India’s solar industry is expanding at a pace unmatched in global clean energy. EUPD Research estimates that the country will install 213 GW of new solar capacity between 2025 and 2029, averaging 42 GW a year. Yet manufacturing capacity is rising far faster, creating a structural surplus that could redefine global supply and pricing.

By 2030, India’s module manufacturing capacity is projected to exceed 280 GW, with cell capacity jumping from 26 GW in 2025 to 171 GW, a 6.6-fold increase. Wafer production could reach 45 GW, indicating deeper upstream integration. This growth is underpinned by policies such as the Production-Linked Incentive (PLI) scheme, Domestic Content Requirement (DCR) mandates, and Approved List of Models and Manufacturers (ALMM-I and ALMM-II), which are designed to localize supply chains and reduce import dependence.

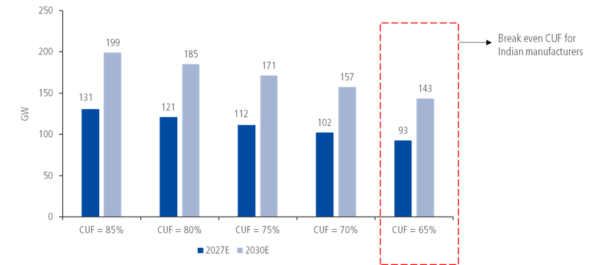

However, domestic demand cannot absorb this expansion. According to EUPD Research’s latest report titled India’s Solar Surge: The Next Looming PV Price Shock?, even at 65% capacity utilization factor (CUF), India’s export potential could reach 143 GW by 2030, while the annual average domestic demand remains around 42 GWdc. This annual manufacturing capacity would be enough to cover the forecasted demands of India, North America and the EU-27 combined!

The country is transitioning from self-sufficiency toward export dependence, with the U.S. market accounting for nearly 97% of shipments in 2024 (4.3 GW). However, with 50% tariffs now in effect, the U.S. market has tightened significantly for Indian manufacturers, with just 1.86 GW of module imports in the first half of 2025. Therefore, to maintain utilization and margins, Indian producers must expand into Europe, where diversification policies and sustainability standards are shaping future demand, and also into the Middle East, Africa, and other emerging markets.

Price Parity in Sight: India Begins to Bridge the Price Divide with China

India’s surge is about both capacity and competitiveness. The spot price gap between Indian and Chinese TOPCon modules has narrowed, from 9 to 5.7 US¢/W between Q1 2024 and October 2025. This convergence suggests India is steadily narrowing the price gap with Chinese manufacturers.

Even so, production costs remain higher. India’s average minimum sustainable price is 17% above China’s and 14% above Southeast Asia’s (SEA), reflecting smaller scale and limited integration. Falling upstream component prices and new production lines are helping narrow the gap, but competitiveness still varies by market. In the U.S., following the introduction of 50% tariffs on India-made goods, the price gap between Indian and SEA modules has doubled, rising from 3.1 to 6.2 US¢/W, impacting the competitiveness of Indian modules.

In the domestic market, India-made modules remain about 40% costlier than Chinese ones, a cost difference largely driven by the DCR premium enjoyed by local producers. This premium, alongside the 20% basic customs duty and ALMM mandate, effectively protects the home market, allowing domestic manufacturers to maintain elevated prices.

Beyond Price: Carbon, Freight, and ESG Edges

As PV markets mature, competitiveness increasingly depends on non-price factors such as carbon footprint, logistics, and ESG performance. These elements could become decisive for Indian manufacturers seeking to expand in Europe and other regulated regions.

As per EUPD Research calculations, freight costs from India to Europe account for about 5% of module price, compared with 8.7% from China, giving India a logistics advantage. The carbon emission intensity of Indian freight is roughly 65% lower than that of Chinese shipments to Europe, due to shorter routes. These attributes align strongly with Europe’s Carbon Border Adjustment Mechanism (CBAM) and Net-Zero Industry Act (NZIA), which prioritize low-carbon, traceable imports.

Currently, Indian manufactured modules are less carbon-intensive than Chinese equivalents. Yet Chinese producers are closing the gap by greening their manufacturing. Indian firms, meanwhile, have to address efficiency shortfalls: domestic TOPCon modules are 1–1.5 percentage points less efficient than leading global brands. Chinese manufacturers also lead in R&D advancement and patent activity, with the majority of global solar technology patents originating from Tier-1 Chinese firms. For Indian manufacturers, strengthening research capabilities and innovation focus will be essential to gain a competitive, non-pricing edge in global markets.

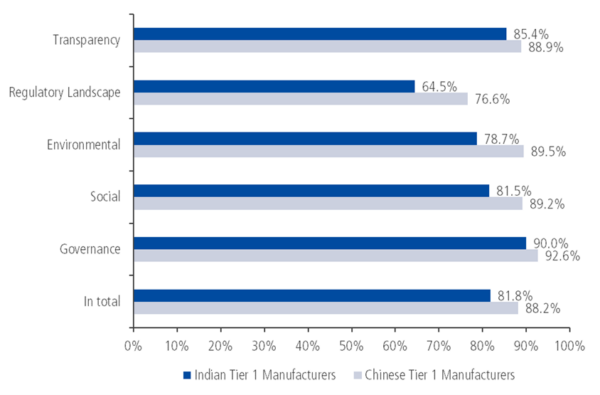

On ESG transparency compliance, Chinese Tier-1 firms still lead in the regulatory landscape, environmental standards and other parameters, courtesy of their scale, global experience, and established systems, according to EUPD Research analysis of the Tier-1 Chinese and the Indian module manufacturers. For Indian exporters, bridging this gap is crucial. As Europe enforces stricter sustainability and human-rights rules, transparent reporting and supply-chain traceability is key for successfully supplying ESG-sensitive large commercial, industrial and utility segments.

With carbon, freight, and ESG metrics becoming new trade filters, Indian manufacturers have an opening to position themselves as low-carbon, credible alternatives to Chinese suppliers, provided they act quickly to align with evolving European standards.

Global Fallout: Overcapacity, Trade Shifts, and New Power Balances

India’s rapid capacity buildup will have wide global implications. With India’s module manufacturing capacity likely exceeding 280 GW by 2030, the world could face a new wave of PV oversupply that drives module prices lower. This parallels earlier phases of Chinese module manufacturing expansion, though with a new competitive geography emerging in Asia.

For China, India’s rise introduces margin pressure in mainstream segments. As price parity approaches, Chinese firms are expected to pivot toward high-efficiency and next-generation technologies such as high-efficiency n-type TOPCon, heterojunction (HJT) and perovskite tandem modules. China’s global market share is expected to decline over the coming years as diversification efforts progress, assuming continued expansion into new regions and technology segments.

In Europe, the outlook is mixed. Persistent price softness could make Asian imports 25–30% cheaper than European-made modules, undermining on-shoring efforts even with subsidies. Yet this same environment opens the door for Indian suppliers that comply with CBAM and NZIA rules. Europe’s demand, exceeding 65 GW annually, combined with its focus on sustainability and supply-chain resilience, could make it India’s next major growth market. Joint ventures, licensing partnerships, and traceability-linked co-production models between Indian and European manufacturers are likely to increase.

For India, overcapacity is both an opportunity and a challenge. Large, integrated players may consolidate market share, while smaller firms face margin stress. India’s position as a diversification hub in global clean-tech supply chains will strengthen if it can align with trade frameworks such as the India–EU Free Trade Agreement (FTA).

The deal under negotiation would align testing and certification standards, reduce duplicate compliance costs, and encourage collaboration on sustainability and labour norms. Once finalized, the FTA could grant Indian manufacturers easier market entry, lower non-tariff barriers, and better positioning if Europe later imposes carbon-based trade restrictions on high-emission imports.

Moreover, several European buyers and intermediaries have been diversifying their procurement toward alternative suppliers as part of broader risk-mitigation strategies, as seen with earlier shifts toward Chinese manufacturers, according to EUPD Research’s PV InstallerMonitor© | EES InstallerMonitor© findings. This evolving sourcing landscape creates a timely opportunity for Indian manufacturers to expand their market share in Europe.

Conclusion

India’s solar manufacturing boom marks a turning point in the global PV industry. Rapid capacity growth, narrowing cost gaps with China, and lower carbon intensity are propelling India into an export-driven phase. Yet these same trends risk creating oversupply and price compression if diversification does not keep pace.

With major markets like China, the United States and Europe showing signs of slowdown, including project delays, financing constraints, and weaker installation margins, global price pressures are likely to intensify. While top Indian manufacturers remain financially stable for now, sustaining capacity utilization will depend on expanding into new markets and aligning early with low-carbon, compliant trade regimes.

To stay competitive, Indian manufacturers must act quickly. Europe offers a critical opening as it seeks reliable, low-carbon suppliers under the CBAM and NZIA frameworks. Early alignment with these standards will be key to securing long-term positions in premium markets.

Sustained competitiveness will depend not only on scale, but on speed, focus, and differentiation. As global competitive intensity rises, time to market and disciplined execution are becoming decisive differentiators. The race for market share is increasingly costly, and chasing volume without clear value creation or profitability risks becoming a trap. The key question is no longer who can produce the cheapest module, but who can identify the right markets, define the right segments within the identified markets contributing over average to net profitability, and move first with the right offering.

To thrive in this environment, Indian manufacturers must evolve beyond production scale and embrace data-driven market evolution. This means understanding how to tier markets, segment customers, and position premium products that deliver measurable differentiation. The ability to match technology and pricing strategy with the most receptive demand pockets will define who captures tomorrow’s opportunities.

This is precisely where EUPD Research provides its decisive value. For more than 25 years, EUPD has been delivering impactful, data-backed solutions that enable manufacturers to understand markets, identify high-potential segments, and connect with the right stakeholders. Through its unique approach, combining intelligent market tierisation, stakeholder access, and impactful communication, EUPD transforms complexity into clarity and data into direction. Its frameworks empower companies to detect emerging trends early, choose the right strategic moves, and accelerate their time to market with confidence.

If managed effectively, India’s solar surge can consolidate its position as a cornerstone of clean-tech diversification. But to achieve this, manufacturers must act now, pairing scale with strategic foresight, market intelligence, and trusted expertise. Those who leverage data sovereignty, digitalization and market intelligence to understand where to play, how to win, and how to differentiate will not just win the race; they will win the market itself, securing enduring strength and premium positioning for the decade ahead.

Ultimately, sustainable leadership will belong not to those who invest the most in production, but to those who quickly balance technological excellence with data-driven intelligence and precise market execution.

About the Authors:

Markus A.W. Hoehner is the Founder, President and Chief Executive Officer of Hoehner Research & Consulting Group and EUPD Group. He has been active in top-level research and consulting, focusing on cleantech, renewable energy, and sustainable management for more than three decades. He can be reached at m.hoehner@eupd-research.com.

Rajan Kalsotra is a Senior Consultant at EUPD Research, bringing over 14 years of experience in the renewable energy sector. His expertise encompasses market research, policy development, and strategic consulting. He has collaborated with leading energy organizations, delivering valuable insights into the global renewable energy landscape, with a particular focus on solar energy, energy storage, and emerging technologies. He can be reached at r.kalsotra@eupd-research.com.

Abhinandan Khajuria is a Renewable Energy Analyst at EUPD Research, focusing on analyzing global solar PV and battery markets, understanding international policies, engaging stakeholders, and undertaking research to deliver valuable inputs for the clean energy market. He can be reached at a.khajuria@eupd-research.com.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.