Global copper demand is set to increase 24% by 2035, according to analysis by Wood Mackenzie.

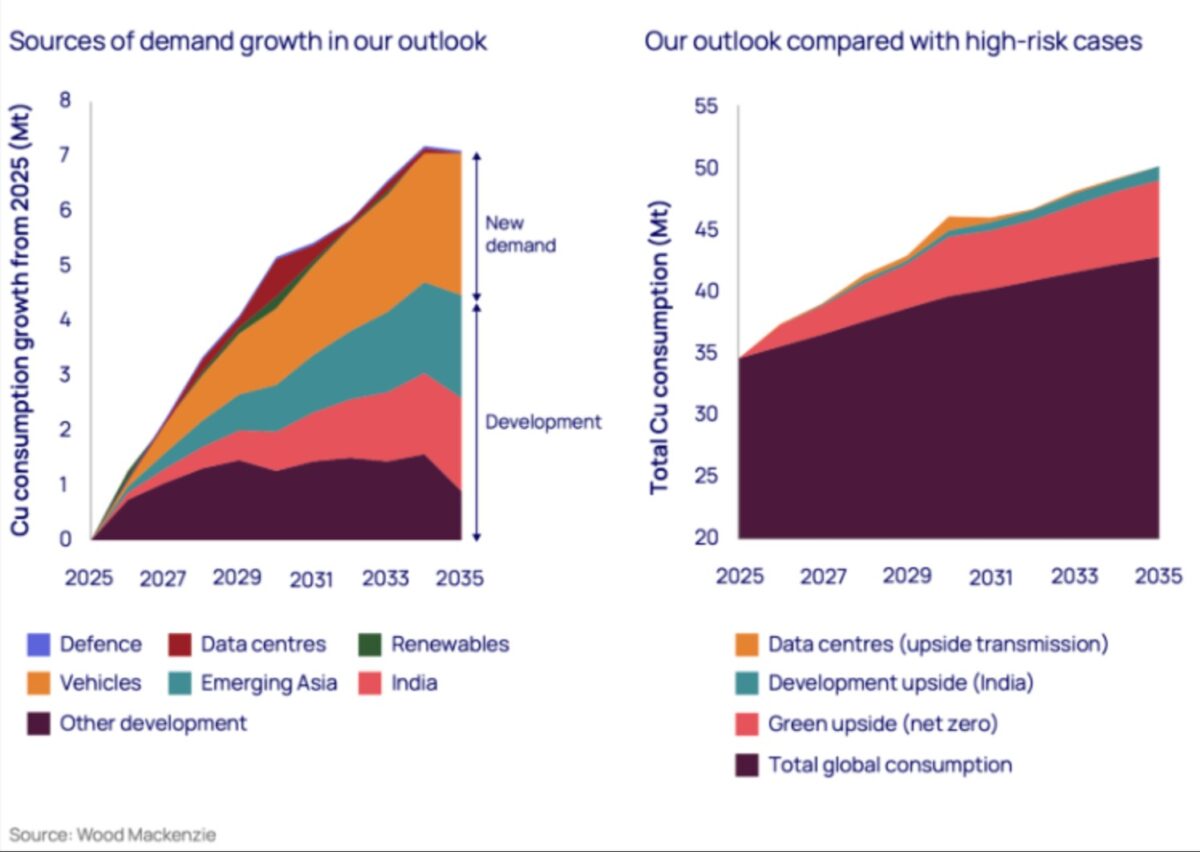

The consultancy’s latest report says global copper demand will rise by 8.2 million tonnes per annum (Mtpa) by the middle of next decade, reaching 42.7 Mtpa, with growth driven by traditional economic development and new structural demand from electrification and digitalization.

While Wood Mackenzie says this growth trajectory seems “certain”, it adds there are four “powerful disruptors” that could amplify demand further, adding an extra three Mtpa, or 40% of total copper demand growth, by 2035.

These disruptors are listed as a global increase in data centres, industrialization in India and Southeast Asia, defence spending and the energy transition.

Wood Mackenzie says the broader energy transition is “fundamentally reshaping copper consumption patterns”, with the shift to renewables expected to require an additional 2 Mtpa of copper supply over the next decade.

Analyst Peter Schmitz explained that as battery technologies advance, copper demand intensity across charging infrastructure and power systems will remain high. “By our forecasts, electric vehicle-related copper demand is set to double by 2035, cementing the metal’s role at the heart of the global energy transition,” Schmitz added. “Each electric vehicle contains up to four times more copper than a conventional car.”

Wood Mackenzie’s analysis warns that in a supply-constrained environment, these four disruptors could result in prolonged periods of high prices and unpredictable market fluctuations.

Analyst Charles Cooper referred to copper as the “strategic bottleneck of the global energy transition.”

“From Detroit to Shenzhen, the impacts of commodity supply chain disruptions and the industry’s inability to deliver will be acutely felt,” Cooper said. “If governments and investors fail to act, we risk turning the metal of electrification into the metal of scarcity.”

Copper is often considered the most valuable alternative to silver in solar manufacturing. In September, pv magazine reported solar module makers were facing rising pressure to curb silver use as prices surge.

More recently, researchers from the University of New South Wales and the Fraunhofer Institute for Solar Energy Systems said efforts to reduce silver use in solar cells will not compromise module quality if properly engineered.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.