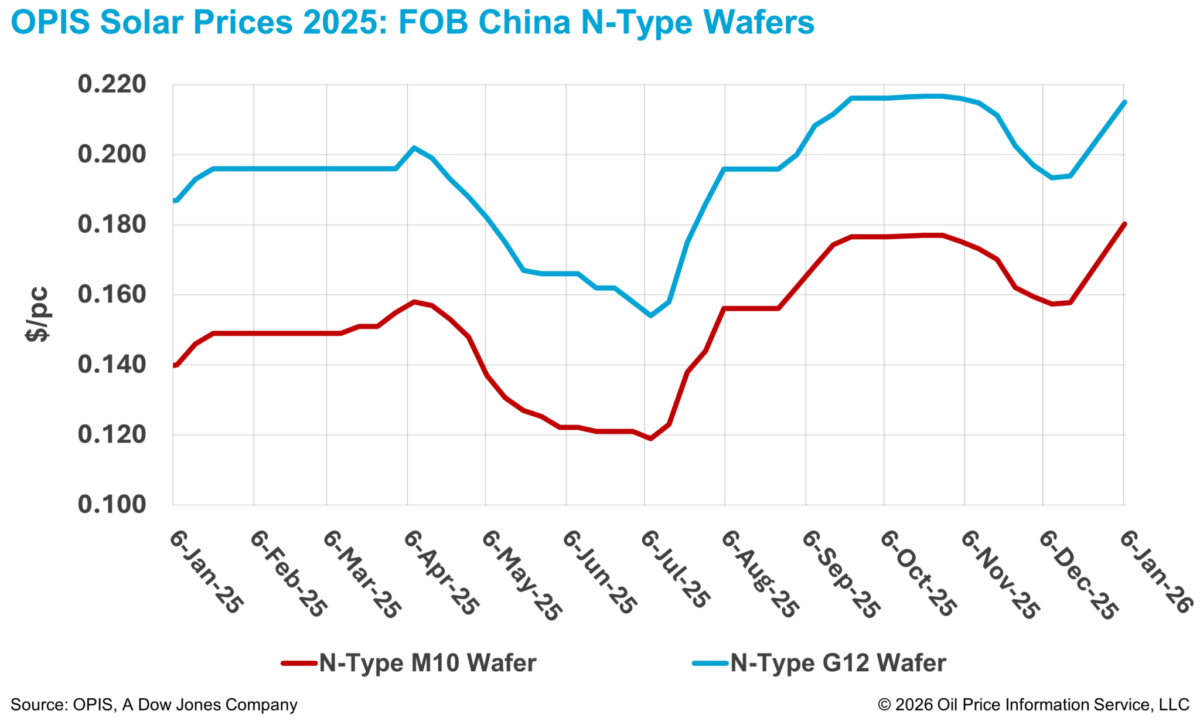

N-type wafer prices rose across the board this week compared with the previous assessment on December 16, 2025. FOB China prices for n-type M10 wafers rose 13.92% to $0.180 per piece (pc) while G12 wafers increased 10.82%, to $0.215/pc, according to the OPIS Solar Weekly Report released on January 6.

According to market participants, manufacturers’ quoted prices for n-type wafers in the China domestic market have risen above CNY 1.4 ($0.20)/pc for M10 products and CNY 1.7/pc for G12 products.

Industry sources attributed the upward pricing momentum partly to rising cell prices, driven by higher silver paste costs, which have provided wafers with some pricing headroom. According to market analysts, silver paste costs have surged as silver prices rose over 160% year-on-year in December amid a persistent supply deficit.

In addition, efforts to advance the polysilicon consolidation plan – aimed at supporting polysilicon prices – have offered further indirect support to wafer price expectations.

However, industry sentiment remains cautious regarding the sustainability of wafer price increases. A market participant noted that while higher silver paste prices have supported cell pricing, cell manufacturers have also reduced operating rates due to limited price tolerance among module producers, constraining their ability to pass on further cost increases. The source added domestic end-market projects cannot absorb current wafer price levels.

Market participants also noted that ahead of the Lunar New Year in February, companies are under pressure to improve cash flow to support post-holiday production, raising the possibility of lower-priced transactions in the coming weeks.

On the supply side, wafer producers are reportedly implementing significant production cuts. One major manufacturer is said to be operating at around 20% utilization. According to sources, specialized wafer producers have reduced output more sharply to ease inventory pressure, while integrated manufacturers have maintained relatively higher operating rates by supplying wafers to their overseas facilities.

Overseas, a major Chinese wafer manufacturer announced this week that it’s subsidiary has joined the Middle East Solar Industry Association (MESIA), positioning the move as a step to deepen its presence in the Middle East and North Africa photovoltaic markets.

The company previously announced plans in July 2024 to develop 20 GW of ingot and wafer manufacturing capacity in Saudi Arabia. A source familiar with the matter told OPIS following the company’s MESIA announcement that construction has yet to begin, although the project remains active, with further details pending official disclosure.

While not confirmed by the company, another industry source said that preliminary preparations at the business-planning level are largely complete, while key implementation milestones remain contingent on the timely availability of funding from all stakeholders.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.