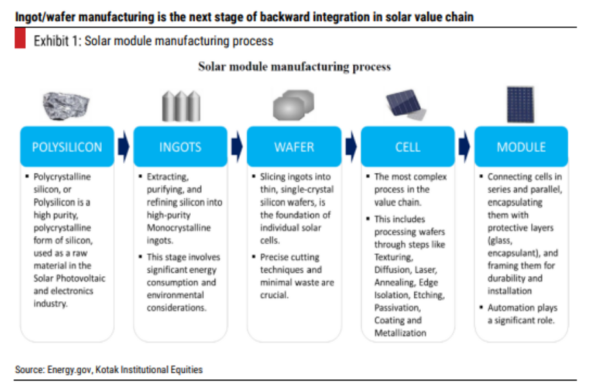

The Ministry of New and Renewable Energy, on September 12, 2025, released a draft amendment (link), proposing the implementation of the ALMM List III for wafers, with an effective date of June 1, 2028, and a cut-off date defined

as one month after the release of the first list. This marks a significant step by the government to deepen domestic participation in the solar value chain.

We believe ALMM List III can enable solar manufacturers that set up wafer capacity early to potentially have superior margins in FY2029/30, with wafer demand expected to align with broader market demand thereafter. While we have not yet incorporated the impact of this amendment into our estimates for Waaree and Premier, its evolution remains a key monitorable given its early-stage nature and potential for revisions.

ALMM list III (wafer) to be effective from June 1, 2028, based on draft proposal

The MNRE, on September 12, 2025, released a draft amendment proposing the implementation of ALMM list III for wafers from June 1, 2028 (effective date). Based on the amendment, net metering and open access projects with commissioning after the effective date will need to use ALMM-compliant wafers. While for other utility-based projects with bids, it will be after the cut-off date (one month after the date of issuance of the first list of ALMM). However, there is one caveat: the ALMM list III will only be issued when there are three independent manufacturing facilities in the country with an aggregate

capacity of 15GW.

Solar manufacturers that set up capacity early could potentially benefit

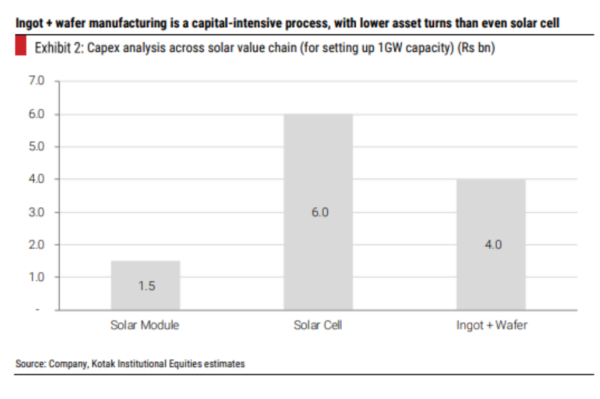

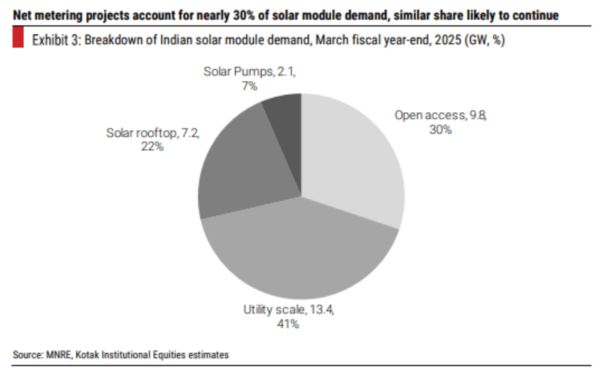

We expect wafer demand to emerge in three phases: (1) net metering and open access projects (~30% of capacity) starting June 1, 2028, (2) utility-scale projects from late FY2029 or early FY2031, assuming an 18-month lag from the estimated cut-off date (depends on when India reaches 15GW supply) and (3) DCR projects such as rooftop solar, solar pumps and CPSU programs, which could begin contributing from June 1, 2028, if central subsidies continue beyond FY2027. Given that ingot-wafer manufacturing is capital-intensive (Rs3.5-4 bn per GW) and technologically complex—though less so than cell manufacturing—companies that scale up faster can potentially have higher margins until supply-demand parity is reached, potentially by FY2031.

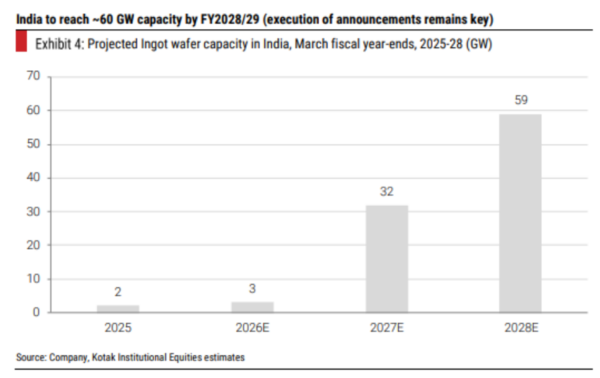

Supply-demand parity likely in FY2031—the pace of execution key

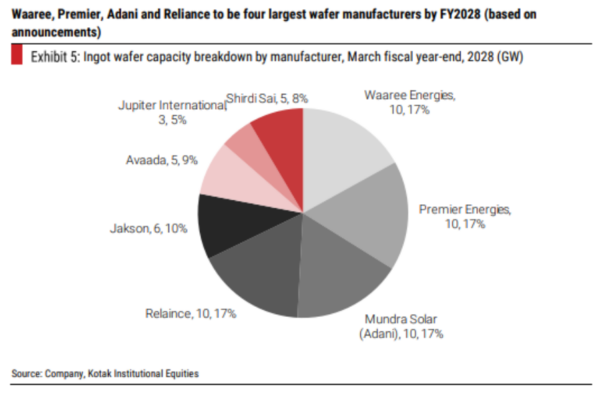

Although India currently has only 2 GW of ingot-wafer manufacturing capacity (operated by Adani), several large and mid-sized players have announced plans to enter the wafer segment. Based on these announcements, India is expected to reach around 60 GW of ingot-wafer capacity by FY2029/30, which should be sufficient to meet the entire domestic demand (the pace of execution is key).

No change in estimates as amendment in early stages

While we believe that amendment in its current form may be beneficial for Waaree and Premier if their capacities come on stream, we have not factored in the impact on our estimates, since the amendment is still in its early stages and might see revisions over due course.

Demand to come across in three stages

We forecast demand for ALMM list III wafer to come in three stages: (1) net metering and open access (2) utility scale and (3) DCR projects (PM Surya Ghar, PM KUSUM, CPSU). We expect Indian wafer demand to reach 45-50 GW by FY2031.

Net metering and open access projects: The said projects currently contribute 30% of solar capacity addition in a year (FY2025). We forecast a similar share going forth as well, with the draft amendment indicating that all such projects will fall under ALMM list III from June 1, 2028.

Utility-scale projects: Based on the draft amendment, utility-scale solar projects will be required to use ALMM List III wafers if the bidding date falls after the cut-off date—defined as one month following the release of the first list. However, the amendment specifies that the list will only be released once India has at least three independent wafer manufacturing facilities with a combined capacity of 15 GW.

Currently, India has only one operational wafer facility—a 2 GW plant by Adani. Given that it typically takes 12 to 18 months to set up an ingot-wafer manufacturing facility, we expect the list to be released no earlier than Q4FY27 or Q1FY28. Factoring in this timeline, actual demand for wafers is likely to materialize only in the second half of FY2029 earliest. This is because it takes approximately 18 months from bid submission to commission a solar power plant, and wafer demand typically arises toward the end of the project cycle when solar modules are procured.

DCR projects: Although PM Surya Ghar Yojna (solar rooftop) is expected to end in FY2027, India’s solar rooftop capacity still remains far away from its target. There is a potential for the scheme to continue going forth and would potentially have to source local wafers from June 1, 2028. In similar PM KUSUM to also get an extension and see additional requirement of Indian wafers from effective date of ALMM list III.

Multiple announcements for setup of wafer capacity made—execution remains key

India is currently in a nascent stage when it comes to wafer manufacturing, with only 2GW capacity commissioned so far by Adani. However, going forth we expect significant investments in the space from large- and medium-sized players. Based on the announcement made by key players in the space, we expect wafer manufacturing capacity to reach 50-60 GW by FY2028/29, which will be able to meet domestic demand.

This report is prepared by Kotak Institutional Equities analysts Deepak Krishnan, Aditya Mongia, Naman Jain.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.