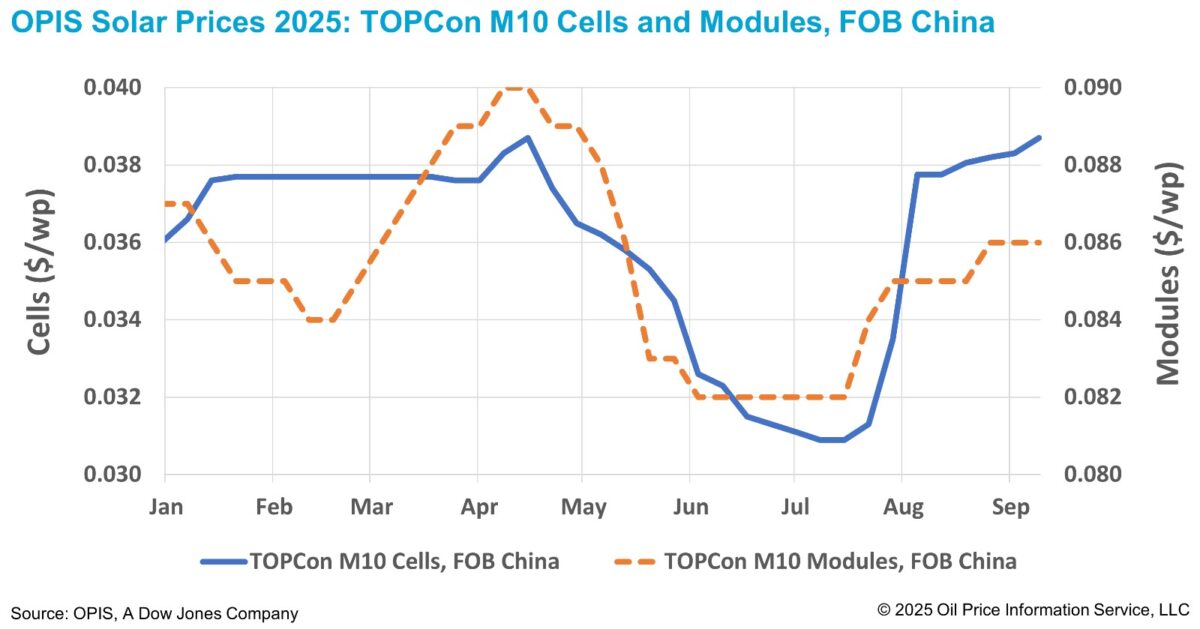

FOB China TOPCon M10 cell prices rose 1.04% this week to $0.0387/W, with price indications between $0.0362-0.0401/W, according to the OPIS Global Solar Markets Report released on September 9. TOPCon cell prices have risen 24.4% since early July’s year-to-date low.

Cell prices are instead tracking module trends amid speculation about potential price floors and stricter production oversight, according to industry sources.

Industry bodies and the government are preparing to roll out a legally binding module price floor in Q4 2025, reportedly set at 0.759 yuan/W (equivalent to $0.098/W FOB including VAT rebate). With this measure looming, some expect module prices to firm up through November, which could in turn lift cell pricing in the near-term, sources said.

Industry sources added that regulatory enforcement has so far been stricter upstream, while cells and modules continue to face weaker oversight, slowing price adjustments in downstream segments.

Beyond price controls, the China Photovoltaic Industry Association (CPIA) has also intensified its enforcement of production quotas. According to a market source, a major manufacturer of 210R cells was called in by authorities for significantly exceeding their production quota and was told to scale back.

A producer source familiar with the matter noted that the industry association had issued annual production quotas to manufacturers last year, broken down into strict quarterly thresholds, and the manufacturer in question failed to comply with its Q3 2025 limits, thus drawing official scrutiny.

Tighter policy oversight from the Chinese authorities follows the recent release of the 2025-2026 Action Plan for Stabilizing Growth in the Electronic Information Manufacturing Industry by the Ministry of Industry and Information Technology (MIIT) and the State Administration for Market Regulation.

The plan calls for average annual revenue growth above 5% and aims to promote high-quality development in sectors such as solar photovoltaics, component manufacturing, and lithium batteries by targeting low pricing and unchecked capacity expansion.

Spot demand for Chinese cells is expected to remain subdued as the momentum from earlier market rumors has faded. The surge in procurement seen in August, which was driven by speculation of a cut or removal of China’s 9% export tax rebate, has now subsided.

Industry sources noted last week that buying activity in the export market has since returned to “normal” levels, as more recent industry speculation suggests the policy change may be postponed.

At the same time, cell producers are navigating a severe margin squeeze. According to the China Nonferrous Metals Industry Association (CSIA), while overseas cell demand has remained stable, wafer producers are pressing for higher prices, supported by persistently elevated polysilicon costs.

In the module market, several trade sources cited higher-than-expected inventory levels as one main factor suppressing downstream price momentum, leaving cells caught between rising input costs and stagnant module prices.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.