sustained at such high levels due to declining demand, and adjustments downward usually follow soon after.

These calculations frequently overlook the buyers themselves. In Europe, for example, the number of small-scale installations continues to decline, with project developers and installers increasingly focusing on larger commercial and utility-scale projects. Early indications suggest this trend will persist in 2026. Such projects are highly price-sensitive, meaning that the steep price increases currently projected could undermine profitability and derail planned developments.

To avoid stifling the photovoltaic market in the opening months of the year, price adjustments must be implemented cautiously. At the same time, long-demanded reductions in bureaucracy must finally gain momentum, ensuring that delays in grid connections, permits, and other necessary certifications do not halt construction projects altogether.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.