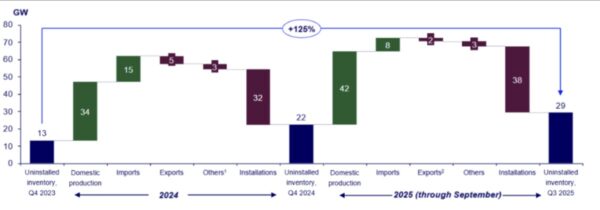

India‘s solar module manufacturing capacity is on course to surpass 125 GW in 2025, more than triple its current domestic market demand of around 40 GW, according to analysis by Wood Mackenzie.

The consultancy said in its latest report that this growth will lead to an inventory buildup of 29 GW by the third quarter of 2025. This figure compares to an inventory buildup of 13 GW as of the final quarter of 2023, and of 22 GW as of the final quarter of 2024.

Wood Mackenzie said the capacity surge highlights the success of the country’s production-linked incentive (PLI) scheme, but comes at a time when India is seeing a sharp downturn in its primary export market.

As a result of the 50% reciprocal tariffs imposed by the United States, solar module exports from India to the US fell by 52% across the first half of 2025 when compared to the first half of 2024.

“India’s government’s PLI scheme has been highly effective in spurring factory announcements, but the industry is now seeing warning signs of rapid overcapacity similar to those that preceded China’s recent price collapse,” said Yana Hryshko, head of solar supply chain research at Wood Mackenzie.

Cost differentials now stand out as a key challenge to India’s solar manufacturing market. An Indian-assembled module using imported solar cells costs at least $0.03/W more than a fully imported Chinese module, while a module made entirely in India under new domestic content requirements would cost more than double Chinese-manufactured modules, said Wood Mackenzie.

Hryshko added that despite such near-term challenges, India still holds the clearest potential to become the “only credible, large-scale alternative to the Chinese solar supply chain”. She suggested that India’s success now depends on shifting from just building capacity to achieving cost-competitiveness.

“This will require a pivot to aggressive research and development, investment in next-generation technology, and a strategic push to open new export markets in Africa, Latin America, and Europe,” Hryshko said. “The foundation is built; this is the next step to securing long-term success.”

Wood Mackenzie’s analysis also points out that India is deploying robust protective measures to support domestic manufacturers, including an Approved List of Models and Manufacturers (ALMM) and a recommended 30% anti-dumping duty on Chinese cells and modules.

By the end of the first half of the year, India’s PLI scheme had established 18.5 GW of module capacity, 9.7 GW of solar cell capacity and 2.2 GW of ingot-wafer capacity. Government figures also indicate that the scheme awarded a total 48 GW of module manufacturer capacity by the same date.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.