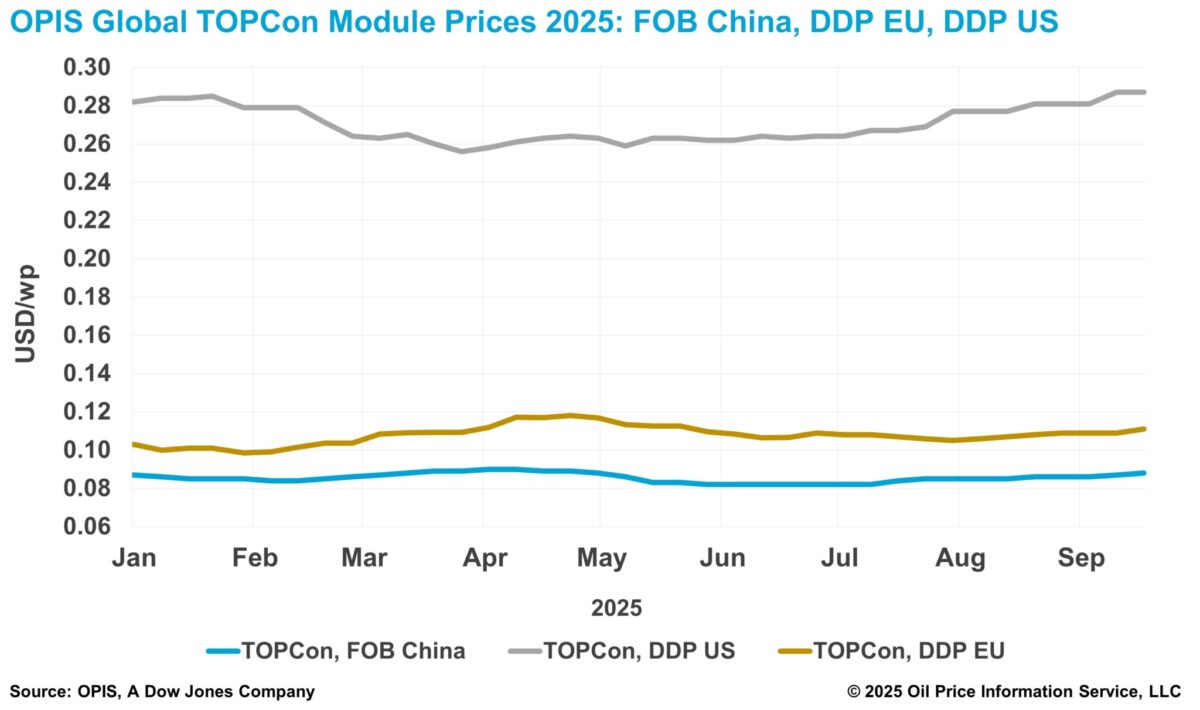

The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China, rose 1.15% to $0.088/W Free-On-Board (FOB) China, with indications between $0.085-0.093/W.

Forward curve indications moved higher across the board this week. Q4 2025 loading prices increased to $0.088/W, Q1 to Q3 2026 loading cargoes to $0.089/W, and Q4 2026 loading cargoes to $0.090/W.

In the domestic market, OPIS assessed TOPCon module prices at CNY 0.696 ($0.098)/W EXW China, unchanged from the previous week. The market remains stable as participants await clearer policy signals for Q4 2025.

Industry participants expect the China Photovoltaic Industry Association (CPIA) to release updated production cost guidelines for n-type modules in October, which would serve as a price floor for state-owned enterprise procurement tenders. Despite earlier speculation, it remains unclear whether the guidelines will become a legally binding price floor for private transactions in Q4.

While CPIA’s current production cost guideline stands at CNY 0.701/W, private transaction prices have remained lower, hovering in the high CNY 0.60/W range. Trade sources added that some manufacturers, looking to offload inventory, are offering discounts of 4-5% from mainstream pricing.

In export markets, TOPCon module prices strengthened this week, though they continue to trail domestic levels. Regulatory oversight is more stringent in the domestic market compared to exports, with authorities hoping this will indirectly support export pricing, according to trade sources.

According to OPIS data, EXW China TOPCon module prices have increased by 9.3% since July 1, while FOB China TOPCon module export prices have risen by 7.3% over the same period.

In Europe, DDP Europe prices for TOPCon modules over 600 W increased 1.08% to €0.094 ($0.11)/W.

The European PV industry continues urging EU legislators to implement concrete plans supporting domestic solar manufacturing. Walburga Hemetsberger, CEO of SolarPower Europe, warned that Europe’s solar industry stands at a crossroads, with immediate coordinated action needed to prevent the loss of existing solar manufacturing capacity.

Despite industry concerns, the Dutch government announced last week it would discontinue conditional allocation of €277 million for Phases II and III of the SolarNL program, which aimed to build domestic solar PV module capacity.

This decision could immediately impact ongoing projects, including Dutch solar company MCPV’s planned 4 GW heterojunction cell facility in the Netherlands. MCPV voiced disappointment over the withdrawal but affirmed it will pursue alternatives in Europe and beyond. Founder and CEO Marc Rechter told OPIS the company will accelerate its Spanish HJT module plant while exploring US expansion.

In the U.S., TOPCon modules over 600 W DDP US remained stable at $0.287/W this week. Southeast Asia cargoes fell 0.37% to $0.269/W, while India cargoes held at $0.331/W.

Amid mounting regulatory supply chain disruptions, industry group American Clean Power last week joined panel makers in appealing an August decision ordering the payment of retroactive tariffs on imports brought in under President Biden’s two-year tariff moratorium between 2022 and 2024.

A market participant noted that while the August decision could spell trouble for smaller companies, the industry is mostly bracing for more urgent concerns, such as the Section 232 investigation into polysilicon imports.

With Foreign Entity of Concern (FEOC) restrictions on the horizon, procurement teams are scrambling for modules and particularly requesting domestic content due to FEOC concerns, according to a distributor with nationwide US presence.

However, a major importer/distributor noted high confusion levels among industry participants regarding FEOC rules and domestic content requirements, with many procurement teams incorrectly assuming FEOC compliance through purchasing modules with domestically produced cells. Forthcoming FEOC guidance, expected in the coming months, will define the market landscape for the next six to eight months, according to market participants.

Currently, most available capacity consists of inventory materials already shipped or US factory cells en route for delivery within the next month, according to a developer source. The source expects exporters will halt new shipments in the coming months as anti-dumping and countervailing duty preliminary determinations approach.

This anticipated shipping slowdown will create limited cell supply for US assemblers in 2026, particularly for non-AD/CVD and non-FEOC materials, according to the developer. However, the source believes the supply constraints are already being priced into current market levels and expects pricing to remain relatively stable despite the tightening availability.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.