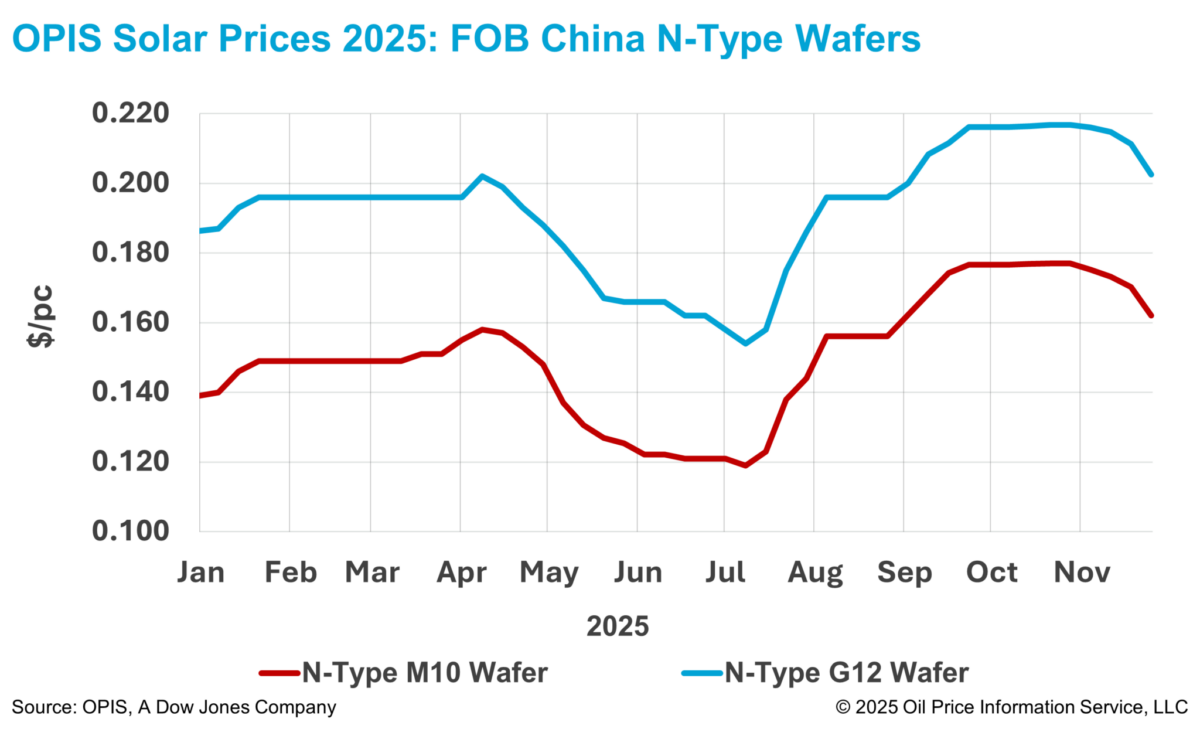

N-type wafer prices have continued to decline for the fourth consecutive week. According to the OPIS Solar Weekly Report released on November 25, FOB China prices for M10 wafers were reported at $0.162 per piece (pc), down 4.71% week-on-week, while G12 wafers were priced at $0.202/pc, reflecting a 4.27% week-on-week decrease.

Since the end of October, M10 and G12 wafer prices have recorded a cumulative decline of approximately 8.5% and 6.6%, respectively.

The current downward trend is driven by the persistent weakness in end-market demand and rising concerns among manufacturers over potential inventory build-up. With year-end cash flow needs intensifying, many producers have opted to lower prices to accelerate shipments. A trading source noted that wafer manufacturers have been operating at a loss for more than two years, making cash preservation and liquidity management their top priorities.

Another industry insider highlighted that wafers, unlike polysilicon, face stricter storage requirements due to their sensitivity to environmental conditions. Prolonged storage can compromise wafer quality, and rapid shifts in preferred wafer sizes in the downstream market further reduce manufacturers’ tolerance for inventory risk. As a result, wafer stock is highly susceptible to impairment, prompting producers to minimize inventory levels.

Feedback from multiple market participants indicates that wafer manufacturers have scaled back production to varying extents, with current operating rates ranging from approximately 50% to just above 70%.

One source noted that even a specialized producer, previously operating at around 80% due to strong OEM order volumes, has reduced its operating rate following a decline in OEM demand, with further cuts anticipated. The sharp contraction in OEM orders is viewed as a clear signal of significantly weakened end-market demand.

Meanwhile, discussions surrounding a potential reduction in export tax rebates, which some previously believed might stimulate an increase in export order prices, have not advanced. A market participant commented that the impact of any tax rebate adjustment would be substantial, and revisions would need to extend beyond the photovoltaic sector alone. As such, changes to the export tax rebate rate are considered unlikely in the near term, or even before the middle of next year.

In Southeast Asia, ingot and wafer facilities continued to operate at relatively low utilization rates last week. Traders report that some Southeast Asian wafers are being shipped to locations such as the Philippines and Ethiopia for cell and module production, which are then exported onward to the United States.

Looking ahead, Egypt and Oman are emerging as the next potential hubs for solar cell manufacturing. New production capacity in both countries is expected to come online early next year, potentially positioning them as the next major destinations for Southeast Asian wafer exports.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.