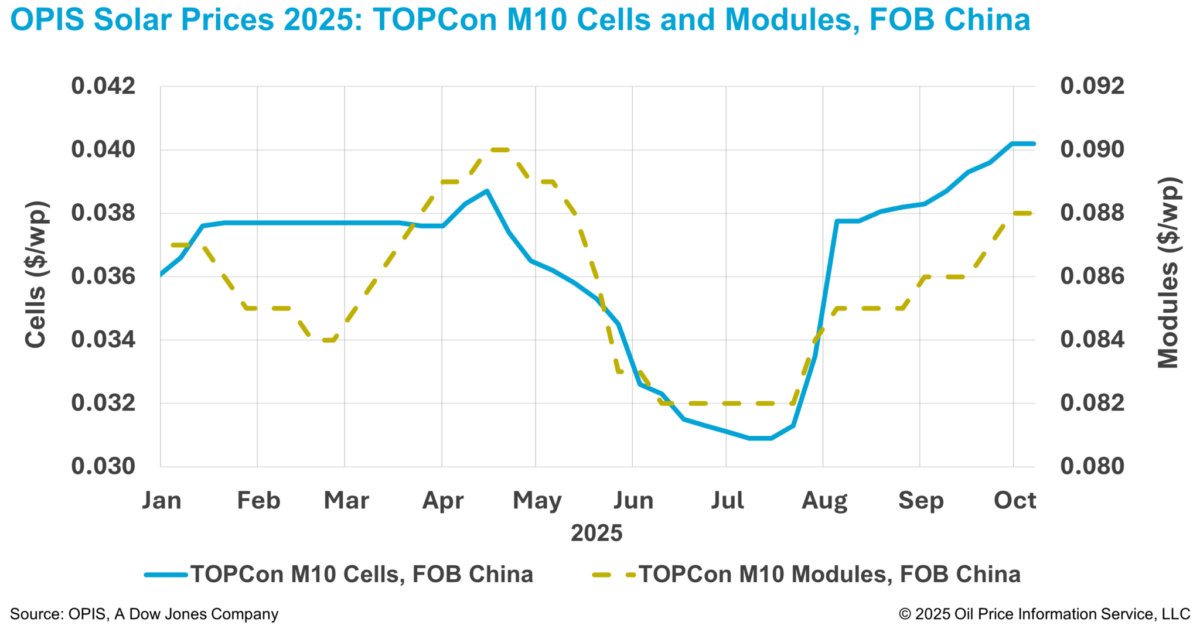

According to the OPIS Solar Weekly Report released on October 7, FOB China TOPCon M10 cell prices held steady this week at $0.0402/W, with price indications between $0.0380-0.0426/W, pausing a four-week rally as trading slowed during China’s Golden Week holiday.

The recent rally has brought TOPCon M10 cell prices up 29.3% since early July, though this still lags the surge in upstream wafer costs. FOB China n-type M10 and G12 wafer prices have jumped 46.3% and 36.7%, respectively, over the same period, according to OPIS data.

Whether these gains can be sustained further downstream hinges on end-user demand, market sources said. However, recent data points to a bearish outlook. According to the National Energy Administration, China added only 7.36 GW of new PV capacity in August—the lowest monthly total in 2025 and marking the fourth consecutive monthly decline.

Against this backdrop of weakening domestic demand, Chinese cell producer sources expect demand from India to rebound after the holiday period, as Indian buyers are likely to ramp up procurement ahead of the anticipated implementation of antidumping duties on Chinese solar cell imports.

On September 29, India’s Directorate General of Trade Remedies released its final findings on an antidumping investigation into Chinese solar cell imports. The findings recommended company-specific duties of up to 30% for a period of three years based on the Cost, Insurance and Freight (CIF) value. The effective date has not yet been announced and will take effect upon notification by the Central Government, though some sources expect implementation by the end of this year.

Among sampled producers, Jinko Solar and Trina Solar will be subject to 0% duties. While these producers had positive injury margins for cell exports, their module landed prices exceeded the non-injurious price threshold, resulting in an overall 0% duty rate.

Aiko Solar Group, which exported only cells with positive injury margins, will be subject to 23% duties. Non-sampled cooperative producers that submitted questionnaire responses face 23% duties based on the weighted average of sampled producers, while non-cooperative producers are subject to 30%.

Market participants noted that price signals remain unclear given the uncertain timing of the duty’s implementation and the limited trading during the Golden Week holiday. However, sources expect a short-term uptick in prices once Indian buyers resume procurement following the break.

Given the recommended tiered duty structure, buyers’ preferences may shift toward suppliers facing lower or zero duties, a Chinese market analyst noted. Meanwhile, some Indian manufacturers are seeking to challenge the exemptions granted to Jinko and Trina, though sources noted these companies focus primarily on module exports rather than cells.

Additionally, a downstream tier-1 Chinese manufacturer observed that India’s domestic cell production remains more expensive, suggesting Chinese imports could stay competitive even under antidumping duties. That said, the source also expects partial sourcing diversification to Southeast Asia.

Addressing industry concerns about potential supply constraints, DGTR final findings project India’s domestic cell capacity will reach 64.6 GW by June 2026, sufficient to meet the annual demand of approximately 44 GW. However, industry sources expressed skepticism about this projection. With ALMM List-II currently containing only 17.9 GW as of September 2025, achieving the target would require bringing 46.7 GW of new capacity online and enlisting within nine months—a timeline some described as unrealistic.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.