South Korean polysilicon producer OCI Holdings is expanding into the solar wafer market by securing a majority stake in a wafer plant in Vietnam.

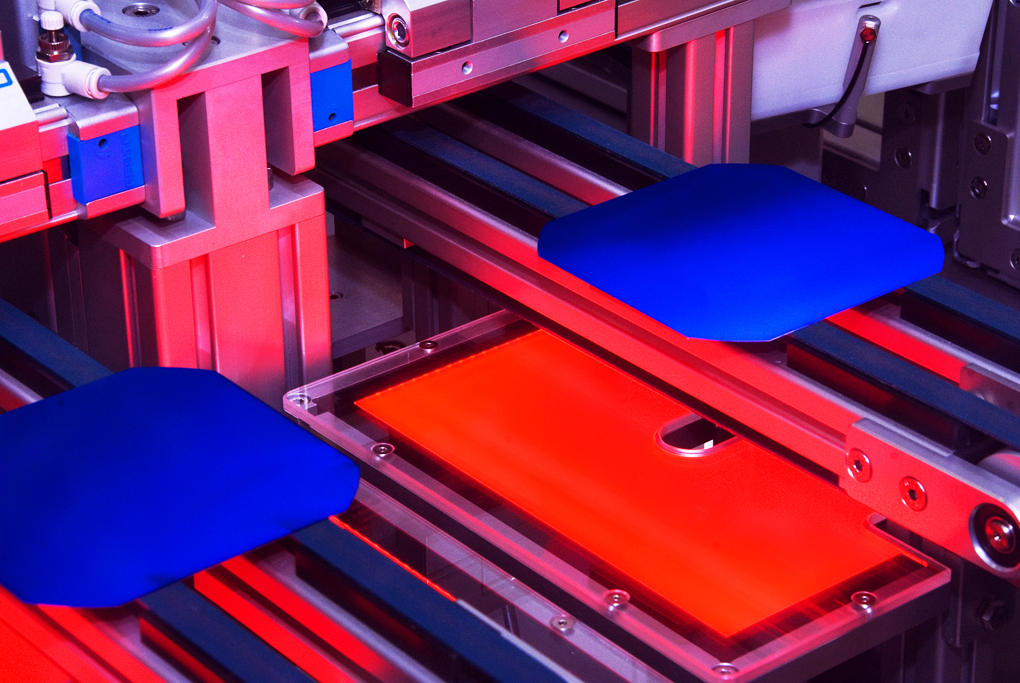

The company, via its wholly-owned subsidiary OCI TerraSus, has established special-purpose vehicle OCI ONE that acquired a 65% stake in a 2.7 GW wafer plant currently under construction by Elite Solar Power Wafer Co. Ltd.

Scheduled for completion by the end of the month, the solar wafer manufacturing facility is expected to begin producing non-prohibited foreign entity (PFE) wafers early next year. Non-PFE status allows the solar wafers to bypass US import restrictions that are tied to some foreign supply chains.

Total investment in the plant amounts to $120 million, with OCI ONE’s stake valued at around $78 million. According to a statement published by OCI Holdings, the plant’s capacity could increase to 5.4 GW within six months if a further $40 million is invested.

The plant will be supplied entirely with polysilicon from OCI TerraSus, which OCI’s statement adds will create full vertical integration designed to enhance both competitiveness and profitability.

Woo Hyun Lee, chairman of OCI Holdings, said the investment brings the company closer to building a supply chain that facilitates US exports. “We will continue to strengthen our presence in the global solar market by fostering partnerships with local companies in Southeast Asia,” the chairman added.

In August, South Korea’s Ministry of Trade, Industry and Energy urged the US to exempt its companies from polysilicon tariffs, warning restrictions could disrupt $2.8 billion in US solar investments.

OCI and Japanese chemical company Tokuyama Corporation recently started construction of a 10,000 MT polysilicon factory at the Samalaju Industrial Park in Sarawak, Borneo, Malaysia.

OCIM Sdn Bhd (OCIMSB), the Malaysian unit of OCI, is currently operating a 35.000 MT polysilicon factory in the Samalaju Industrial Park in Sarawak, Malaysia, which it bought from Tokuyama in 2016.

With this factory, the group’s total annual polysilicon output – including its 3,000-MT factory in Gunsan, South Korea – currently amounts to 38,000 MT.

In August 2024, Tokuyama signed an agreement with Thanh Binh Phu My JSC to build a $30 million polysilicon factory at the Phu My 3 Industrial Park in Vietnam’s Ba Ria-Vung Tau province.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.