Chinese module manufacturer Longi has revealed that it will begin mass production of base-metal PV cells in the second quarter of 2026, moving toward copper-based metallization as rising silver prices and cost pressures weigh on the solar manufacturing supply chain.

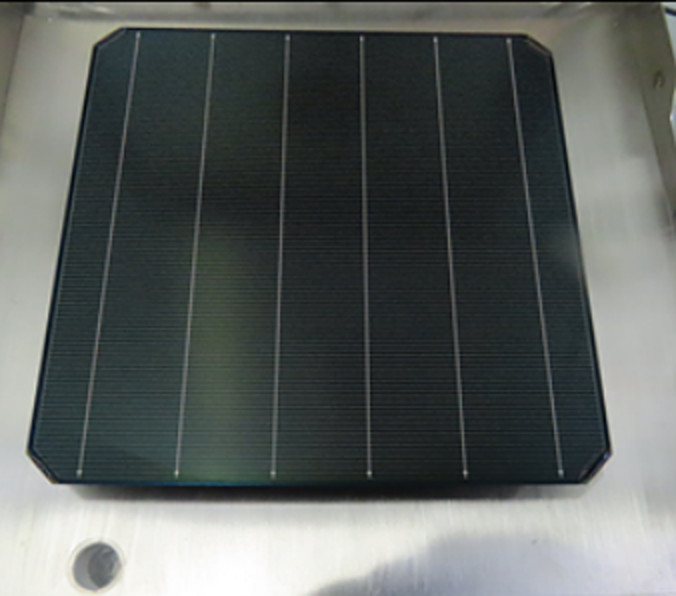

The company disclosed in investor communications on Jan. 5 that it has already started building part of the production capacity required for the shift. Longi framed the move as a strategy to reduce metallization costs and manage raw material exposure while maintaining performance in its back-contact (BC) cell platform.

Longi said BC architectures are better suited to alternative metallization approaches because most conductive features are located on the rear side of the cell, reducing optical and patterning constraints compared with mainstream tunnel oxide passivated contact (TOPCon) designs.

Silver prices have risen sharply in recent weeks, reaching a record $83.62 per ounce on Dec. 28. Solar manufacturing is one of the largest industrial end uses of silver, making the sector highly sensitive to price volatility.

BloombergNEF analysts have said that solar manufacturers are the world’s largest industrial consumers of silver and expect silver demand from PV modules installed this year to fall to about 194 million troy ounces, or roughly 6,028 metric tons (MT). That would represent a 7% year-on-year decline as manufacturers accelerate material “thrifting” and substitution efforts.

Longi has not disclosed expected unit cost savings from copper metallization. Metallization remains one of the most expensive consumables in cell manufacturing, and replacing silver with copper could materially reduce cost per watt if reliability and yields are maintained. The company said it has evaluated multiple approaches, including patterned vacuum coating and base-metal pastes, and is now focusing on integrating materials, equipment, and process steps to support high-volume manufacturing.

Technical hurdles remain. Copper is more susceptible to oxidation and diffusion-related degradation, increasing requirements for barrier layers, sintering processes, and long-duration damp-heat performance. Yield stability at scale and third-party reliability testing are expected to play a central role in determining how quickly copper-metallized cells gain acceptance in mainstream procurement.

Separate research by Ghent University in Belgium and Engie Laborelec, the research unit of French energy group Engie, has highlighted longer-term supply risks. The researchers estimated total global silver demand could reach 48,000 MT to 52,000 MT per year by 2030, while projected supply would reach only about 34,000 MT.

The study found that PV-sector silver demand could rise to 10,000 MT to 14,000 MT per year by 2030, driven by higher silver usage in cell designs such as TOPCon and heterojunction technology. Under those scenarios, the PV industry could account for 29% to 41% of projected global silver supply by the end of the decade.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.