ICRA expects the Indian steel industry’s decarbonization to be gradual, with near-term emission reductions driven mainly by higher adoption of renewable energy and improvements in operational efficiency, as high costs and technology constraints limit faster decarbonization.

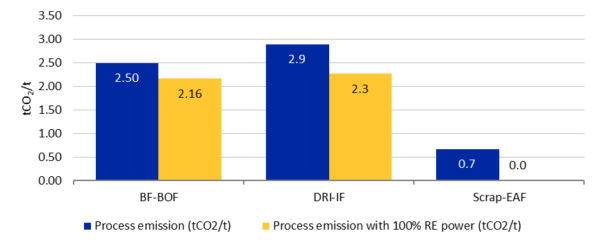

Indian steelmakers’ carbon emission intensity averages about 2.5 tonnes of CO₂ per tonne of steel (scope 1 and 2), roughly 12% higher than the global average for the blast furnace-basic oxygen furnace (BF-BOF) route. While the government’s Green Steel Taxonomy, introduced in December 2024, provides a clear framework to define green steel, most domestic producers remain well above the prescribed emission thresholds, highlighting a wide decarbonisation gap.

“The planned capacity additions of about 80–85 million tonnes (mt) in India by 2030-31 are heavily skewed towards the coal-based BF-BOF route, the share of which will increase from 45% currently to roughly 51% by 2030-31, reflecting a high carbon intensity in the medium term,” said Girishkumar Kadam, Senior Vice-President & Group Head, Corporate Sector Ratings, ICRA .

“Consequently, the domestic steel industry’s near-term decarbonisation will mainly rely on operational efficiency gains and higher renewable energy adoption, which is expected to result in 19% reduction in emission intensity by 2029-30 and would bring the sector average down to roughly 2.0 tCO₂ per tonne by the end of this decade. A major part of this reduction is expected from renewable energy integration and process optimisations”.

ICRA reports that steelmakers in India have already announced around 9 GW of captive renewable power capacity, which is expected to cut emissions by 13% for BF-BOF plants and up to 22% for DRI-based units. Additional gains are expected from higher scrap usage, waste-heat recovery and energy efficiency measures, though scrap availability continues to constrain low-carbon EAF capacity.

Wider adoption of hydrogen-based DRI route for steelmaking remains constrained due to the high cost of green hydrogen. ICRA estimates green hydrogen prices need to fall to $1.5–1.6 per kg, from over $3 per kg currently, for the DRI-EAF route to become economically viable, making large-scale green steel capacity unlikely in the near to medium term.

Beyond 2030, demand for green steel is expected to rise, supported by stricter ESG norms, supply-chain decarbonisation by end-user industries, and policy support. However, ICRA notes that renewable energy will remain the primary decarbonisation lever in the coming years, while green hydrogen adoption will depend on sustained cost reductions and technology maturity.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.