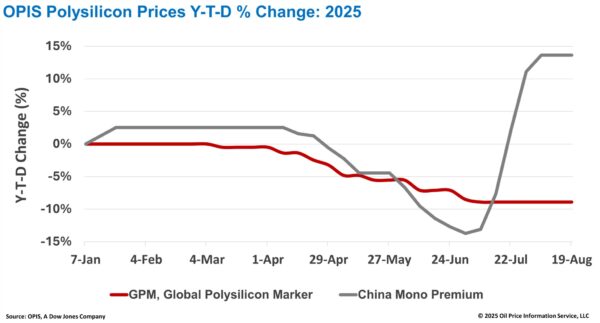

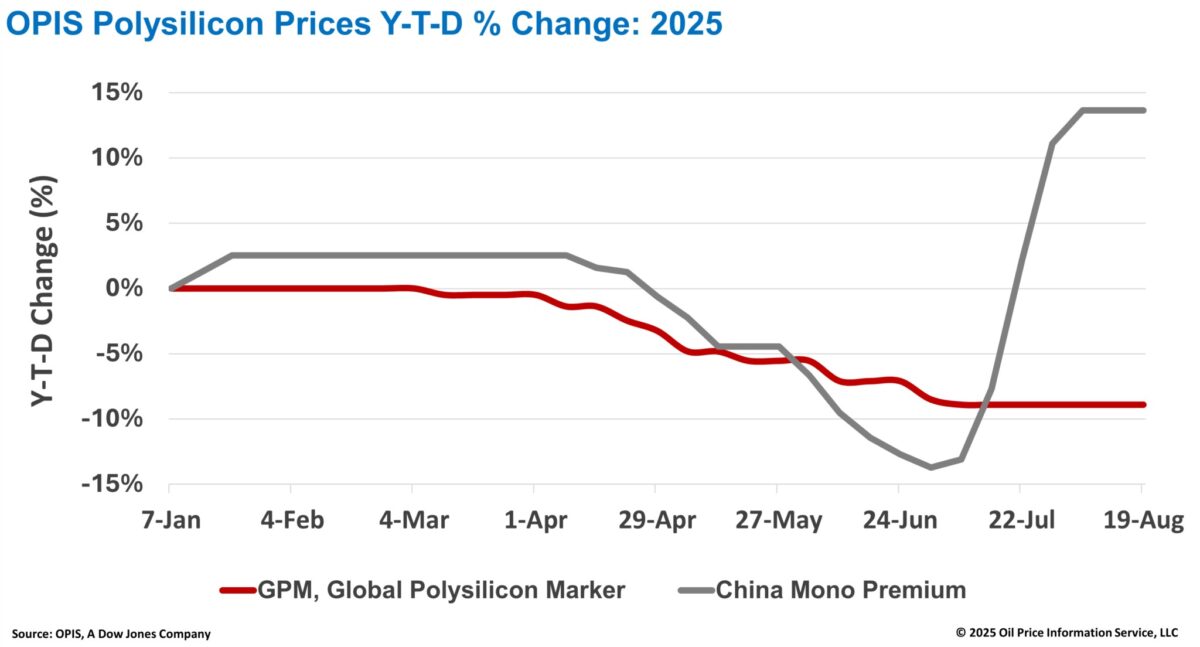

The China Mono Premium – OPIS’ price assessment for mono-grade polysilicon used specifically in n-type ingot production in the China domestic market – remained stable this week at CNY 44.750 ($6.23)/kg or CNY 0.094/W, according to OPIS Solar Weekly Report released on August 19.

Following a 31% rally over five consecutive weeks under government guidance since early July, polysilicon prices have now stabilized for two weeks.

Industry insiders attribute the stabilization to prices reaching levels that ensure sustainable operation for certain manufacturers. Additionally, the prevailing on-demand procurement model employed by most wafer producers, coupled with rising monthly production over the past two months, has curbed upward price momentum.

China’s monthly polysilicon production is expected to rise for a third consecutive month. According to the China Nonferrous Metals Industry Association (CSIA), monthly production reached 107,800 metric tons (mt) in July and is projected at 125,000 mt in August, potentially rising to 140,000 mt in September as plants resume operations and increase operating rates. With wafer production expected to remain stable, polysilicon inventories could expand by 50,000 mt above previous highs, further exacerbating supply-demand imbalances.

Polysilicon inventories continue to mount across the industry. According to a market participant, a leading manufacturer already maintains around 130,000 mt of inventory, while other producers collectively hold roughly two months’ worth of China’s total production. With the optimal inventory clearance window having passed in mid-to-late July, focus has shifted to whether government regulation can effectively curb excessive production capacity, according to another market observer.

The highly anticipated initiative involving major Chinese polysilicon producers and relevant authorities to establish a platform company for acquiring surplus production capacity as well as regulate future operating rates, has yet to disclose specific progress. Industry insiders suggest leading manufacturers are approaching the matter cautiously, as acquiring capacity means assuming associated debt, making the scale too large relative to expected returns.

Some expect this initiative could materialize before year-end, suggesting the current period may be the last opportunity for manufacturers to expand operating rates without restrictions.

The Global Polysilicon Marker (GPM) – the OPIS benchmark for polysilicon produced outside of China – remained stable this week at $18.550/kg, or $0.039/W.

Market conditions remain stable, with most activity concentrated in long-term contracts, supplemented by limited spot orders at favorable prices.

The anti-dumping and countervailing duty investigations into solar products from Indonesia, Laos, and India, launched August 7, have yet to materially affect demand, according to a market source. The impact on upstream suppliers is expected to be limited, as Chinese-invested facilities in Laos and Indonesia represent only a few gigawatts of downstream capacity, with an annual polysilicon demand of around 10,000 mt.

Looking ahead, oversupply pressures are likely to intensify with new capacity additions. A polysilicon plant in Oman is scheduled to begin production in Q4, while Highland Materials has announced plans to build a 16,000 mt/year solar-grade polysilicon facility in the U.S., with construction slated to commence within a year and take 18 to 20 months.

At the policy level, South Korea has opposed the U.S. Section 232 investigation into polysilicon imports, warning of supply chain disruptions. Hanwha Q CELLS has proposed a tariff-rate quota allowing 20,000 mt/year of polysilicon from Germany and Malaysia to enter duty-free, following recent detentions of its U.S.-bound shipments over upstream material concerns. However, sources remain uncertain whether these exemptions will be approved.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.