China TOPCon cell prices softened this week amid weaker trading interest in the export market and ongoing renegotiations of existing India-bound contracts following the country’s recently announced antidumping duty on Chinese solar cells.

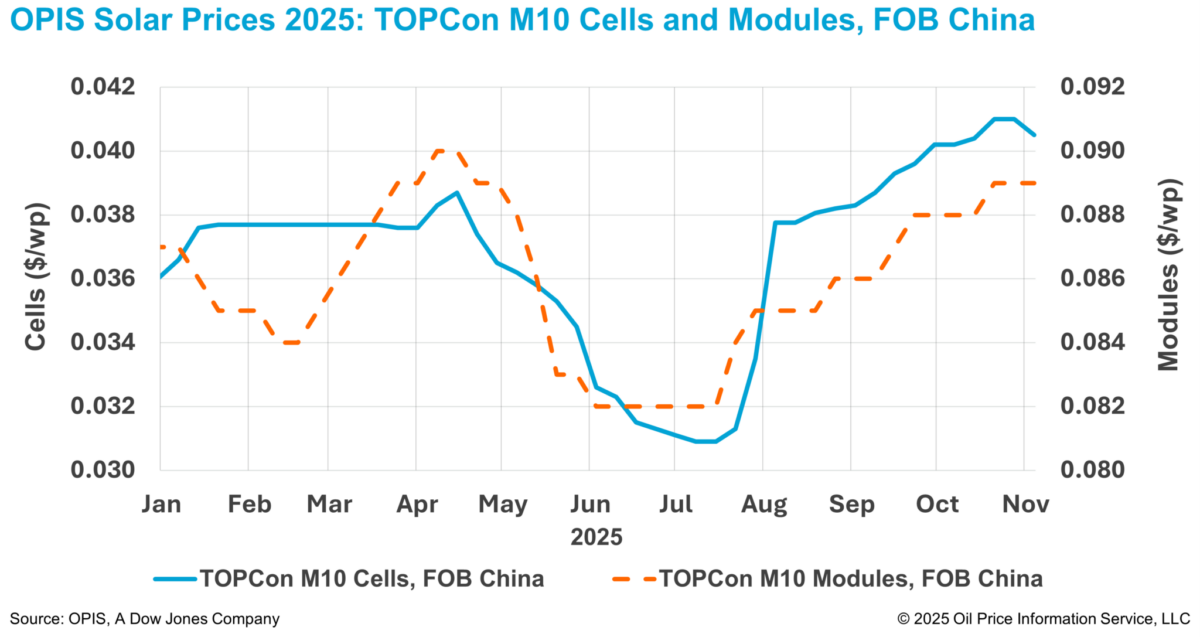

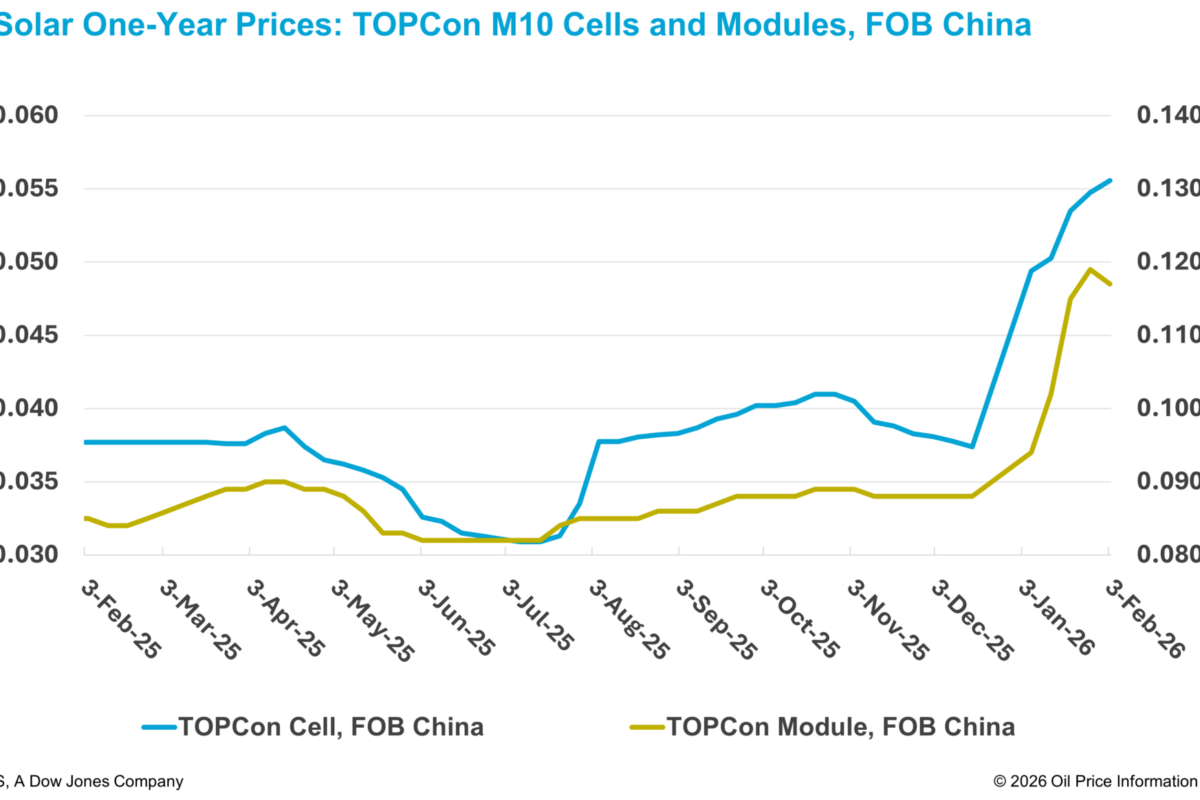

According to the OPIS Solar Weekly Report released on November 4, FOB China TOPCon M10 cell prices were assessed 1.22% lower at $0.0405/W, with price indications between $0.0400-0.0414/W.

India’s Directorate General of Trade Remedies in October recommended company-specific antidumping duties of up to 30% on the Cost Insurance and Freight (CIF) value of Chinese solar cell imports for three years. The measure will take effect once officially notified by the central government.

Chinese cell manufacturers report that Indian buyers are renegotiating contracts amid uncertainty over who would bear the cost of antidumping tariffs if the new duties are imposed while goods are still in transit.

Still, several market participants pointed out that Chinese-made cells are expected to remain significantly cheaper than Indian-made cells even after the new duties are imposed, with discounts potentially exceeding 50%, according to some market indications.

Trade sources added that Indian buyers may pivot to imports from Southeast Asia. Others familiar with the matter noted that Chinese-origin cells have already been transshipped through Southeast Asian ports, mainly to obtain new certificates of origin before ultimately entering India.

Recent data from Ember supports this trend. China’s cell exports to Indonesia averaged around 340 MW per month in 2024 but climbed to nearly 2.5 GW in September. Exports to the Philippines averaged around 19MW per month, reaching a year-to-date high of 318 MW in September.

Meanwhile, in India, projects under certain government schemes are required to meet the Domestic Content Requirement (DCR), which mandates the use of modules built with Indian-made cells. Market indications suggest DCR modules are traded at around INR 24.5 ($0.28)/W, while non-DCR TOPCon modules — mostly using Chinese-made cells — are priced at about INR 13.5 ($0.15)/W.

According to market sources, the price gap, observed prior to the implementation of the antidumping duty, is largely driven by the premium on India-made cells and higher production costs for DCR modules. The limited availability of India-made cells has also added upward pressure on DCR module prices.

In China’s upstream segment, most wafer producers continue to show strong price support sentiment amid stable polysilicon prices, according to the China Nonferrous Metals Industry Association (CNIA). However, soft demand has led downstream cell and module producers to reduce new procurement and prioritize existing inventories.

With end-market demand entering the seasonal low period, procurement momentum is expected to remain weak, and the wafer market will continue to face oversupply pressure, CNIA said. That said, a number of wafer manufacturers are planning to lower operating rates from November, which may gradually improve the supply-demand balance, the industry body added.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.