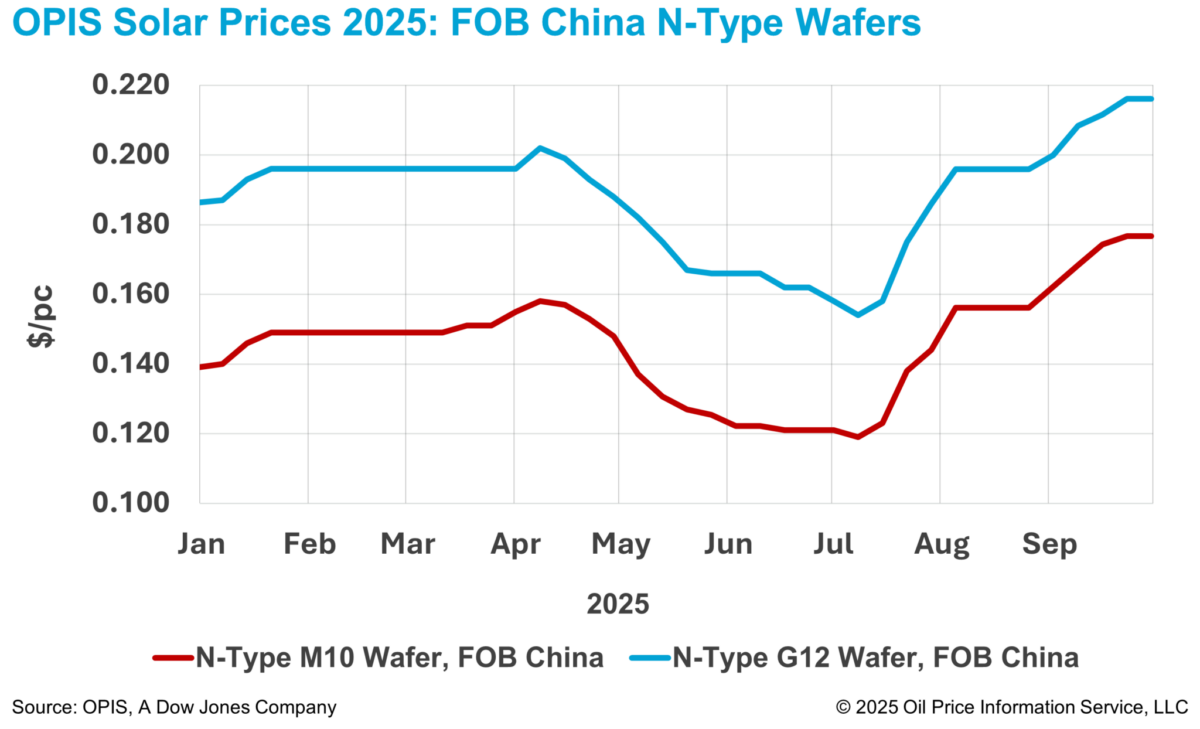

Wafer prices in China remained steady this week, halting a four-week streak of consecutive gains. According to OPIS Solar Weekly Report released on September 30, FOB China prices for n-type M10 and G12 wafers showed no week-to-week changes, holding steady at $0.177/pc and $0.216/pc, respectively.

Wafer prices have paused their recent upward trend, reflecting stable polysilicon prices and weakening downstream demand, according to market insiders. One insider anticipates a cooling of demand, noting that rising solar product prices run counter to the interests of end-user power companies, while newly installed solar capacity in the first three quarters of this year has already reached 230 GW, almost catching up with the full-year total for 2024 at 277 GW.

Recent data supports this outlook, with the National Energy Administration reporting that China added 7.36 GW of new solar capacity in August—the lowest monthly figure so far in 2025 and the fourth consecutive decline. August’s installations fell 55% year-on-year and 33% month-on-month.

Against this backdrop, the Chinese President outlined a new target during his speech at last week’s United Nations Climate Change Summit: to increase China’s total installed wind and solar power capacity to more than six times its 2020 level by 2035, reaching 3,600 GW.

While this goal has been widely interpreted as positive for long-term demand, some market observers view it as relatively conservative. China’s current installed wind and solar capacity already exceeds 1,600 GW, implying an average annual addition of only about 200 GW over the next decade. One source explained that even after factoring in replacement demand from older plants that have been in operation for 20–30 years, this growth rate may be insufficient to absorb the industry’s existing production capacity or to meaningfully stimulate new demand.

On the supply side, a market participant noted that operating rates among wafer manufacturers have shown little change to date. Last week, industry insiders noted that wafer prices had been closely tracking polysilicon prices with a noticeable lag, resulting in relatively stable operating rates as manufacturers were not incentivized by price increases to expand output. First-tier producers were reportedly maintaining approximately 50% utilization while specialized wafer producers continued to operate at up to 80%, supported by growing customer demand for OEM wafer supply.

Looking ahead, stricter government oversight of output could drive further production cuts in the fourth quarter, the source added. However, to balance reduced production with manufacturers’ operational needs, overall monthly wafer output is likely to remain in the range of 50–60 GW over the long term.

Separately, multiple insiders disclosed that a vertically integrated manufacturer was recently found in violation of regulatory requirements concerning production volumes and pricing. According to one source, potential consequences include removal from the list of self-regulatory agreements and possible restrictions imposed by industry associations, barring other manufacturers from purchasing the company’s products.

Another source, however, argued that in a market where government regulation plays a supporting role, association-led measures are unlikely to completely obstruct a company’s development prospects. Even so, the source expects the enterprise in question to undergo rectification, noting that at this critical stage of market regulation, going against official directives brings no long-term benefit.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.