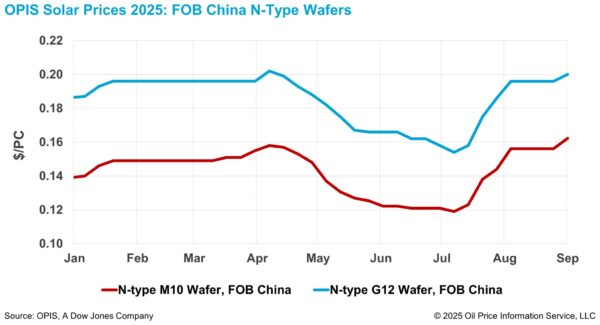

Wafer prices in China recorded broad-based gains this week after three weeks of relative stability. According to OPIS Solar Weekly Report released on September 2, FOB China prices for N-type M10 and G12 wafer climbed to $0.162/pc and $0.200/pc, up by 3.85% and 2.04%.

Trade sources indicated that the recent price increases are primarily driven by higher polysilicon costs and a tighter wafer inventory, which currently stands below 20 GW—less than half a month’s production. Despite the price gains, overall trading volumes remain limited due to weak end-user demand and cautious procurement strategies among downstream manufacturers.

Faced with market pressure, integrated and specialized wafer producers are pursuing differing strategies, according to market participants. Integrated manufacturers, which prioritize cell and module profitability, have reduced wafer operating rates. With current wafer prices largely covering only cash costs, these manufacturers are using a combination of internal production and external procurement to minimize overall costs.

In contrast, specialized wafer manufacturers have increased operating rates, supported by stronger demand for wafer Original Equipment Manufacturer (OEM) services. Some downstream players have stockpiled polysilicon and supplied it to these specialized factories for OEM production—an approach that benefits both parties by minimizing losses and reducing costs. According to a source, the wafer OEM model allows manufacturers to earn stable processing commissions by converting customer-supplied polysilicon into wafers, insulating them from changes in wafer prices. This protects downstream customers from price fluctuations in the wafer segment.

Separately, a leading wafer producer has maintained low production rates in the third quarter after reporting deeper losses in the second quarter, according to a market insider. The company’s financial report for the first half of 2025 indicated that second-quarter losses exceeded those of the first quarter. Sources attributed this to the company increasing its operating rate during the second quarter’s installation boom without adequate cost control. The report showed year-on-year increases in both sales and management expenses.

Looking ahead, a market observer noted that despite favourable policy support in China, significant challenges persist. Given the large-scale production capacity in the market, a meaningful industry recovery would require extensive consolidation, and even leading enterprises could face serious difficulties in raising fresh funds.

Beyond the domestic market in China, developments in the U.S. are creating new pressures and prompting strategic shifts. Last week, reports emerged of a domestic wafer manufacturing project in the U.S. that has reportedly started negotiations with downstream customers.

In another development, Foreign Entities of Concern (FEOCs) regulations in the U.S. have not yet extended to wafer imports, but industry consensus points to this being only a matter of time. In anticipation, manufacturers have begun implementing measures to mitigate potential risks. Reports indicate that several Southeast Asia–based wafer companies with Chinese ownership are exploring shareholder divestments to alter their corporate structures, aiming to reduce exposure to future FEOC-related risks.

Meanwhile, some cell and module makers are considering activating capacity outside of FEOC-designated regions by relocating equipment to Africa, the Middle East, and other emerging markets, to establish more diversified supply systems.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.