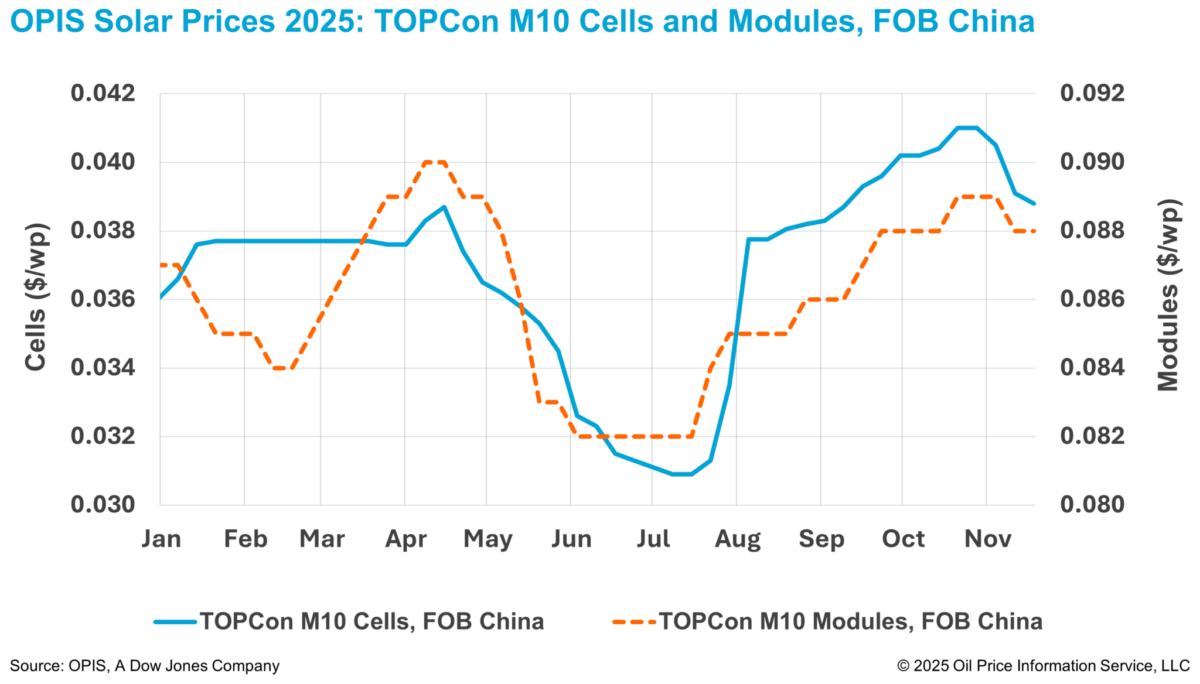

The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules above 600 W, remained flat at $0.088/W Free-On-Board (FOB) China, according to the OPIS Solar Weekly Report released on November 18.

By contrast, upstream cell prices continued to soften. According to the same report, FOB China TOPCon M10 cell prices fell 0.77% to $0.0388/W. TOPCon cell prices have now fallen for four consecutive weeks, down 2.7% since early October, while module prices have remained unchanged over the same period.

The continued weakness in Chinese TOPCon cell prices stems from subdued demand and weak trading activity in export markets. Market sources said that buyers had already stockpiled Chinese cells earlier this year on expectations that a reduction in export tax rebates could trigger price increases in the second half of 2025, prompting a rush to secure cargoes in Q3.

However, some market sources no longer expect the rebate change to materialize this year, citing the industry association’s focus on curbing domestic supply through production and sales quota controls.

A downstream producer told OPIS that the industry association has assigned specific quotas to leading manufacturers, with financial penalties looming for companies that exceed their allocations.

Another producer noted that even if the rebate is removed or reduced, the change would not necessarily improve manufacturers’ profitability because sale prices have already factored in the tax component. If buyers don’t accept the price hike, sellers may still have to absorb the cost, which doesn’t make sense, the producer added.

While the timing remains uncertain, several sources said a policy adjustment could still be implemented before year-end, though confidence in this outcome has weakened. Market views also remain divided, with some expecting a complete removal of the rebate, while others believe the rate may be lowered from 9% to 5%.

Meanwhile, the highly anticipated polysilicon consolidation initiative appears to be encountering headwinds, despite earlier indications of progress. In an interview with China Central Television’s Economic Channel on October 28, GCL Technology Chairman Zhu Gongshan stated that 17 companies have reached a preliminary agreement to establish a consortium and that the plan has basically reached the stage of signature confirmation. He further noted that the consortium is already taking shape and is expected to be finalized within the year.

Despite this development, a market analyst noted that the initiative is now facing regulatory hurdles. The plan, originally targeted for implementation in Q3 2025, is now expected to be delayed until Q2 2026, with one trade source describing the current status as a “standstill”.

Even so, industry sources noted that the consolidation efforts have had minimal impact on downstream cell and module prices to date. However, they anticipate that once enacted, the initiative could alleviate upstream supply-demand imbalances, thereby helping to stabilize prices over the longer term.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.