Solar module manufacturing costs in Europe could get close to those of the thriving Indian PV industry, according to Peter Fath, the CEO of Germany-based RCT Solutions.

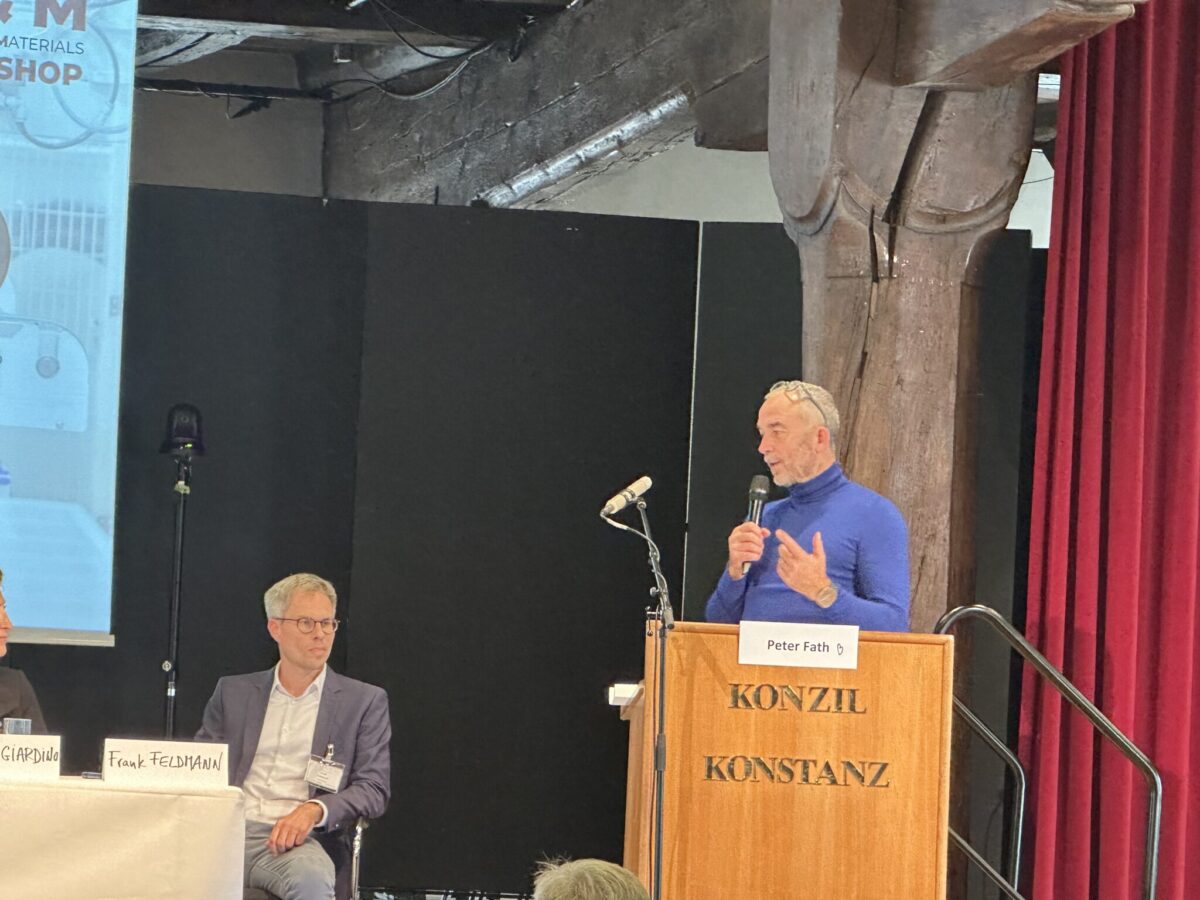

“Producing modules at €0.15-0.16 ($0.17-0.18)/W is already feasible,” he told pv magazine at the Modules and Materials Workshop organized in Konstanz, southern Germany, by RCT Solutions in collaboration with German research institute ICS Konstanz. “Of course, if we want to achieve these price levels, we need the related production equipment with gigawatt-scale and a high degree of automation. Moreover, we should use the same materials as our Chinese competitors.”

Fath argues that a European 1 GW module assembly facility using the same supply chain as Chinese Tier 1 counterparts could even reach module manufacturing costs of €0.11-0-12/W. “Assuming the conditions I mentioned before, meaning we use the same bill of materials as the module maker, this could be achieved now, not in many years,” he went on to say. “With a cell production in Europe and with wafers being sourced either from China or India, a module production cost of €0.15/W would be easily achievable. If we then include ingot and wafer production in Europe, the module manufacturing costs could grow to €0.17-0.18/W.”

According to Fath, the cost of labor would not be relevant today due to the high degree of automation and the scale that European factories can reach. “For module assembly alone, a 1 GW factory would be enough,” he said. “For cell production, we may need a higher scale, but also a 1 GW cell factory could have a good cost structure today in Europe.”

Fath emphasized that Chinese solar products are currently being sold in Europe below production costs. “The whole supply chain in China is selling below production costs, also the suppliers of raw materials,” he stated. “The real price difference between Chinese and European modules, with the same cost assessments, is around 15-20%.”

During one of the sessions of the Modules and Materials Workshop, Laura Sartore, Executive Managing Director of Italian PV production equipment provider Ecoprogetti, said that module manufacturing costs of €0.10-11/W would enable the European solar industry to scale up without public subsidies. “We need incentives only for temporary gap closing,” Sartore said.

“Continuous subsidies would never reach a stable result,” added Fath. “What is much more important is building European rules for PV manufacturing. For example, we should not allow the sale of solar products in Europe below production costs. Dumping is, in theory, not allowed in Europe, but we continue to buy products below production costs. We then have social and environmental standards that should be taken into account.”

During one of the sessions of the event, Puzant Baliozian, Group Leaders Photovoltaics Equipment at Germany’s Machinery and Equipment Manufacturers Association (VDMA), stressed the importance of building factories that could range from 5 GW to 10 GW.

“In Europe, we have 28 PV production equipment suppliers, with all relevant technologies being ready,” he said. “The global PV equipment market is expected to reach €43.8 billion by 2035. Are we really ready to give this up?”

Baliozian also recognized the importance of public support in the current industry’s phase, adding that support for Opex is needed.

Radovan Kopecek, the co-founder and director of Germany’s ISC Konstanz, warned that we need to act fast if we want a European PV industry, without losing a highly-qualified workforce.

Michael Schmela from SolarPower Europe stressed the political difficulties the efforts to rebuild a PV manufacturing industry are facing at the EU level. “Brussels is the sum of European members, which act separately. Maybe, with France, Italy and Germany teaming up, we may have different results,” Schmela suggested. “Ursula Van der Lyen is still pushing to maintain the green deal, but the fossil fuel lobby is very strong. We have to play the policy game.”

Another session during the event saw the participation of two French companies planning to each build a 5 GW cell and module factories – Holosolis and Carbon – although with different approaches. The first, in fact, has decided to team up with Chinese module maker Trinasolar for its project, while the second is seeking to rely exclusively on a European ecosystem.

“We still need to build the ecosystem, but we see choice of raw materials outside China,” said Carbon’s Managing Director, Raffaella Giardino. “We want cell European production equipment, but at this stage we can be open to Chinese imports of equipment for ingots and wafers.”

“High market risk can only be mitigated by regulations,” said Frank Feldmann, Cell Development manager at Holosolis. “We need know-how from China and strong partners like Trina. We don’t need 100% of the production to be in Europe.”

Meanwhile, Xabier Otaño from Spanish PV equipment provider Mondragon stressed that Capex for buying production lines has very little influence on a product’s final price. “Saving on Capex is not a good choice,” he said. “We can rebuild a European PV industry and we should probably hybridize it with the Chinese ecosystem.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.