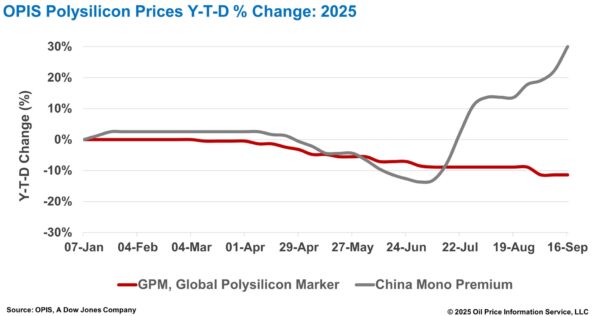

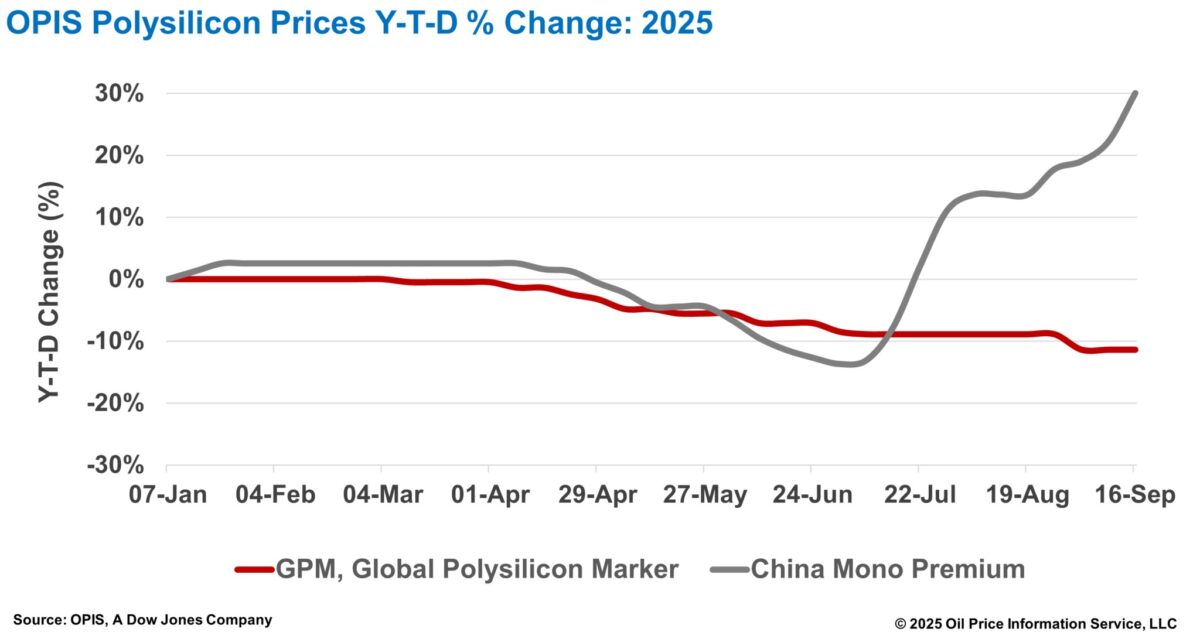

The China Mono Premium—OPIS’ assessment for mono-grade polysilicon used in n-type ingot production—rose 6.39% week-on-week to CNY 51.200 ($7.20)/kg or CNY 0.108/W, according to the OPIS Global Solar Markets Report released on September 16.

The price has now climbed 50.7% from its year-to-date low of CNY 33.975/kg on July 1.

The recent increase in polysilicon prices is driven less by fundamentals and more by market sentiment. Industry insiders attribute the rally to ongoing expectations of government-led capacity consolidation and stricter production controls. Market sentiment around these potential measures created room for prices to rise despite climbing inventories that now reportedly exceed 500,000 MT.

However, manufacturers are eyeing further price hikes, according to a market participant. Their immediate goal is to lift market prices to CNY 55/kg—7% higher than the current OPIS assessment—with some producers already issuing quotes at this level and completing limited transactions. On the buy side, trading volumes have reportedly remained small, with firms purchasing only essential materials to sustain production amid rally, potentially leading to a delayed pace of increases to some extent.

These developments align with remarks by Lin Ruhai, Deputy Secretary General of the China Nonferrous Metals Industry Association, at the 2025 China Silicon Industry Conference (CSIC) in Inner Mongolia last week.

Lin stated that the solar industry is expected to stabilize between 2025 and 2027, with the primary objective of reducing overcapacity. He projected global polysilicon capacity to reach 3.5 million MT by 2025, with about 30% of outdated capacity to be phased out. A key indicator of progress, he noted, would be polysilicon prices stabilizing in the range of CNY 50–60/kg.

OPIS learned from sources at the 2025 CSIC that the operating company—jointly proposed by leading polysilicon producers and relevant government departments to acquire and phase out outdated capacity—has not yet been formally established.

Key obstacles include determining which manufacturers will participate as buyers and which firms are willing to be acquired. Rising prices have made several second- and third-tier manufacturers less willing to offload assets, opting instead to restart idled production lines to benefit from current favorable prices.

Global Polysilicon Marker (GPM)—the OPIS benchmark for polysilicon produced outside of China—was unchanged at $18.043/kg, or $0.038/W. The fundamentals of the global polysilicon market remain weak, primarily due to subdued demand driven by U.S. trade policy restrictions.

According to a global polysilicon buyer, while bound by long-term contracts requiring monthly orders from certain suppliers, the firm has been actively seeking to delay deliveries due to insufficient production to absorb contracted volumes. The buyer added that it has already accumulated several thousand tons of global polysilicon inventory.

In contrast, sources at 2025 CSIC noted that with domestic polysilicon prices in China continuing to rise under government intervention, overseas producers may see an opportunity to export back into China if those prices reach sufficiently high levels.

Policy developments are also shaping the outlook. The industry is closely monitoring the U.S. Section 232 national security investigation into polysilicon and derivative imports.

Under discussion is the possibility of imposing strict restrictions on Chinese polysilicon and its derivatives—such as imposing tariffs—while providing duty-free import quotas from allied countries like Malaysia and Germany. A market participant commented that if implemented—combined with Section 301 tariffs and reciprocal duties—this would effectively block Chinese products from entering the U.S. market, regardless of whether they meet traceability requirements.

The source further noted that while such measures could drive an increase in global polysilicon demand, they would likely result in price divergence: prices within duty-free quotas would rise, while those for volumes outside the quota would inevitably decline.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Are the US and global prices per Watt accidentally reversed?

You wrote that the Global Polysilicon Marker price (outside China) is $18.043/kg or $0.038/Watt, yet you also wrote that China Mono Premium is $7.20/kg or $0.108/Watt.

Your reported price per kg is lower for China, but your price per Watt is comparably higher.